SAP Payroll - Quick Guide

SAP Payroll - Introduction

SAP Payroll is one of the key modules in SAP Human Capital Management. This is used to calculate the remuneration for each employee with respect to the work performed by them. SAP Payroll not only consists of remuneration part, but also the other benefits that the organization has to provide for the employee welfare according to different company laws in any country. These commonly include −

- Labor Law

- Benefits Law

- Contribution Law

- Tax Law

- Information Law

- Reporting Law

- Statistics Law

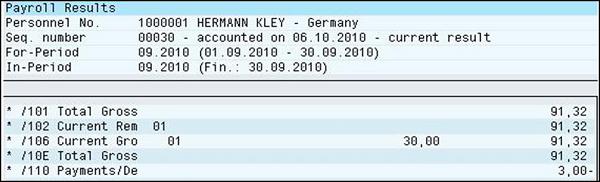

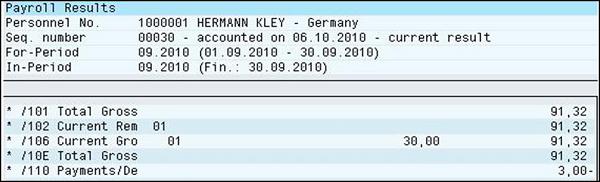

A SAP Payroll System manages the gross and net pay, which also includes the payments and deductions calculated while processing payroll for an employee. The system calculates the payment and all deductions while processing remuneration using different wage types.

Once the payroll processing is done, the system carries out different subsequent activities.

For example − You can generate various lists related to remuneration and deductions performed in the system.

Integration with Other Modules for Payroll Processing

SAP Payroll module is easily integrated with −

- Personnel Administration

- Time Management

- Incentive and Wages

- Finance and Accounting

Personnel Administration is used to get the master data and other payroll related information. By using Time Management, you can get the time related data to calculate the remuneration and for payroll run.

Incentive and Wages data is used to calculate the incentive wages component in the payroll. Wage type defines the daily payroll for each employee and incentive defines the other extra benefits that should be paid to an employee.

Expense Payable for payroll is posted to cost center using integration with SAP Finance and Accounting module. You can assign the cost to cost centers in Finance and Accounting module. Here you can also manage the expense for payroll processing of the third party vendors.

Basics – Payroll

Payroll is based on the payroll driver that varies with each country and region. The payroll driver considers the administrative and legal regulations of the country while defining the payroll. While running a payroll, the payroll driver refers to its corresponding payroll schema, which contains a number of different functions. Each function consists of import data function from internal tables and payroll related files.

The steps in Payroll processing −

A payroll system gets the payroll related data from the system. In case of off-cycle payroll, the system deletes the internal table and imports the last payroll result. The gross wage, shift schedule, and compensation along with the valuation bases are calculated in the system and the master data relevant to this payroll is added in the calculation.

Next is to calculate the partial period factors, salary elements, and to calculate the gross results. Finally, in the last process system calculates the net remuneration and performs the accounting in case there is any change in the master data from a previously processed payroll.

Once this payroll run is completed, the results are transferred to Finance Accounting and evaluation. Then the posting is done for the corresponding cost centers.

Payroll Driver

Payroll driver is used to run the payroll and their structure is based on that particular country’s laws, as each country has a specific payroll driver.

Following are a couple of drivers with their technical names −

RPCALCx0 − Here, x represents the country specific code, like ‘D’ for Germany and F for France, etc.

HxxCALC0 − Here, xx represents the ISO code for country, like ID for Indonesia.

Payroll Schema

This represents the calculation rules used by the payroll driver. In SAP Payroll system, you have country-specific schemas X000 where X represents the country indicator.

The Schema structure consists of the following components −

Initialization

Step 1 −

- Includes updating the database

- Importing the Infotypes

- Calculating gross pay

Step 2 −

- Processing of time data from time management

- Off cycle payroll run

- Payroll accounting of last processed payroll

- Calculating time related data and calculating gross amount for each employee

- Performing factors

- Calculating Net pay

Step 3 −

- Calculating the net remuneration

- Performing the bank transfers

Payroll – Background Operation

It is also possible to automate the payroll run partially or fully and schedule it to run in the background. SAP recommends a few tasks to be run in the background for better performance.

For example − Payroll can be run in the night and you can check the results the next morning.

How to Schedule Payroll in Background?

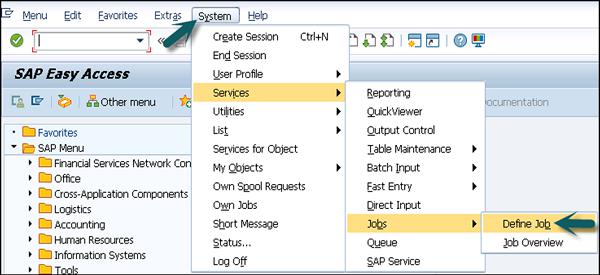

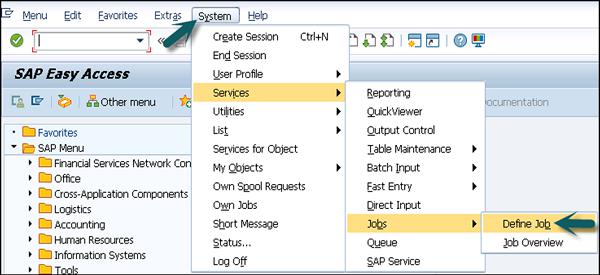

Go to System → Service → Jobs → Define Job or SM36

You can define the job here to let the payroll run to process in the background. These background jobs are processed using a Computing Center Management System (CCMS) in the SAP system. The CCMS can be used to perform the following functions.

- The configuration and monitoring of this background processing system.

- Managing and scheduling background jobs in the system.

How to Schedule a Background Job?

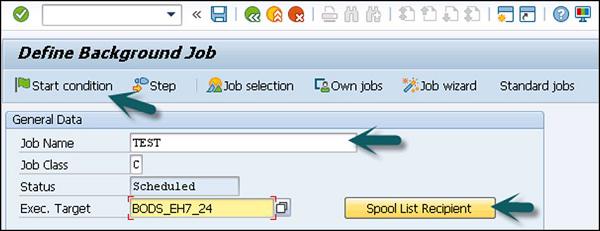

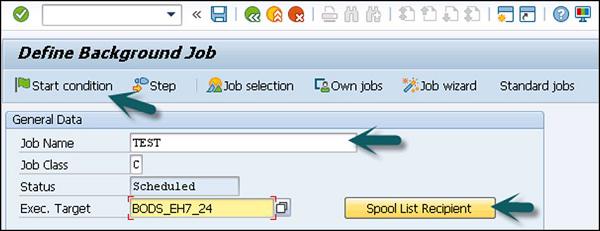

To schedule a background job, enter the Job Name. Enter the job class that defines the priority of the job.

You can define three types of priorities −

- Class A - High

- Class B - Medium

- Class C - Low

You can also define the system for load balancing in the target filed. If you want the system to select the server automatically for load balancing purpose, you can leave this option blank.

If you want the spool request generated from this job to be sent to someone using email, you can mention the same in the Spool list recipient.

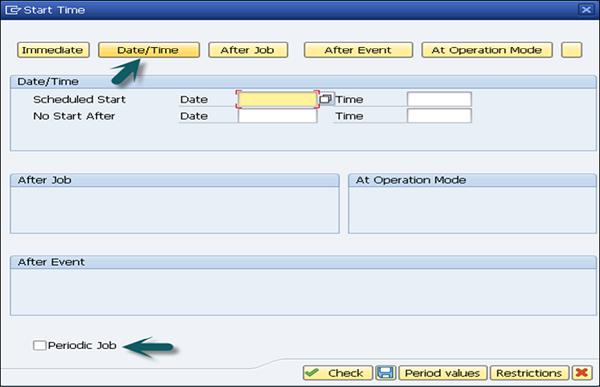

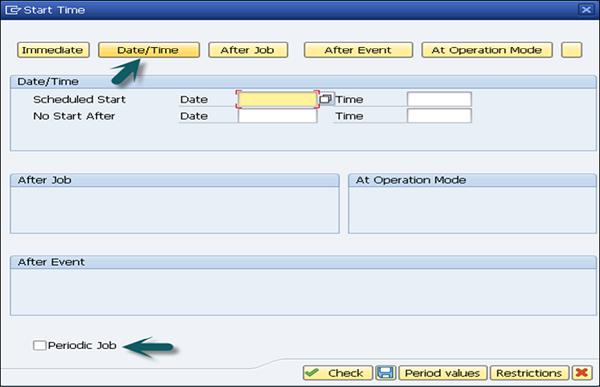

To define a start condition, click on the Start condition tab, there are various options that you can use to define the Start condition. If you want to create a periodic job, check the box at the bottom left side of the screen as shown in the following screenshot.

Define the steps of the job by clicking the Step tab. You can specify the ABAP Program, external command or any external program to be used for each step. The next step is to save the job to submit to background processing system.

Note − You have to release a job to make it run. No job even those scheduled for immediate processing, can run without first being released.

SAP Payroll - Off-Cycle Activities

Off-Cycle activities are carried out to process payroll for an employee on any day unlike payroll run that is a periodic activity and schedule to run at specific time interval.

In order to perform Off-Cycle activities, you should define an Off-Cycle activity section in customizing for payroll. Off-Cycle consists of the following areas −

Off-Cycle Workbench

It provides a uniform user interface for all the Off-Cycle activities. You can perform the following functions in an Off-Cycle workbench −

To make a bonus payment to an employee on a special occasion like a marriage gift, new born baby, etc.

To perform an immediate correction run.

For example − Consider where employee master data got modified.

To pay an absence like a leave in advance.

To process the payments that are added to Payroll Results Adjustment under Infotype 0221.

Consider a case where the payment was made but not received by an employee. To perform a replacement, you can use Off-Cycle workbench.

If you want to reverse a payroll result.

Payroll History

This is one of the key components that allows you to check the previous payroll run results for an employee within an Off-Cycle workbench.

In the Off-Cycle workbench, go to History tab to display an extract from the payroll which contains all the necessary information of an employee payroll. It also shows details of all the payments that are replaced with a check along with any payroll’s which are reversed are also mentioned here.

If you want to check any further details on an employee payroll, you can check the remuneration statement for the employee for a specific payroll period.

You can also check the following details about the payment made in the History tab under workbench −

For reverse payment you can check the reason for reversal and person who has carried out reversal payment.

To check the replace payment details, you can find which payments are replaced and by which check number.

Details of check number, bank name, etc.

Note that to view the remuneration statement of a payroll → select the result and choose → Remuneration Statement.

Off-Cycle Subsequent Processing

This is used to further process the Off-Cycle payroll results, a payment reversal or repayment, etc. When a bonus payment is made using a workbench, a replaced or reverse payroll, remuneration statement should be generated and results from payroll run should be posted to Accounting.

All the details related to Off-Cycle payroll, reverse payment or repayment is stored in table T52OCG and is available in the report H99LT52OCG and this report is available in Off-Cycle menu.

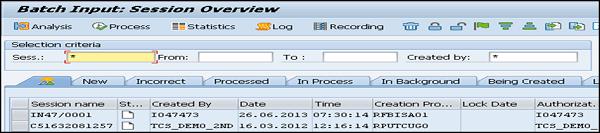

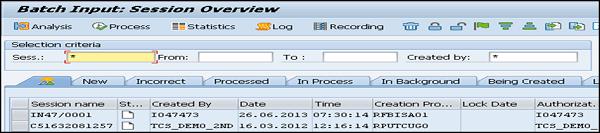

Report for Batch Subsequent Processing

Subsequent processing is performed by running one or more batch reports and to ensure that subsequent processing is performed in the correct sequence. You should schedule the report for a Batch Subsequent Processing in the international standard system as regular background jobs. With scheduling report that subsequent processing is conducted regularly and on time.

Process Model

Process model is used to define a subsequent program and order in which they run. When you select a report for Batch Subsequent Processing, you also have to define the process model report that should be used.

Off–Cycle subsequent processing, it is possible to schedule the batch report in background job with process model or you can also call it in a workbench menu and run it from there.

According to the function executed in an Off-Cycle workbench, different activities are performed.

For example − Consider replacing a payment.

| Function |

Activities |

| Replacing a Payment |

Runs Preliminary Program Data Medium Exchange

Indicates each payment replacement with a key composed of program run date and the indicator feature CYYYP.

Enters the details in the indicator table for off-cycle batch processing

Runs the batch report for subsequent processing of check replacement as a background job at the time that you have scheduled for the regular processing of the report

Reads indicator table

Runs the process model that you have specified in the report variant

Prints new checks

|

SAP Payroll - Infotypes

To maintain a master data in SAP system, there are different Infotypes defined in SAP system for Personnel Administration and payroll.

| Infotype |

Infotype Name |

Description |

| (0003) |

Payroll Status |

It stores the payroll and time status data. This is automatically created when an employee is hired. |

| (0008) |

Basic Pay |

This is used to store and employee’s basic pay. When an employee leaves an organization, Basic pay Infotype should not be delimited and remain in the system for retroactive accounting. |

| (0014) |

Recurring Payment and Deductions |

These are not processed with every payroll and paid or deducted for an employee at a specific time period. |

| (0015) |

Additional Payment |

These are not processed with every payroll and paid or deducted for an employee at a specific time period. |

| (0011) |

External Bank Transfer |

This stores the payment information for an employee made to third party vendors. |

| (0267) |

Additional Off-Cycle payment |

This is used to make additional off-cycle payment for one of the few employees. This is not available for all the countries and can be created using Off-Cycle Workbench. |

| (0045) |

Loan Infotype |

This is used to store HR master data for loans. This is used to calculate: Loan repayment, Loan interest, imputed income taxation. |

| (0165) |

Limit on payment/deduction |

This is used to store information about limit on payments/deductions. You can define certain maximum values for payments/deductions for individual employees and wage types. |

| (0037) |

Insurance |

This is used to insurance information for employees. The standard system different insurance types −

Company insurance

Group accident insurance

Life insurance

Supplementary insurance

Not liable

Risk

Risk/pension

Nursing care

Sick pay

|

| (0057) |

Membership fee |

This Infotype is used to store any membership information for an employee. An employee can enroll in different kind of membership −

Sports club

Medical

Union, etc. |

| (0025) |

Appraisals |

This is used to store employee performance related information. You can use an existing or add new performance criteria for employee performance appraisal. |

| (2010) |

Employee remuneration info |

This is used to store information about wage types calculated manually. Example: wage type for hazardous working condition bonus or other non-standard wage types. |

| (0128) |

Notifications |

This Infotype is used to print any additional information that should be displayed on employee’s remuneration statement. |

Reporting Bases

Payroll system consists of Date Specifications and monitoring of tasks Infotypes. Using monitoring of task, you can set automatic monitoring of tasks for HR activities and system suggest a date when you want to be reminded of the stored tasks.

Date Specifications

This is stored in Infotype 0041 and date type defines the type of information. You can create series of reports on specific date type. You can use this Infotype to run Payroll and also to maintain leave.

In a standard payroll system, it contains 12 combinations of date type and date and to add more date specification for an employee at the same time, you can use time constraint 3.

Monitoring of Tasks

You can also create an automatic monitoring of all HR related tasks that includes follow up activities to be performed and it is maintained in Infotype 0019. System suggests a date according to task type on which you will be reminded and this allows you to perform follow up activities as per the required schedule.

The reminder date in the system is used to determine when you want to be reminded for a task type. Reminder date can be defined based on this criteria −

When you select a task type, if the operator indicator has a blank or negative (-) value then reminder should be set before the task data.

If the Operator indicator has a positive (+) value, reminder date shouldn’t be before the task date.

Note − Payroll system also suggests a reminder date for each task independent of task type and you can change this at any point of time.

Following are a few task types that can be added under monitoring −

- Temporary contract

- Expiry of inactive contract

- Expiry of temporary contract

- Next appraisal

- Pay scale jump

- End of maternity protection

- End of maternity leave

- Start of maternity protection

- Training period

- Dismissal protection

- Personal interview

- Vaccination date

- Follow-up medical

- Submit SI statement

- Work permit

- Work permit expires

- End of leave of absence

- Expiry of probation

Employee Qualification

This contains Infotype related to employee’s previous/other work experience, education and training and qualification.

- Other/Previous Employers (0023)

- Education and training (0022)

- Qualifications (0024)

Other/Previous Employers (0023)

This is used to store other employer contract of an employee. You can store the information where an employee works or has worked before working for your company. To enter multiple employer details, you can add multiple data records and validity period for each employee.

Enter the employer’s name and the country for each employer. The following information can be stored in this Infotype −

- City HQ – where the company is based

- Industry in which company is active

- Job role that an employee or applicant carried out or carries out

- Type of work contract with other employer

Qualification (0024)

This is used to store employee/application qualification details in this Infotype. Incase to store information on more than one qualification for an employee, you can also create multiple data records in this.

Each qualification type is identified by a key and you can also add proficiency level for each qualification. Proficiency level defines the knowledge and skill of an employee on a qualification.

Proficiency level can be defined in the following order −

Proficiency 0 means non-valuated

Proficiency 1 means very poor

...

Proficiency 5 means Average

...

Proficiency 9 means excellent

Education (0022)

This is used to store education details of an employee/applicant. To store the details about the complete education and training history of an employee/applicant, you have to create as many data records as necessary for the respective subtypes of this Infotype. You can enter the respective dates of the training period as the validity period.

The following subtypes can be created for each education establishment type −

Institute/Place − This contains institute details like University, college name, etc.

Country Key − It is used to contain the country in which the education/training institution is based.

Certificate − This is used to maintain possible leaving certificates in relation to the educational establishment type specified.

Duration of Course − This is used to specify the length of each course of study.

Final Marks

Branch of Study − This includes the specialization of education like ECE, Computers, Mechanical, etc.

Communication (0105)

This is used to an employee’s communication id for a certain type of communication. You can define various subtypes under this Infotype to maintain communication details of an employee. The following subtypes can be defined −

- Credit Card number

- Internet Address

- Voice Mail

- Fax, etc.

Credit Card Number (Subtype: 0011)

This subtype is used to store the employee’s credit card number for clearing, so the items booked on a credit card should be assigned to a personnel number in the system. This is more helpful incase an employee contains multiple credit cards or credit cards from different credit card companies.

You can also maintain different card numbers for different companies – first two positions of the ID/number field have been defined with an ID code that corresponds to the individual credit card companies.

| AX |

American Express |

| DI |

Diners Club |

| EC |

Euro Card |

| TP |

Lufthansa AirPlus |

| VI |

Visa |

Authorization Management (0130)

This contains Infotype for test procedure and contains the test procedure for your employee. Test procedure includes test procedure key and release date.

You can store the following information in Infotype 0130. All this information is defined by a system and cannot be entered −

- Date

- Time

- Releaser User ID

- Program to implement release

When a test procedure is performed for an employee up to a certain release date, then write authorization may no longer be performed which involves changing certain Infotype data with validity start date is before the release date.

Personal Data − This is used to maintain personal information for an employee in different Infotypes.

Addresses (0006)

This is used to store the address information of an employee. Various subtypes can be maintained under the Address Infotype.

- Permanent Address

- Residence Address

- Home Address

- Mailing Address

Bank Details (0009)

This is used to maintain the bank account details to process the net pay of travel expenses from payroll from the HR module.

Challenge (0004)

This Infotype is used to maintain legal obligations for severely challenged persons. Different subtypes can be defined under this Infotype −

- Challenge Group

- Degree of Challenge

- Credit Factor

- Type of Challenge

Personal Data (0002)

This Infotype is used to store the information for identifying an employee.

For example −

- Name

- Marital status

- Nationality, etc.

Family/Related Person (0021)

This Infotype is used to maintain an employee’s family member and relative details. The following relationship types can be maintained in the standard system −

- Spouse

- Divorced spouse

- Father

- Mother

- Child

- Legal guardian

- Guardian and Related persons

- Emergency contact

Internal Medical Service (Infotype 0028)

This Infotype is used to store the data related to employee’s medical examination. Various subtypes can be defined under this −

- Blood Group

- Habits

- Vision

- Allergy

- Hearing Test

- Nervous system, etc.

Personnel Actions (0000)

Using Action Infotype you can combine several Infotypes into one group. You can use Personnel action for the following purpose −

- Hiring an Employee

- To change assignment of an employee

- To perform pay change

- Employee leaving the organization

Contractual and Corporate Agreements

This section contains the following Infotypes −

Company Instructions (0035)

This contains the general instructions that an employee is supposed to perform – data protection, accident prevention, other instructions, etc.

Corporate Function (0034)

This Infotype is used to maintain an employee’s corporate function like work council member, etc.

Internal Control (0032)

This Infotype is used to maintain data on company car, employee identification and work center.

Works Councils (0054)

This is used to compare three personnel numbers while processing the payroll. When an employee loses his bonus, night work allowance cos of his involvement in work council, this is used to process his bonus by comparing with similar personnel for this purpose. This Infotype is maintained only for those employees which are involved in work council function.

Objects on Loan (0040)

This Infotype is used to maintain details of all the assets that have been provided to employee as loan. You can define the following subtypes under this −

- Key(s)

- Clothing

- Books

- Tool(s)

- Plant ID

Contract Elements (0016)

This Infotype is used to store the data related to employee’s employment contract. While creating a record for Contract Elements Infotype (0016), system suggests default values for the following fields −

- Contract type

- Sick pay

- Probation period

- Continued pay

- Notice period for EE

- Notice period for ER

These default values are determined by the company code, personnel area and employee group/subgroup in Organizational Assignment Infotype (0001).

Powers of Attorney (0030)

This Infotype is used to store any special authority/privilege that has been assigned to an employee − Power of Attorney.

Different subtypes can be defined under this −

- Commercial power of attorney

- General commercial power of attorney

- Power of attorney to perform banking transactions

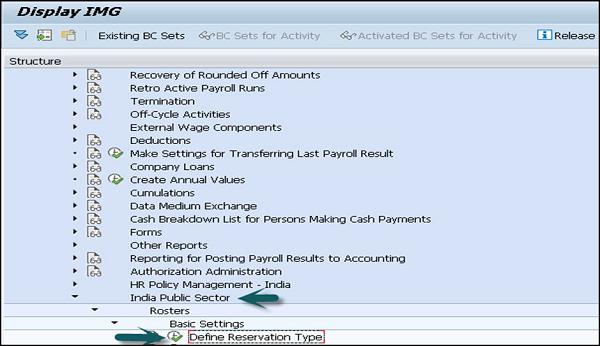

SAP Payroll - Pay Scale Grouping

Pay scale grouping for allowances is performed to add similar type of employees in a group and similar characteristics are applied on each group. This is used to determine: compensation structure as per grouping, payroll processing procedure, and the value of compensation for an employee.

While defining the payroll processing, grouping is the first step that is performed. Wage type can’t be defined till you define the pay scale grouping for allowances.

Pay scale grouping for allowances is defined based on few parameters −

- Pay scale area

- Pay scale type

- Pay scale group

- Pay scale level

Employee Subgrouping for Collective Agreement Processing

As an example, consider a company with offices in Hyderabad, Bangalore, Mumbai, Delhi and Chennai. Now the employee location where he is located affects the compensation to a certain level. In this case, it is possible to assign the different cities to pay scale area and hence pay scale area becomes a key pay parameter to create pay scale grouping for allowances. In a similar way you can define other pay scale parameters depends on various factors.

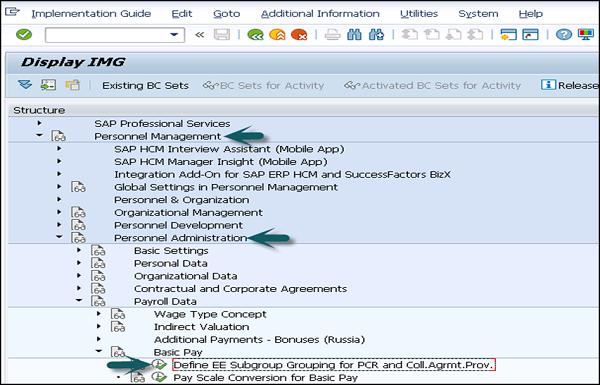

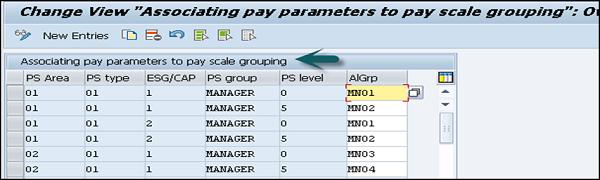

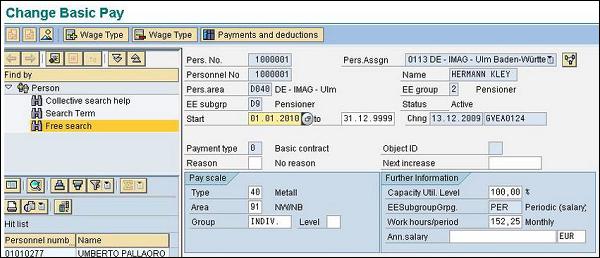

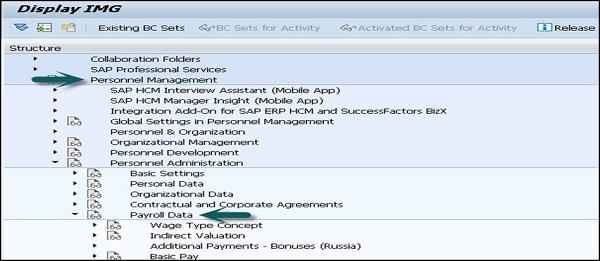

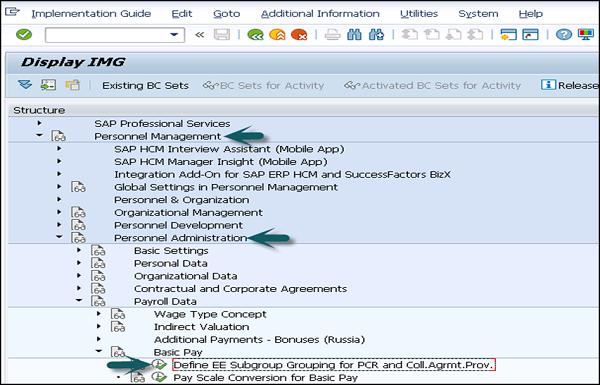

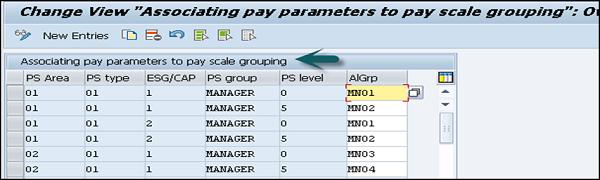

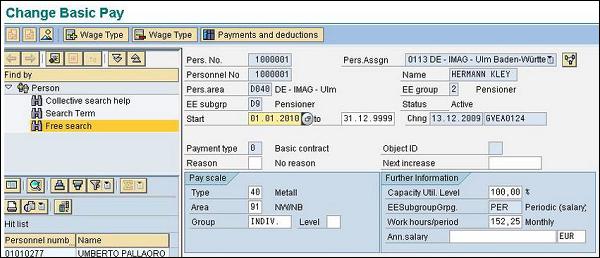

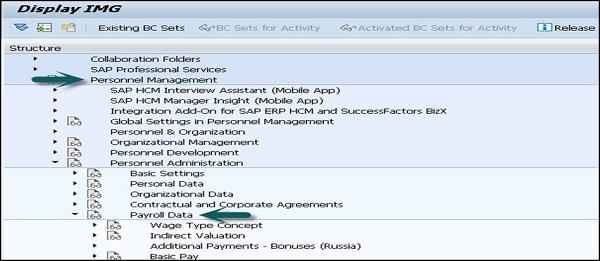

In SAP Easy access menu → SPRO → IMG → Personnel Management → Personnel Administration → Payroll data → Basic Pay → Define EE Subgroup Grouping for PCR and Coll.Agrmt.Prov.

It will show you the list of EE group, the EE group name and different fields associated with it. If you want to change it, this can be done here.

Pay Scale Grouping for Allowances is not define in any of the Infotypes. You can’t put an employee directly to a pay scale grouping for allowances. When you define five different pay parameters, an employee is directly assigned to a pay scale grouping for allowances.

By entering an Employee Group and Employee Subgroup in Organizational Assignment Infotype (0001) and pay scale area, pay scale type, pay scale group, pay scale level in the Basic Pay Infotype (0008), it adds the employee to a pay scale grouping for allowances automatically. So, the pay scale grouping is defined as an assignment of the pay parameters.

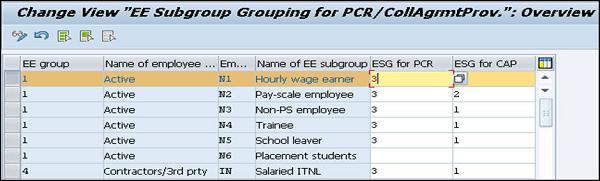

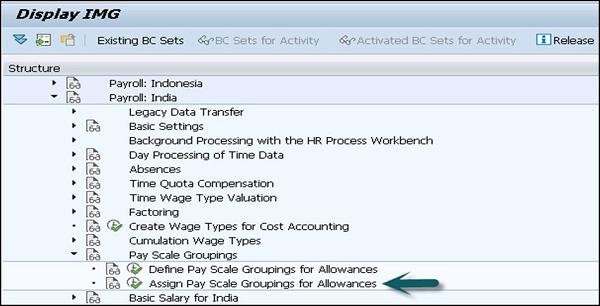

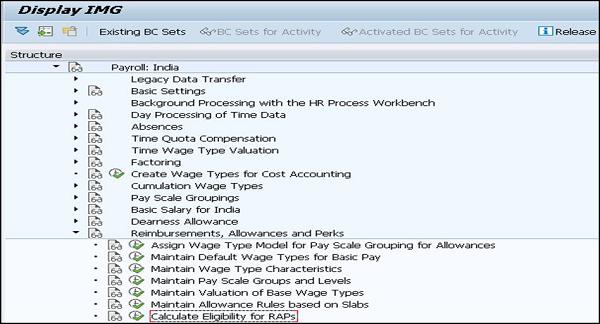

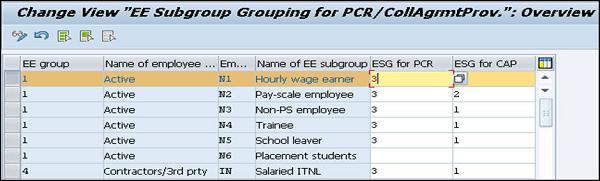

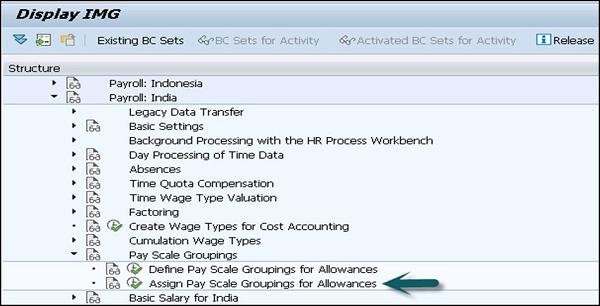

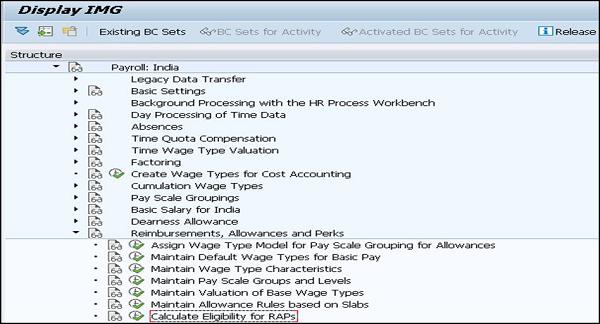

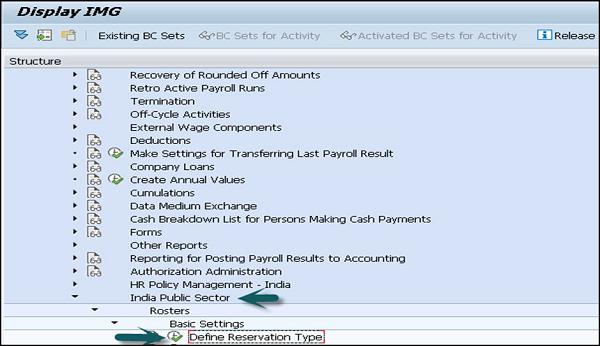

Go to SPRO → IMG → Payroll → Payroll: India → Assign Pay scale grouping for allowances.

In the next window that comes up, you can see the associated pay parameters to pay scale grouping.

- PS Area

- PS Type

- PS Group

- PS Level

Pay Scale grouping for allowances can decide the following objects in Payroll −

- Wage types

- Basic salary and increments

- Dearness Allowance

- Housing and Car & Conveyance

- Recurring allowances and deductions

- Reimbursements, Allowances and Perks

- Leave Travel Allowance

- Gratuity

- Superannuation

- Long Term Reimbursements

- Rounding off Recovery

- Provident Fund

SAP Payroll - Mid-Year Go Live

Mid-Year Go Live data is used in countries where payroll is implemented in the middle of financial year. This is used for transferring legacy payroll data to the SAP System and also for creating payroll results from the transferred legacy data.

For Example − You can consider a case for India where income tax assessment year is performed from 1st April − 31st March. Now to implement SAP Payroll India in the middle of a Financial Year, there is a need to transfer payroll results for those periods of the financial year that lie before that period.

Pre-Go-Live

This is defined as a period for which the payroll results are available and need to be transferred to the SAP system.

Go-Live

This period is defined as the term when you process the first productive payroll run.

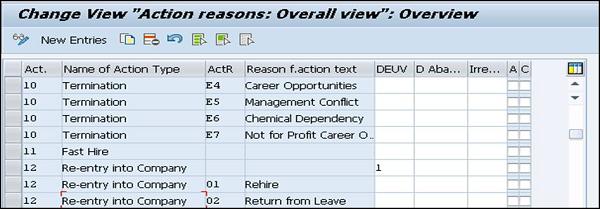

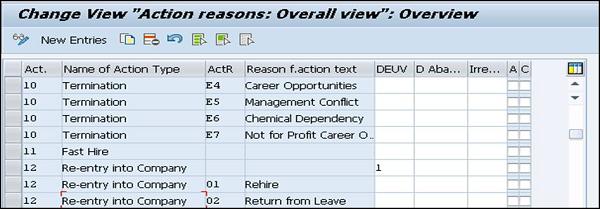

Rehiring

This is used to rehire an employee by using the same Personnel number as used in the time of last employment or within same financial year. The action type associated with this is – Reentry into the company.

In case of rehiring an employee, if previous records are not delimited, you will have to delimit the previous records and there is a need to create new entries.

The following Infotype value needs to be updated for this action type −

Recurring Payments/Deductions (0014)

Organizational Assignment (0001)

Membership Fees (0057), Example: sports club, Union, etc.

Family Member/Dependents (0021)

Other Statutory Deductions (0588)

Long term reimbursements (0590)

Housing (0581), Example − HRA, Company owned, etc.

Running Payroll for Rehiring

While running the payroll for a rehired employee, payroll function checks the status of the rehired employee’s employment in the system. If the system is showing the present status as active preceded with withdrawn and active status within same Financial Year, this represents that the employee is rehired.

The status of an employee’s employment is maintained in the internal table COCD.

To check the previous payroll data for a rehired employee – earning, deductions, and exemptions, this can be checked using the Results Table (RT) and the Cumulative Results Table (CRT).

Previous Employment Tax Details

The Payroll function INPET is used to process the previous employment tax details.

The following wage types are generated −

Wage Type /4V1 to /4V9 − This is created to maintain details of the employee’s employment in the other company in the same Financial Year.

Wage Type /4VA to /4Vg (From internal table 16) − This is created to maintain employee’s previous employment details in the same company in the same Financial Year.

The following components of the employee’s tax is calculated for a rehired employee −

Tax Exemptions on −

House Rent Allowance (HRA) (Metro or non-Metro)

Leave Travel Allowance (LTA)

Child Education Allowance or Tuition fee

Child Hostel Allowance (CHA)

The following perquisites are checked before calculating tax −

- Company Owned Accommodation

- Company Paid/Leased Accommodation

- Loans

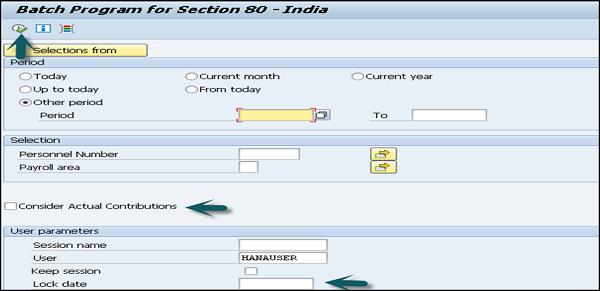

The Payroll system also checks the below deductions for the employee −

- Deductions under section 80

- Section 89 relief

- Professional Tax

- Labor Welfare Fund (LWF), etc.

- Employee State Insurance (ESI)

- EPF Provident Fund and Pension Fund

A Split Payroll is run for the following periods – First of the month to one day before the employee is rehired. And from the date of rehiring to the end of the month.

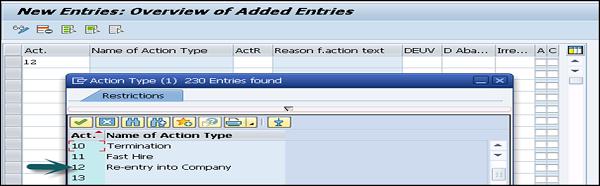

When an employee is rehired on any day other than the first, a split payroll is enabled. Go to SPRO → IMG → Payroll → Payroll India → Basic Settings → Enable Split Payroll Run.

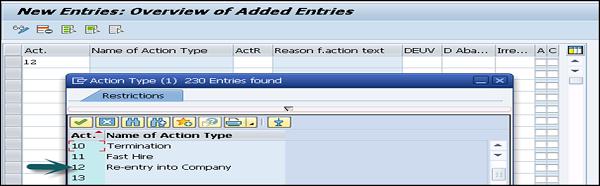

In a new window, you will see the list of all split payroll in the system. To create a new entry, click on the New Entries tab at the top left hand side of the screen.

Enter the values: Act. 12 stands for re-entry into the company. In a similar way, you can select the other fields as well.

Once you enter all the details, click the save icon at the top left hand side of the screen.

An example of rehiring and payroll run −

An employee left a company on May 17, 2015 and was rehired on Nov 25, 2015. In this case, November payroll will be run twice.

For the period between Nov 1, 2015 and Nov 24, 2015.

For the period between Nov 25, 2015 to Nov 30, 2015.

SAP Payroll - Indirect Evaluation

Indirect Evaluation is used to calculate payroll for some specific wage types that are defaulted under the Basic Pay Infotype (0008) or Infotype 0014 or 001 (recurring payment/deductions or Additional payments).

Note − While using indirect evaluation, it is also possible to calculate INVAL as numbers instead of using value as amount considering the wage type configured correctly.

For example − You can configure INVAL for an employee to be eligible for 10 liters of petrol each month. This represents INVAL as number.

Variants for Indirect Evaluation

There are quite a few types of variants for indirect evaluation, which are −

Variant A − This is used to calculate the wage type value as a fixed amount.

Variant B − This is used to calculate the amount as percentage of the base wage type added to a fixed amount. In this, multiple amounts with same or different percentage of the base wage type, can be calculated for an INVAL wage type. In this case, the amount that will be Indirectly Evaluated will be the sum of all such calculated amounts added to a fixed amount.

For example − Wage type M230, consider the following different INVAL B amounts.

10% of MB10

30% of M220

Fixed amount of Rs.1000

So in this scenario, wage type M230 will have INVAL amount as sum of a, b and c.

Variant C − This is used to calculate the amount as a percentage of a base wage type subject to a maximum limit. More than one such amount, with same or different percentage of the base wage type, can be calculated for an INVAL wage type. In this case, the amount that will be Indirectly Evaluated will be the sum of all such calculated amounts, subject to a maximum limit.

For example − Wage type M230, consider the following different INVAL C amounts.

15% of MB10

20% of M220

Limit of Rs.4000

In this scenario, INVAL amount for the wage type M230 will be the sum of a, and b

subject to a maximum of c.

This is used to calculate the fixed amount and the percentage of the basic slab. This is done by first calculating the percentage of a base wage type added to a fixed amount. And then secondly, the percentage of a base wage type which is subject to a maximum limit.

SAP Payroll - Gross Part

The Gross Part of the Payroll is used to determine an employee’s gross pay as per the contractual requirements and consists of payments and deductions. The Gross Pay consists of different components, which includes −

- Basic Pay

- Dearest Allowance

- Variation allowance

- Bonuses

- Provident fund

- Gratuity

Then there are different deductions that are made as per the employee enrollment. These deductions include company owned apartment (COA), company sponsored day care, and other deductions.

All these factors are based on a country’s legal labor rules and determines the gross taxable income of the employee.

Wage Types

Wage type is one of the key components in payroll processing. Based on the way they store information; wage type can be divided into the following two categories −

Dialogue wage type or Primary wage type

Primary wage type is defined as the wage type for which data is entered in an Infotype. The Primary wage types are created by copying the model wage types provided by SAP. There are different types of primary wage types −

Time wage type

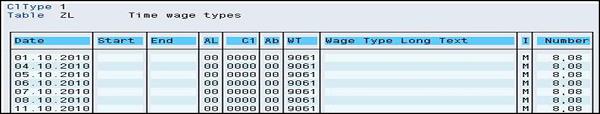

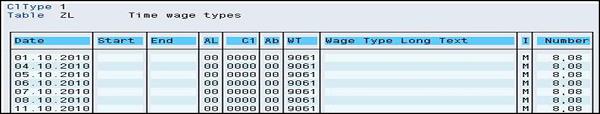

Time wage type is used to store the time related information. This wage type is used to combine payroll and time management. Time wage type is generated at the time of evaluation and is configured through T510S or using a custom PCR.

Dialogue wage type

This wage type includes basic pay IT0008, recurring payments and deductions IT0014, and additional payments IT0015.

Secondary Wage type or Technical Wage type

The secondary wage types are predefined wage types in the SAP system and starts with a ‘/’. These wage types are created during the payroll run.

These wage types are system generated and can’t be maintained online.

For example − /559 Bank Transfer

Wage Type Elements

The key elements of a wage type include −

- Amount AMT

- Rate RTE

- Number NUM

As per the processing type, each element can have one, two or all element values.

For example − The basic pay can have a Rate and a Number, however a bonus pay can only have an amount.

Payments

The payment includes all the payments given to an employee according to the employment contract and any voluntary payment paid. A payment combines the employee gross remuneration.

This gross remuneration is defined as the calculation of social insurance and tax payments and also for the calculation of net remuneration.

Payment Structure

The payment is defined in terms of the following components in the SAP Payroll system −

Basic Pay − This component consists of the fixed wage and other salary elements and is paid to the employee for each payroll period. The details are entered in the Basic Pay (0008) Infotype.

Recurring Payments and Deductions − Recurring payments and deductions include components like overtime, leave or other components. This information is maintained in Recurring Payment and deduction Infotype (0014).

Additional Payments − There are many components in the payment section, which are not paid in each payroll period. This information is added to Additional Payments Infotype (0015).

Time Management in Payroll

Time management is one of the key components in Payroll that is used to calculate the gross salary of the employees. Monetary benefits are determined by work schedule and planned working hours.

The time management integration with payroll is used to determine wage types like bonuses for overtime, night/odd hour work allowance, work on holiday, etc.

You can also use Time Data Recording and Administration Component Integration with Time Management component to find out time data information for employees and further to determine the time wage types.

When you use this time evaluation component Integration with Time Management component, this is used to find time wage types determined by Time Evaluation.

Night Shift Compensation/Shift Change Compensation

This component is used to ensure that an employee shouldn’t get financial disadvantage, if he/she is working in odd hours or if a shift time is changed for them.

For example − An employee’s planned working time is changed and he is facing a financial disadvantage, he or she is paid on the basis of the original working time – like an employee gets his shift changed from a night shift with night shift bonuses to an early shift.

If an employee’s shift time is changed and that employee will be benefited financially, he or she is paid on the basis of the changed working time.

Consider an employee whose shift changes from Friday to a Sunday with Sunday bonuses. In this case, a shift change compensation will be listed under the remuneration statement. It is also possible to limit the payment of a shift change compensation for a particular category.

Employee Remuneration Information

This is used to process the manually calculated wages, bonus or non-standard wage types.

| Function |

Required Component |

| Record wage types for work performed and the information on other components in the system |

Cross-application time sheet |

This component provides information on payroll with time and person related time wage types. Time wage type is used to perform the financial evaluation of work performed on a payroll.

Wage Type Valuation

Wage type is one of the key components in payroll processing. Based on the way they store information, they can be defined as Primary and Secondary Wage types.

During the payroll run, the primary wage types are provided with the values and secondary wage types are formed at the time of the payroll run. You can check the characteristics of a wage type by going to the following path −

SPRO → IMG → Personnel Management → Personnel Administration → Info Type → Wage types → Wage type catalog → Wage type characteristics

Old and New Processing of Averages

With the release of 4.6B, processing of averages has been changed. Processing of averages depends on the country and release and with countries like Argentina, Brazil and a few other, a new processing is released with version 4.5B.

At one time, you can only use any of these two versions, if you are using an old version, you can continue to use the same version and there is no need to move to the new version, but the older version is not under development.

The technical processing of averages can be configured as shown in the following steps −

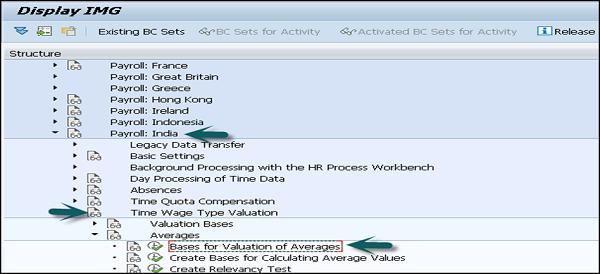

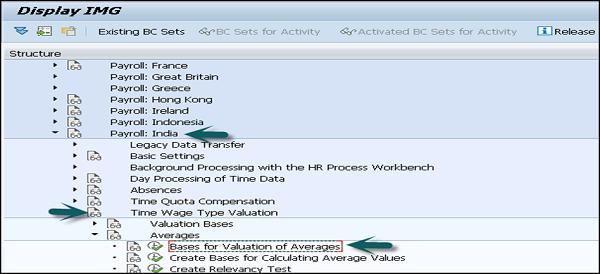

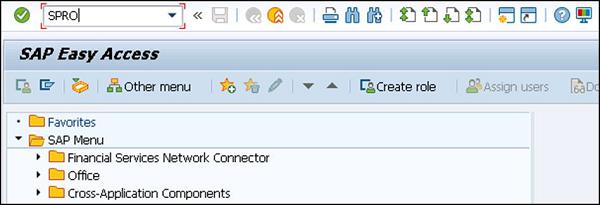

SPRO → IMG → Payroll → Payroll India → Time wage type valuation → Averages → Bases for valuation of Averages

You should check the following perquisites for this −

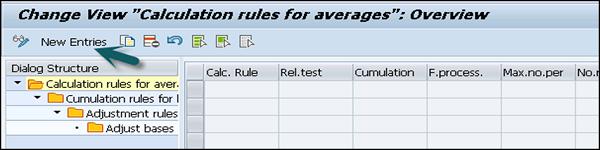

- Forming the basis for calculating average values

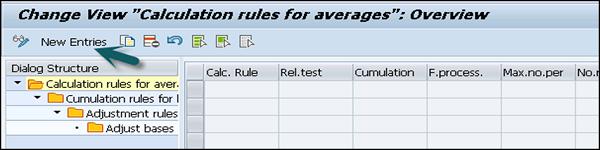

- Definition of calculation rules for averages

- Assignment of calculation rules to wage types

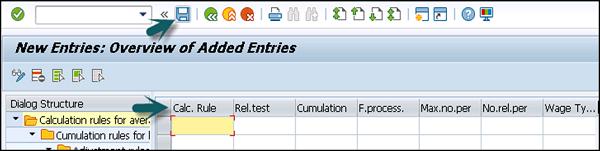

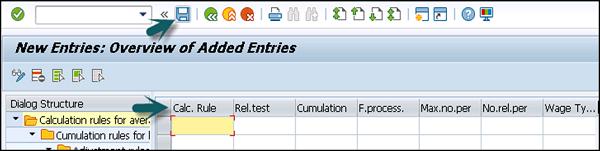

To create a new technical processing of average, click on New Entries

In a new window, define the different rules as mentioned above and click on the save icon at the top.

Incentive Wages: Overview

To maintain incentive wages, different accounting processes are defined in standard SAP system.

Monthly Wage Calculation for Incentive Wages

In this Wage Type, target time for each ticket is calculated using a piecework rate. This is used to calculate the amount for time ticket that the employee is due. This amount consists of −

Basic Monthly Pay − This defines the gross amount that is paid to the employees irrespective of their performance and it can be paid as a monthly sum or in terms of hourly pay as per their contract.

Time Dependent Variable Pay − This is used to define the pay scale rate that is different from a master pay scale rate for an employee. It is possible that an employee is remunerated at a high rate as compared to a master pay rate for specific activities. You have to enter a higher pay scale into the time ticket.

Performance Dependent Variable Pay − This is used to credit when an employee completes the work in less time than the target time. The different between target time and actual time is mentioned on time ticket.

Hourly Wage Calculation for Incentive Wages

This is similar to the monthly wage calculation with the only difference that the monthly wage is specified as an hourly wage from the starting, so you don’t need to convert the monthly basic wage into an hourly wage.

Incentive Wage Accounting: Tools

Personnel calculation schemas −

There are two types of schemas valuation of time tickets for incentive wages −

German Version DIW0 − this contains special features that are specific to German only.

International Version XIW00 − You can use schema XIW00 to set up your own incentive wage accounting rules as per different countries. As valuation of time tickets vary according to different countries and organizations so there are no country specific accounting schemas in it.

Partial Period Remuneration

This component is used to check the remuneration when an employee works for a lesser period of time. You can use factoring in the following cases −

When an employee leaves, joins or remains absent for a specific period of time.

When there is a change in the basic pay, substitution, work reassignment or change in personal work schedule.

To find the correct remuneration for an employee, the remuneration amount is multiplied by a partial period factor which is based on different methods −

- Payment method

- Deduction method

- PWS method

- Hybrid method

Each Payroll system contains few factoring rules that are needed to determine the partial period factor. These rules can be customized to meet specific requirements in the company.

The following Infotypes are calculated for partial period remuneration −

| Actions |

Infotype 0000 |

| Organizational Assignment |

Infotype 0001 |

| Planned working time |

Infotype 0007 |

| Basic Pay |

Infotype 0008 |

| Recurring payments and deductions |

Infotype 0014 |

| Additional Payments |

Infotype 0015 |

| Absences |

Infotype 2001 |

| Substitutions |

Infotype 2003 |

Partial Period Factor

This factor is used to calculate the partial remuneration. This is defined as a variable value which is calculated using different formulas as per the company and the circumstances.

While customizing, partial period factors are defined in a personnel calculation rules for specific situations and assigned to wage types for particular periods.

When you multiply the partial period factor by the fixed remuneration amount, this gives you partial period remuneration amount to be paid for a specific period.

For example − Consider an employee who was on an unpaid leave from 3rd February to 29th March, this means that the employee has worked for 2 days in February and 2 days in March considering 20 workdays in Feb and 23 workdays in Mar.

| Parameter |

February |

March |

| Planned working time (SSOLL) |

148 |

172 |

| Absence(SAU) |

132 |

156 |

| Individual period working time (SDIVI) |

148 |

172 |

| General period working time (SDIVP) |

167,7 |

167,7 |

Now consider reduction using the following different ways −

- Partial Period Factor

- Basic Remuneration

| Method |

Calculation formula |

Remuneration for February |

Remuneration for March |

| PWS |

a = (SSOLL-SAU**)/SDIVI |

0,108 |

0,093 |

|

Reduced remuneration: b×a |

351,22 |

302,44 |

| Payment |

a = (SSOLL-SAU**)/SDIVP |

0,095 |

0,095 |

|

Reduced remuneration: b×a |

308,94 |

308,94 |

| Deduction |

a = (SDIVP-SAU**)/SDIVP |

0,213 |

0,070 |

|

Reduced remuneration: b×a |

692,68 |

227,64 |

Now if you use the payment method, the employee receives the same remuneration for both the months.

If you use the deduction method, the employee is overpaid in Feb and underpaid in March.

If the PWS method is used, the employee receives more salary in Feb as compared to March, however the difference is negligible.

Salary Packaging

This component is used to determine an employee’s gross and net income and various components that effects the net income of an employee.

It consists of the following components −

- Personnel Administration

- Payroll South Africa

- Payroll Australia

The following Infotypes should be configured before setting up the salary package for an employee. The following are Infotypes are country specific and valid only for a few countries only −

- Actions (Infotype 0000)

- Addresses (Infotype 0006)

- Basic Pay (Infotype 0008)

- Organizational Assignment (Infotype 0001)

- Personal Data (Infotype 0002)

- Bank Details (Infotype 0009)

- Planned Working Time (Infotype 0007)

- Social Insurance SA (Infotype 0150) (only for South Africa)

- Superannuation (Infotype 0220) (only for Australia)

- Taxes SA (Infotype 0149) (only for South Africa)

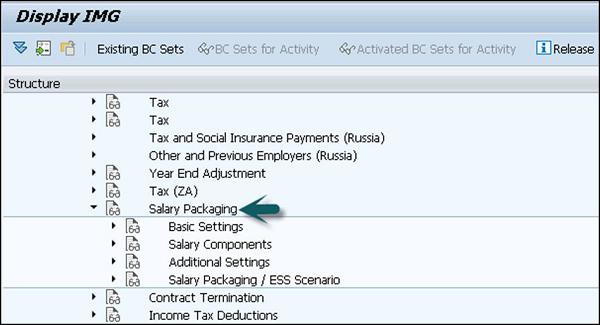

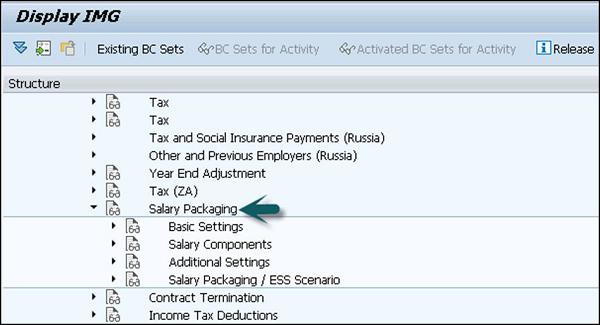

You can find the Salary Packaging SPRO → IMG → Personnel Management → Personnel Administration → Payroll Data → Salary Packaging

You have to define the following components under customizing −

For example − Basic Salary and Company Car.

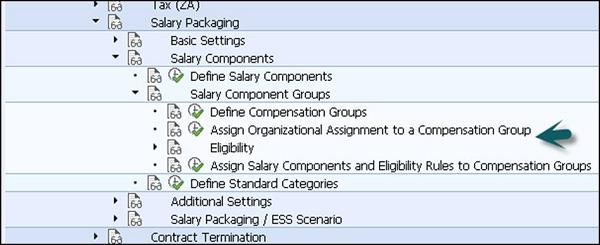

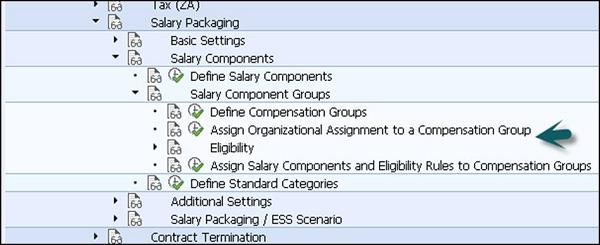

Salary Component Groups

This is used to define the default salary components based on an employee's organizational assignment.

Eligibility Criteria

Using the Eligibility Criteria, you can create checks to determine if an employee will have a specific salary component defaulted into their salary package.

For example − An employee is eligible for a certain salary component, once they reach a specific pay scale level. You can set eligible criteria for this rule.

Additional Settings

This is used to maintain additional features for salary packaging. Various steps can be defined as per different country specifications −

- Maintain Company Car Regulation

- Define Receiver Travel Allowance Rates

- Result

Modeling a Salary Package

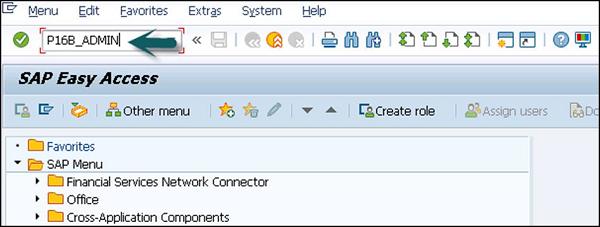

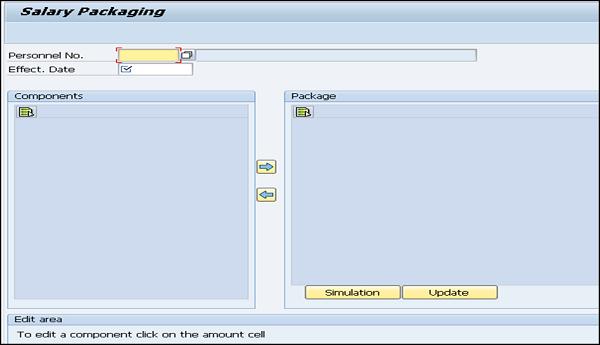

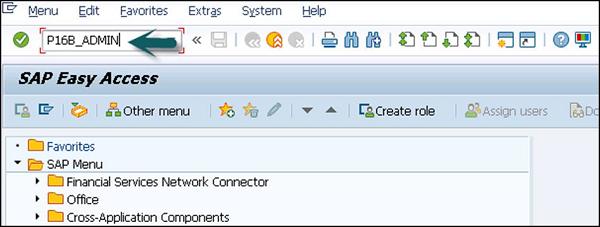

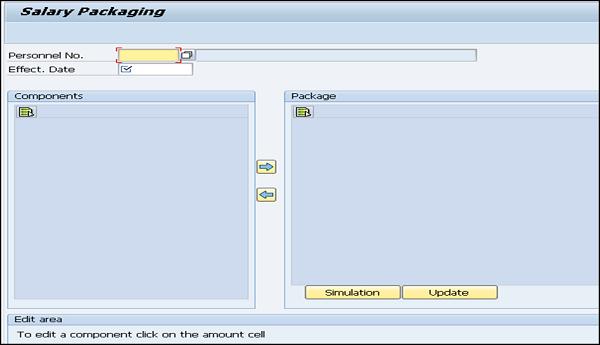

T-code: P16B_ADMIN

The following is some general information about the subsequent screenshot −

The following tasks should be performed to model a Package −

First is to click on the salary component text and choose the arrow to move the component between two boxes. Using this you can add/remove the components from the package.

If you want to change the component details, click on the amount for the component.

Below this you can see the edit section. This section is specific to each component and contains the relevant amount, percentage, and contribution information valid for the component.

Click Accept to include your new attributes to the package.

You can click on the Reset button to put the last values used.

Once you close the modeling screen, you can select from the following options −

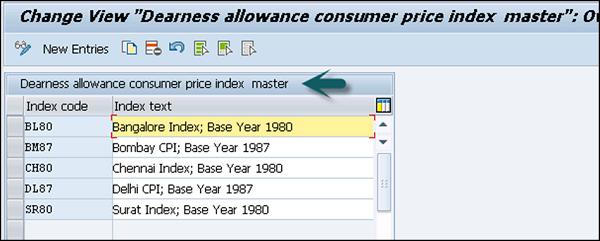

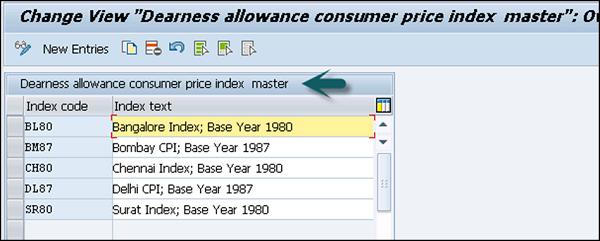

Dearness Allowance

This allowance is a part of the monthly remuneration paid to an employee and varies as per the location and other factors. The value of this component depends on the Consumer Price Index (CPI) for that location and this index varies as per government regulation. When an employee is transferred or moved to a different location, this allowance is also changed as per the location.

Dearness allowance along with other components like Base salary, Income tax, Gratuity, etc., forms the salary package of an employee for computation.

You can calculate Dearness allowance in a standard SAP system by using the following methods −

CPI slab based calculation

You can also define new CPI in SAP system using New Entries.

- Incremental CPI slab based calculation

- Basic slab based calculation

- Basic slab based calculation, subject to minimum value

- Non-slab based calculation

- Incremental basic slab based calculation

Note − For a non-managerial category this allowance is called Dearness allowance however for managerial category employee group it is also called Cost of Living Allowance (COLA).

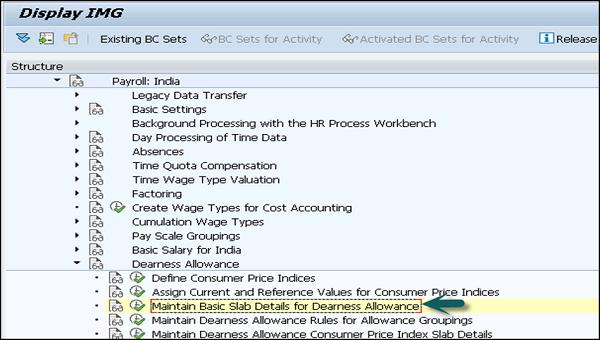

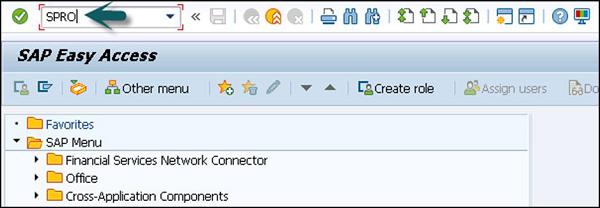

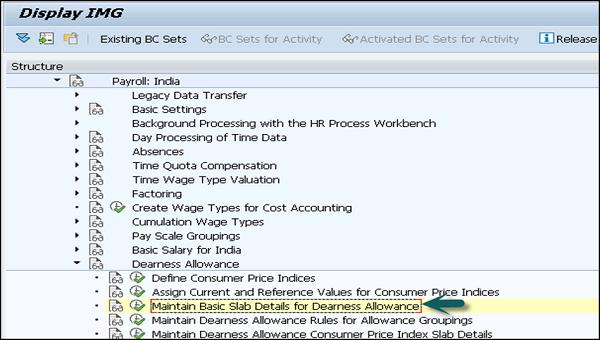

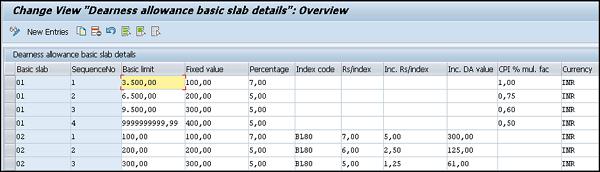

To configure DA in SAP system, go to SPRO → IMG → Payroll → Payroll India → Dearness Allowance → Maintain Basic slab details for Dearness allowance.

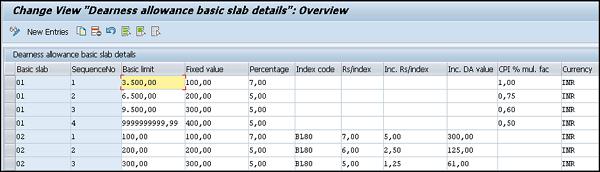

Once you click on this, it shows you the Basic slab details for Dearness allowance, which includes Fixed value, Percentage, CPI % mul. Fac., currency.

Housing Allowance

This component is used to maintain information about an employee accommodation. This is used to calculate tax exemptions and to check perquisite applicable on a housing benefit.

While updating or creating a housing record using the Housing (HRA / CLA / COA) under Infotype (0581), the system dynamically updates the Basic Pay Infotype (0008) with the new or changed wage type for Housing.

Different Types of Accommodation Under Housing

Rented − When an employee uses a Rented Accommodation, he receives a House Rent Allowance (HRA) to meet the expenses incurred by renting a residential accommodation.

In this case, the system calculates the tax exemption on the rented accommodation and rented amount paid by an employee.

Company Leased Accommodation (CLA) − When an employee uses a Company Leased Accommodation, the company leases an accommodation and provides it as a housing benefit to the employee.

The company Leased eligibility depends on the employee Pay Scale Grouping for Allowances. When an employee uses CLA benefit, the system checks the applicable perquisite on the CLA.

Company Owned Accommodation (COA) − When an employee uses COA, in this case company owns the accommodation and provides it as a housing benefit to the employee. Like CLA employee eligibility for COA depends on the employee grouping for pay scale allowance.

When an employee opts for COA benefit, the system will compute the perquisite applicable on the COA.

Hotel Accommodation − A company can also provide a hotel accommodation to the employee. Their stay in the hotel depends on a fixed period as per the Government rule and if the stay exceeds the time limit, a perquisite is applicable on the cost of accommodation.

In a SAP standard system, the following accommodation types are configured by default −

- Rented Accommodation

- Company Leased (Old)

- Perkable Hotel Accommodation

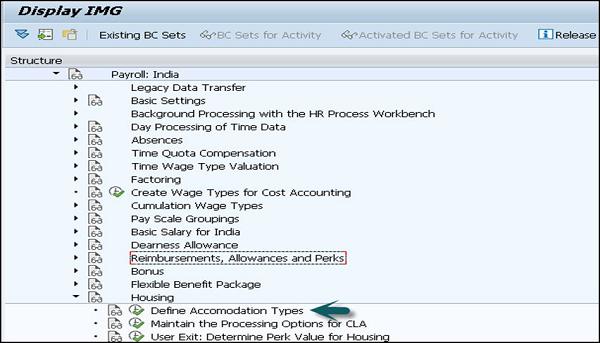

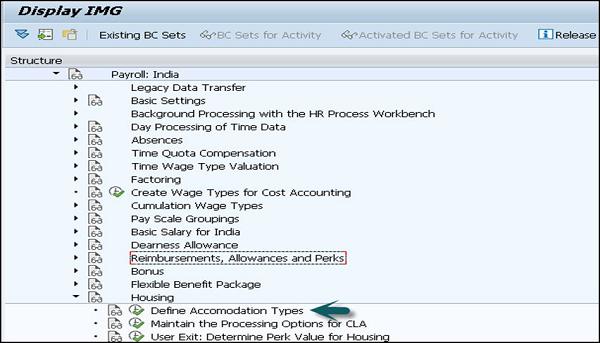

It is also possible to create a new accommodation type in the system. Go to SPRO → IMG → Payroll → Payroll India → Housing → Define Accommodation type

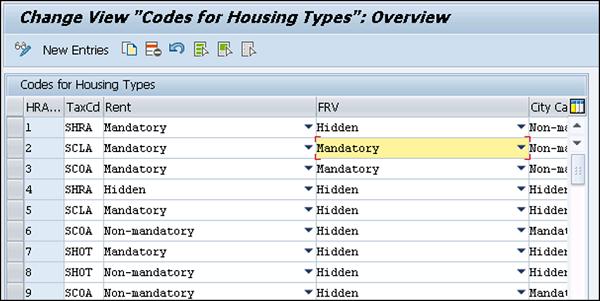

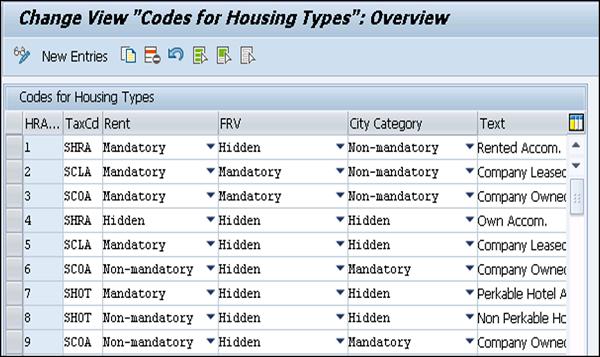

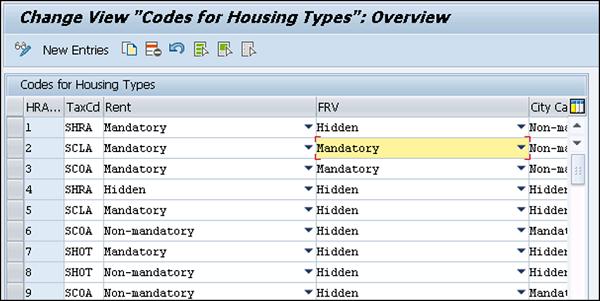

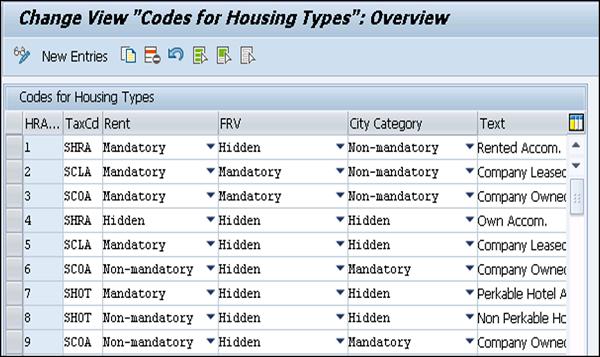

Under the Accommodation type, you can view the already defined Housing types or can create new entries by clicking the New Entries button.

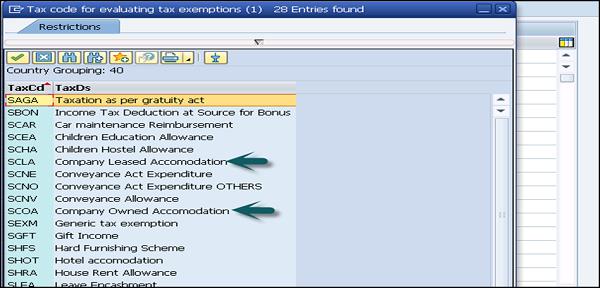

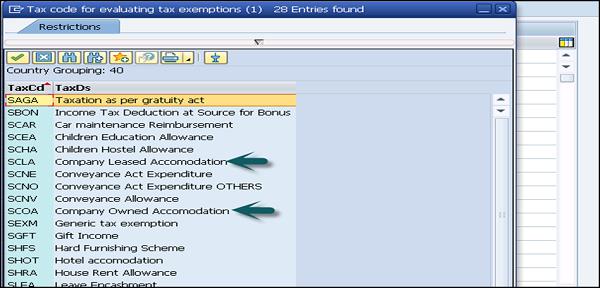

In the Tax Code, select the tax code as per the accommodation type.

Tax code field determines as per different accommodation type −

Car and Conveyance Allowance

This component is used to process the exemption on conveyance allowance. The details are maintained in Car and Conveyance Infotype (0583).

The standard SAP system provides exemption on conveyance allowance given to the employees. The following configuration has to be configured in the system if you want to give conveyance allowance and exemption to the employees.

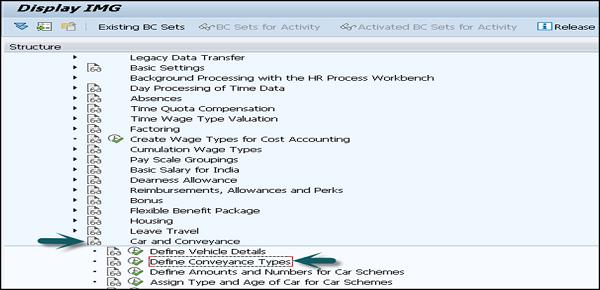

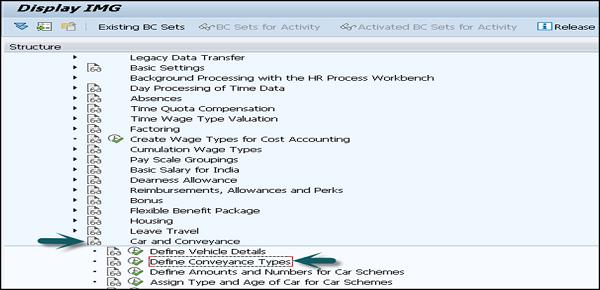

Go to SPRO → IMG → Payroll → Payroll India → Car and Conveyance → Define Conveyance Type.

Different Car schemas can be used in the SAP system for exemption under different sections.

Long-Term Reimbursements

This defines as the long-term benefits provided to the employees over a fixed period of years. The duration varies from three to five years. In a standard SAP system, long-term benefits can be divided into the following categories −

Hard Furnishing Scheme

This includes benefits provided to employee for purpose of purchasing movable items like Fridge, TV, Washing machine, computer, etc.

Soft Furnishing Scheme or Other Reimbursements

This includes benefits provided to employee for purpose of purchasing consumer good items like Sofa, chair, Carpet, etc.

Car Maintenance Scheme

This benefit includes maintenance of their car over a period of time, etc.

Long Term Reimbursements Infotype (0590)

This Infotype is used to maintain Long Term Reimbursement claimed by the employees and under one of the following subtypes −

Subtype SHFS − For maintaining hard furnishing schemes information

Subtype SSFS − For maintaining soft furnishing schemes information

Subtype SCAR − For maintaining car maintenance schemes information

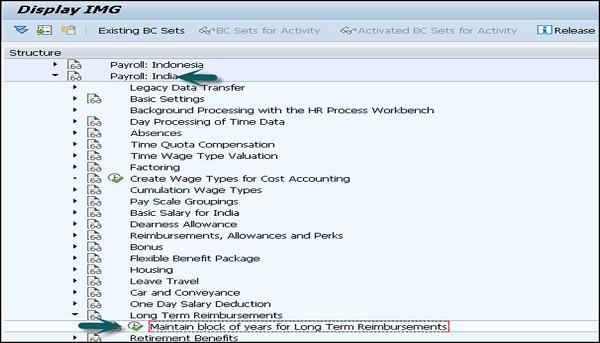

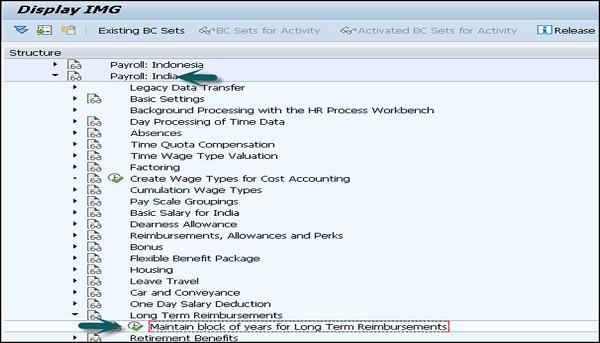

To configure a long term reimbursement, go to SPRO → IMG → Payroll → Payroll India → Long Term Reimbursement → Maintain block of years for long tern reimbursement.

To avail long-term benefits by an employee, there are different perquisites attached with each benefits that should be met −

Hard Furnishing Scheme

In this, there is a fixed percentage as the perquisite value applicable on the assets that an employee can avail during a financial year.

This fixed value is maintained in Calculate Hard Furnishing Perk Value constant (HFPRC) of the table view Payroll Constants (V_T511K).

Soft Furnishing Scheme

In this, the system calculates perquisite value for the assets that an employee avails in the current financial year and it is based on the perquisite percentage that you maintain in the Long Term Reimbursements Infotype (590) and subtype SSFS.

Car Maintenance Scheme

Normally, the system doesn’t contain any perquisite value with the Car Maintenance Scheme or any other similar type of scheme you create in the system.

Claims

In a company, an employee is eligible to claim some monetary and non-monetary benefits and these claims vary as per the pay scale grouping and many other factors. An employee needs to submit the claim based on the eligibility to get these benefits. Claims submitted can be of the following types −

Monetary Claims

This includes the claims that are available as per the eligibility amount.

For example − A conveyance allowance of Rs. 1800 per month or a Medical claim of Rs. 15000 in a given assessment year.

Non-Monetary Claims

These claims are commonly raised by an employee for company work. They are normally placed in units like Stationary request, Calculator, Petrol, etc.

Apart from this, there is one more type of claim known as the slab based claim. A few common types of slab based claims are LTA, car maintenance allowance, etc. These type of claims has an eligibility which is normally more than a year.

For example − Car maintenance allowance – where the validity period starts from the date of purchase of the car and in the first and second year an employee is eligible for a car maintenance allowance of Rs. 3000 and in the third year, claim eligibility is Rs. 5000 and in the fourth year, the eligibility is Rs. 7500.

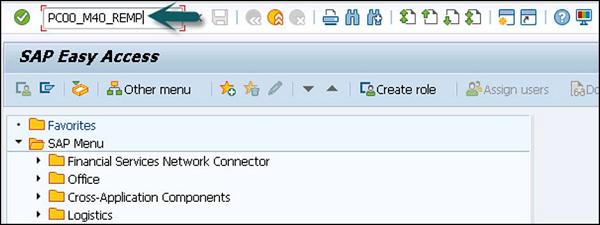

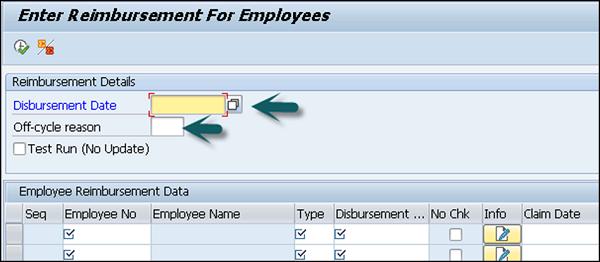

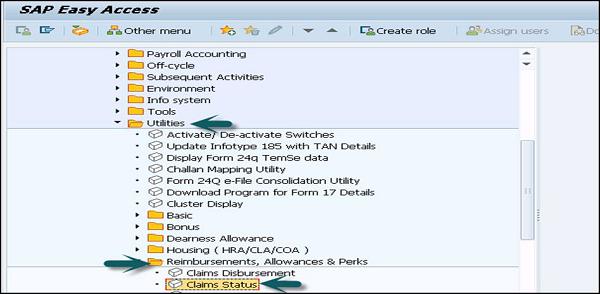

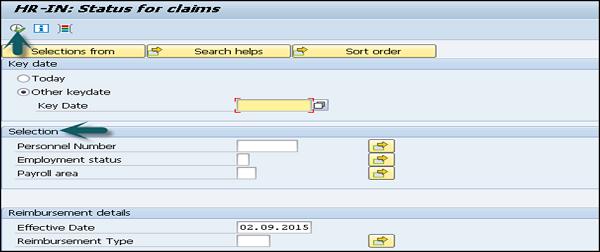

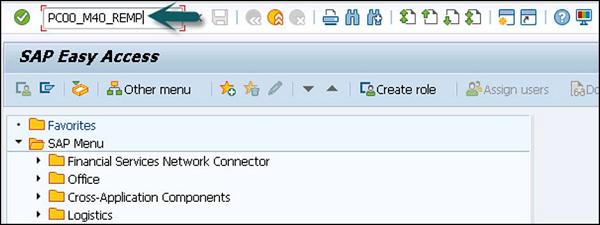

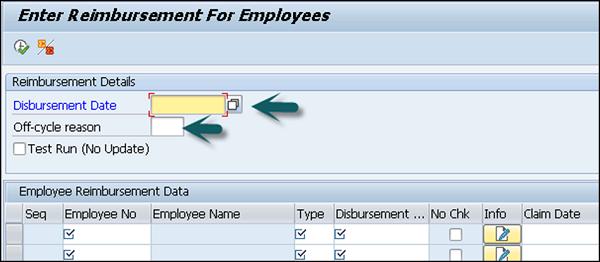

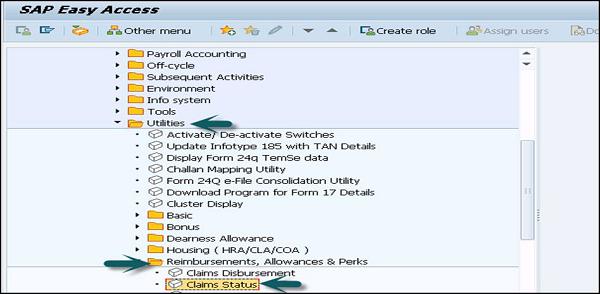

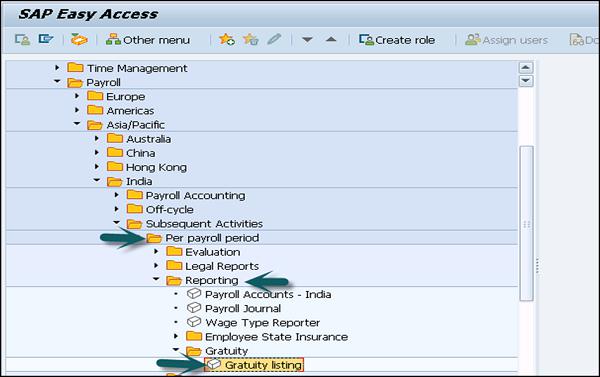

To get into the non-monetary claims section, you should use the following Transaction Code: PC00_M40_REMP as shown in the subsequent screenshot.

Once you run the above transaction, the reimbursement claim screen will appear.

The claims can be processed via −

Regular payroll run − In this reimbursement type, additional payments Infotype 0015 is updated with the information that you enter in this report and claim disbursement is made along with the regular payroll.

Off-cycle payroll run − In this method, One-Time Payments Off-Cycle Infotype 0267 is updated with the information that you enter in this report and approved claims can be disbursed through an off-cycle payment process.

For example − In this disbursement, claims are disbursed on the same day or claims submitted during the week are disbursed on any day of the week.

Bonus

This component is used to process the employee bonus and can compute both regular and off-cycle bonus.

As with claims, there are two types of bonuses that can be paid −

Type 1 Additional Payments 0015 − In this, the SAP system updates the Infotype when a regular bonus is processed.

Type 2 Additional Off-Cycle Payments for Off-Cycle Bonus 0267 − In this, 0267 Infotype is updated in the system, when an Off-Cycle bonus is computed.

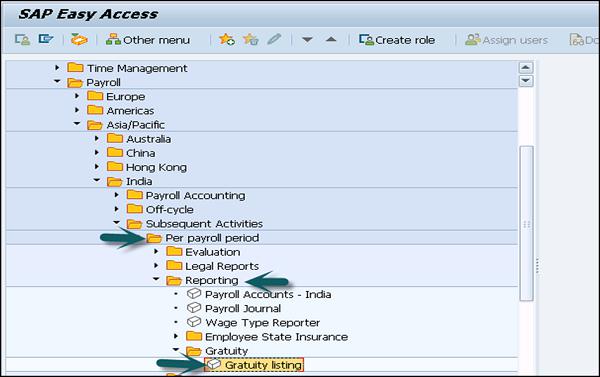

Gratuity

It is defined as a statutory benefit provided to an employee by his employer for his association with the company. The Gratuity can be configured based on the following rules −

Payment of Gratuity Act, 1972 − As per this, a minimum amount that an employer has to contribute for this component is 4.81% of the base salary of the employee. As per the company policy where the benefits are better as compared to the Gratuity Act.

Personal IDs 0185 Gratuity for India subtype 03 − This is used to maintain the employee Personnel id number for Gratuity and the name of the trust to which you are contributing for employee gratuity.

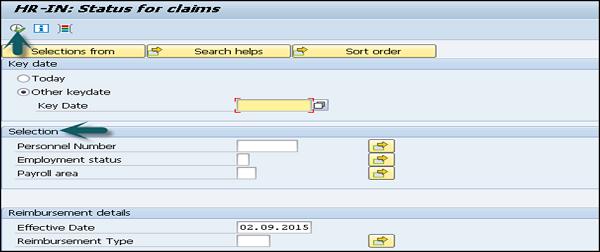

Gratuity Listing Report (HINCGRY0) to Generate Gratuity List − This report is used to generate a list which shows the employee wise contribution to the trust name on behalf of the employee.

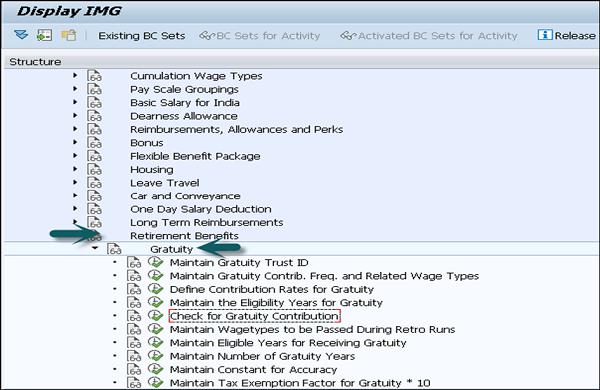

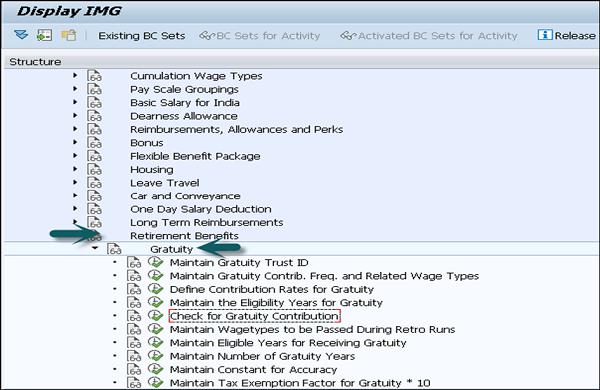

You can configure Gratuity in the SAP system by following this path. Go to SPRO → IMG → Payroll → Payroll India → Retirement benefits → Gratuity.

The employee record for Gratuity (Personnel Id’s) is maintained in Infotype and Gratuity for India Subtype 03.

Superannuation

This is defined as the benefit provided to an employee by the employer for his association with the company. The employer contributes towards Superannuation trust on a monthly or yearly basis to provide this benefit to the employee and it doesn’t include any employee contribution. This component is not presented as part of the monthly pay slip and is not a taxable component.

Superannuation report (HINCSAN0) for list − This report can be used to generate Superannuation List which provides employer contribution for this component for a specific time period.

Superannuation component and configuration − This component consists of the employee record as Personal Id’s Infotype 0185 Superannuation for India Subtype 01. This subtype is used to maintain the trust name and employee identification number for the employee.

To define the trust name where the employer maintains the Superannuation account, you need to define trust id and name of trust in the system.

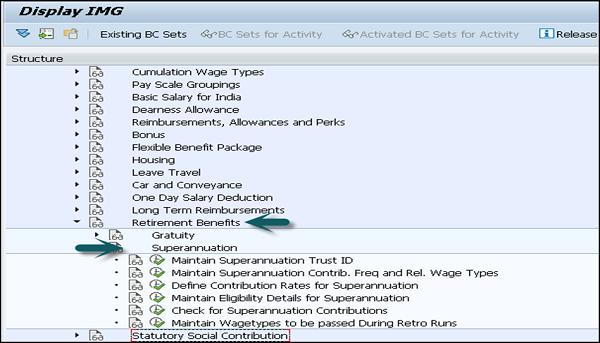

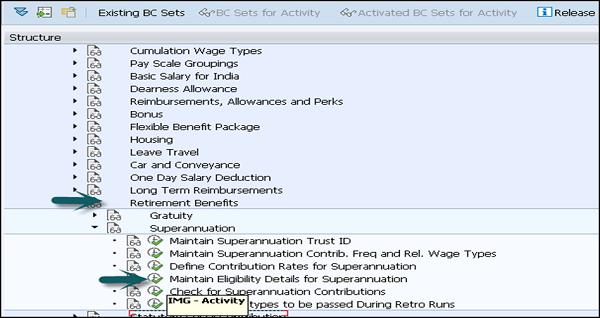

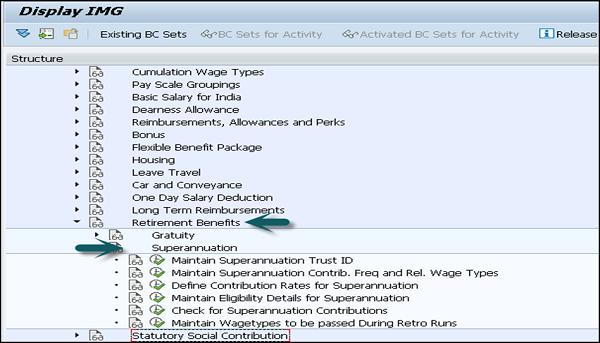

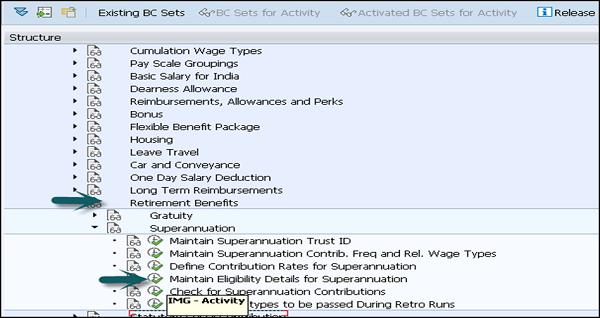

This can be done by going to SPRO → IMG → Payroll → Payroll India → Retirement Benefits → Maintain Superannuation Trust ID

The Superannuation ID field of Personal IDs Infotype (0185) Superannuation for India Subtype (01), displays options as per the Trust IDs that you have configured in this IMG activity.

To configure the criteria under which you want an employee to be eligible for Superannuation, it can be configured in a SAP system with the following method −

SPRO → IMG → Payroll → Payroll India → Retirement Benefits → Maintain Eligibility Details for Superannuation.

SAP Payroll - Net Part

This component of the payroll system deals with the net part of the remuneration paid to an employee after the deductions. There are various deductions applied on the Gross salary like tax, insurance paid, etc. The Net pay is the amount paid to an employee after all these deductions.

Income Tax

This component is used to compute tax on the income received by an employee. An employee income consists of the following parts −

Regular Income

This consists of regular income components like Basic pay, HRA, conveyance allowance. Regular income can be categorized as monthly regular income or annual regular income.

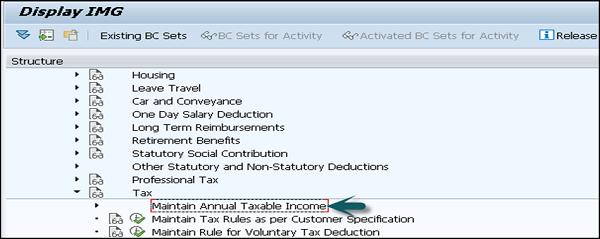

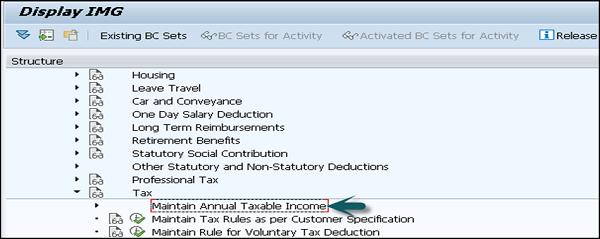

The system projects the annual regular income using either the Actual Basis or Nominal Basis. The system, by default uses Actual Basis to project annual regular income. You can access this from SPRO → IMG → Payroll → Payroll India → Tax → Maintain Annual Taxable Income.

Professional Tax

Professional tax in a SAP system is defined as the tax calculated on the employee salaries. Professional tax is also defined as the tax applied by the State Government on profession, trades, employment, etc.

Income Tax

A SAP system calculates the annual professional tax of an employee and deducts it from the salary as per the Section 16(ii) of the Income Tax Act. Professional tax is based on the following salary components for an employee −

- Basic Pay

- Dearness Allowance

- Medical Reimbursement

- Bonus

- Housing

- Other remuneration that employee receives regularly

Tax on Medical Reimbursement

This includes the medical reimbursement amount that is more than the amount, exempted in the Income Tax under the IT Act, as a part of the professional tax basis.

Housing Allowance

For all the employees who are availing company leased (CLA) or company owned accommodation (COA), the system calculates the difference in housing allowance and the rent. When an employee gets the amount for the difference in both the components as a part of the regular income, then professional tax is applied on the differential amount.

Professional Tax Report

To display and take prints of professional tax returns, the system generates the professional tax returns that your company needs to submit to the state authorities, while remitting the professional tax deductions of the employees.

When you generate a professional tax report (HINCPTX0), there must be an Infotype – Other Statutory Deductions Infotype (0588) and PTX (Professional Tax Eligibility) subtype (0003). In this Infotype, you must select the Professional Tax eligibility indicator for an employee.

And there should be professional tax results for at least one payroll period.

Provident Fund

This component is used to maintain information on the employee Provident Fund. The Provident fund is a benefit provided to the employees and contains two parts −

Provident Fund (PF)

As per the government rule, both employee and employer contributes a fixed percentage of the PF basis towards the Provident Fund. The minimum percentage that each employee needs to contribute is 12% of the base salary.

An employee can also select some percentage of fixed basis towards PF which is known as Voluntary Provided Fund (VPF).

Pension Fund

As per the authority rule, an employer has to contribute a fixed percentage of the PF basis towards the Pension Fund of an employee.

Also note that apart from these contributions, an employer has to contribute to the Employee's Deposit Linked Insurance (EDLI or ESI).

In a SAP system, Provident Fund component allows you to maintain and process the following components −

- PF

- Pension Fund

- EDLI

- VPF

- Provident Fund

Reports for Provident Fund

By using the employees Provident Fund Reports (HINCEPF0), you can generate the following monthly PF forms −

Form 5 − This can be generated for the employees who qualify for the PF, Pension Fund and EDLI membership for the first time.

Form 10 − This can be generated for those employees leaving the service, or leaving the PF trust in the current payroll period.

Form 12A − This can be generated for wages paid and recoveries made in the current payroll period, as the Employee and Employer's contribution.

By using the PF Report (HINCEPF1), you can generate the following annual PF forms −

Form 3A − This is used to get the statement on the PF contributions made towards un-exempted establishments annually.

Form 6A − This report is used to print the consolidated contribution statement for that financial year.

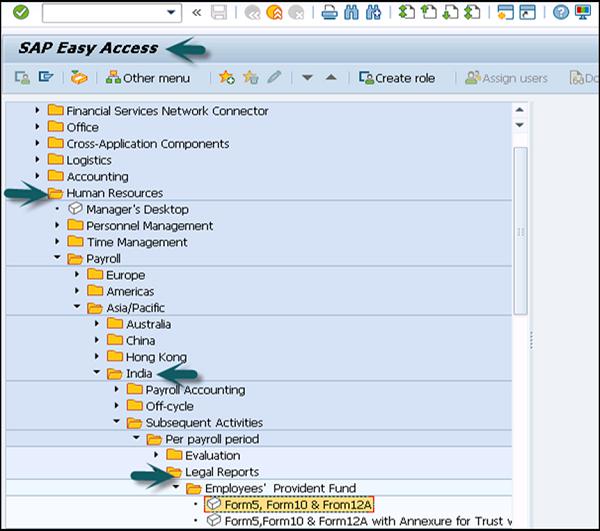

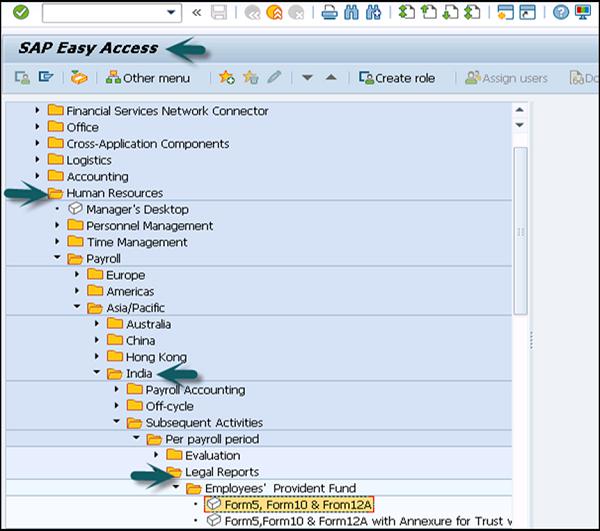

If you want to generate the Monthly reports on the Employee PF and Employee Pension Fund contribution, go to SAP Easy access → Human Resources → Payroll → Asia/Pacific → India → Subsequent Activities → Per Payroll Period → Legal Reports.

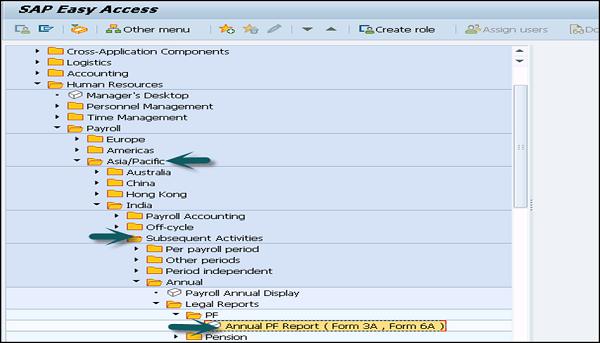

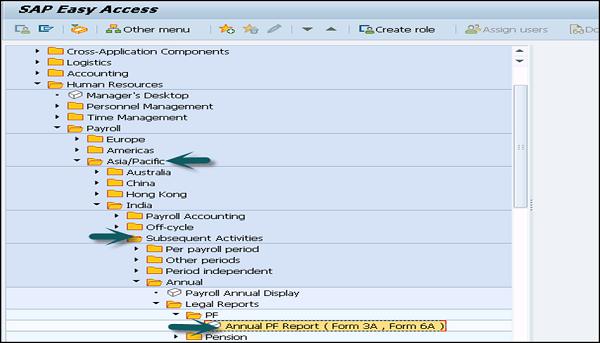

To generate the Annual reports on the Employee PF and Employee Pension Fund contribution, go to SAP Easy Access → Human Resources → Payroll → Asia/Pacific → India → Subsequent Activities → Annual → Legal Reports.

Employee State Insurance

Employee State Insurance is one of the other statutory benefit type that has been provided to employees of a company. ESI contribution includes deduction/contribution −

- From the employee salary

- From the employer side

In case there are other statutory deductions Infotype 0588 and subtype ESI (0001) record exists for the employee, then an employee is considered as eligible for ESI.

Note − The ESI Basis for an employee is less than or equal to the amount stored in the ESI Eligibility Limit.

ESI Contribution and Benefit Period

| Contribution Period |

Benefit Period |

| 1 Apr – 30 Sep |

1 Jan –30 June |

| 1 Oct – 31 March |

1 July –31 Dec |

The Employee contribution towards ESI is 1.75% of the ESI Basis. While the Employer contribution towards ESI is 4.75% of the ESI Basis.

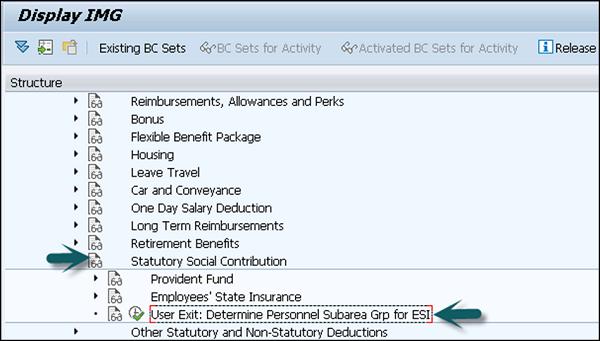

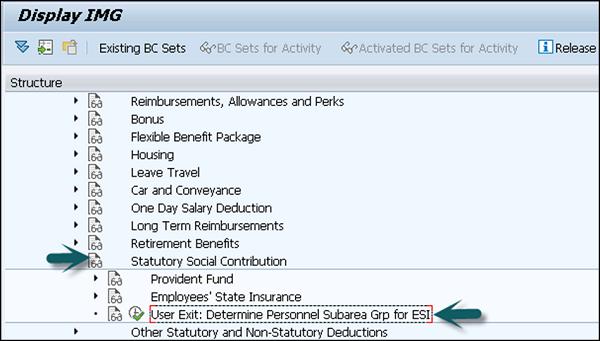

To change the ESI Grouping for an employee, this can be configured in the user exit by following SPRO → IMG → Payroll → Payroll India → Statutory Social Contribution → Employees' State Insurance User Exit: Determine Personnel Subarea Grp for ESI.

Labor Welfare Fund

Like Employee State Insurance, LWF is known as the statutory contribution towards welfare of the employees. LWF contribution and frequency of contribution is decided by the state authority.

Infotype and Reports

The LWF (Labor Welfare Fund) details are maintained under other Statutory Deductions Infotype 0588 and LWF subtype 0002.

In a SAP system, you can define the eligibility of for Labor Welfare Fund, LWF contribution frequency, LWF computation rates and the Validity date. The LWF data is available in the legal report – Labor Welfare Fund legal reports (HINCLWFI)

By using this report, it is possible to generate the LWF form for submission to the authorities. You can configure your SAP system to generate LWF statements in the format prescribed by the concerned state authority.

Minimum Net Pay

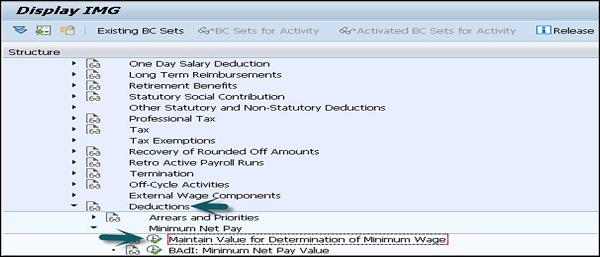

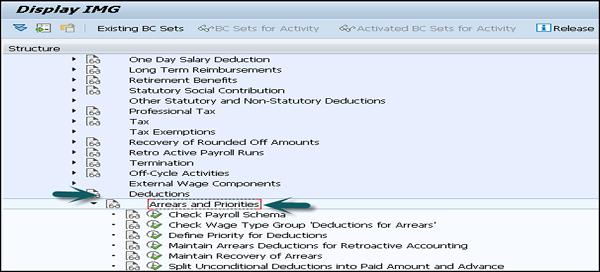

This component is used to define the minimum wage for an employee for processing the payroll. All the deduction to be considered for the minimum net processing is defined by following this path −

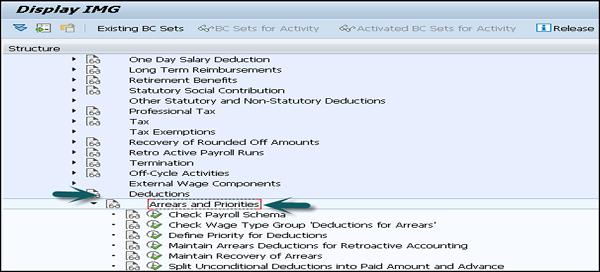

Go to SPRO → IMG → Payroll → Payroll India → Deductions → Arrears and Priorities.

In a SAP system, you can configure the minimum net pay using the following two methods −

Percentage of a Particular Wage Component

Using this method, you can maintain the percentage in the Minimum Net Pay under Percentage Constant (MNPPR) of table view Payroll Constants (V_T511K).

Note − By default, the system takes a particular wage component as the Total gross amount wage type (/101).

Fixed Amount

You can also define a fixed amount in the minimum Net Pay-Fixed Amount constant (MNPAM) of table view Payroll Constants. Both the methods can be configured in the SAP system by the following path −

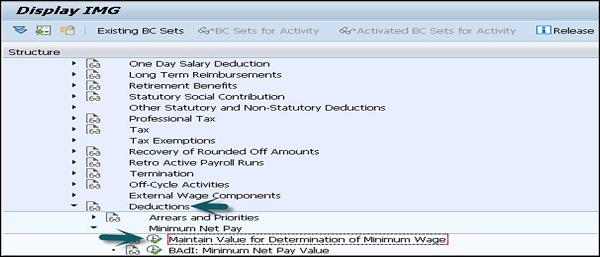

SPRO → IMG → Payroll → Payroll India → Deductions → Minimum Net Pay → Maintain Value for Determination of Minimum Wage.

Note − In case you are maintaining both of the above methods, the amount in the Minimum net pay − Fixed Amount constant (MNPAM) is taken as the minimum wage.

SAP Payroll - Deductions

This component is used to calculate all the payments that are made to third parties and are deducted from the employee’s salary. Different types of deductions can be calculated on gross remuneration or on net remuneration.

Statutory Deductions

This involves social welfare payment and taxes.

Voluntary Deductions

This includes the payment made by an employee to any saving accounts or any voluntary insurance policy that the employer has taken for the employee. You can consider these as one time deductions and recurring deductions.

One time deductions are those which are paid by an employee once in a Financial Year. Recurring deductions are maintained in the Infotype 0014 and they are paid in a defined periodicity.

Loans

This component is used to manage the details of a loan that is provided by the company to an employee. This can include – house loan, car loan, personal loan, etc. An interest amount is charged which is lower than the normal interest rate in the market and the employee salary is considered as a security for this loan.

In a SAP system, you can select between different loan categories and different repayment types −

- Installment Loan

- Annuity Loan

The loan data is maintained in Infotype 0045 and you can get the following details while processing the payroll −

- Loan Repayment

- Loan Interest Calculation

- Imputed income taxation

Loans Infotype 0045 − as you enter the information on a company loan, it can contain loan approval date, loan amount, etc.

How to Identify a Loan in the System?

You maintain loan type’s information in subtypes in the Loans Infotype 0045. There is a sequential number that is assigned to each loan. In a SAP system, you can use the combination of a loan type and a sequential number to uniquely identify every loan and hence this allows you to create multiple loans of the same type for an employee.

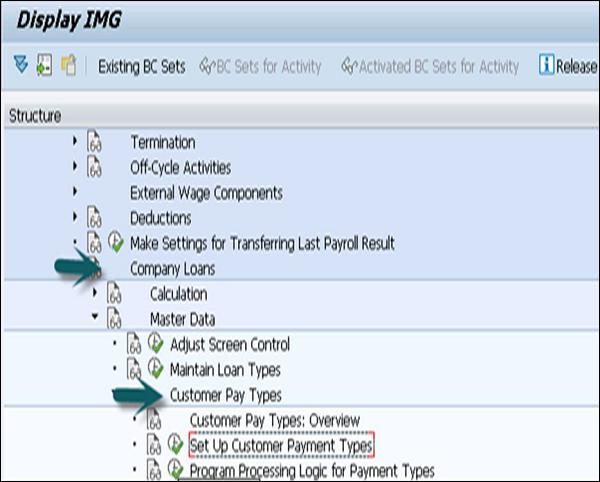

Payment Type

There are different categories of repayment types that can be used and differentiated as follows −

Payment is made to the borrower or a repayment to the employer.

Payment is made directly by check or a bank transfer is made or is processed during the employee payroll run.

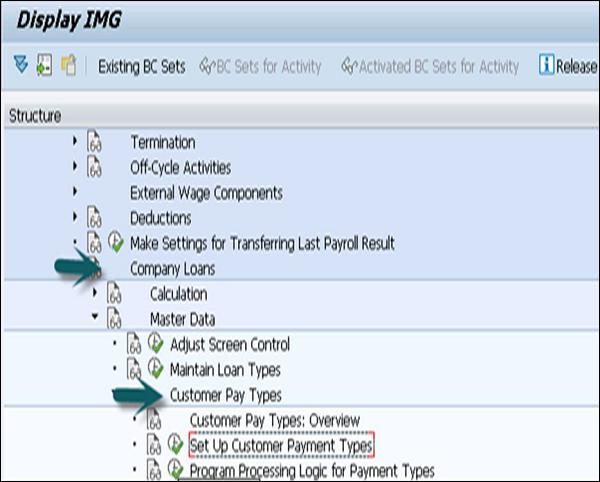

You can use the payment types that are defined in a SAP system or you can also define under SPRO → IMG → Payroll → Payroll India → Company Loans → Master Data → Customer Payment Types.

| Outgoing payment to third-party |

you do not want to pay out the loan to the employee, you want pay it to a third person instead. |

An employee receives a building loan to build a house. You do not pay the loan to the employee, but to the contractor who builds the house. |

| Loan payment (payroll) |

You want to pay the employee the total approved amount of the loan or part of this together with his/her pay. |

|

| Loan payment (external) |

You want to pay the employee the total approved amount of the loan or part of this by check or bank transfer |

|

| Loan remission |

An employee cannot repay his/her loan or you want to release him/her from the remaining debt |

You can only close a loan in the system when the remaining loan amount has either been repaid by the borrower or remitted by the lender |

| Fees |

You want to demand fees from your employee for granting the loan |

|

| Total repayment |

The employee repays the total outstanding amount of the loan by check or bank transfer |

|

| Special repayment (payroll) |

The employee makes an unscheduled repayment that should be withheld from his/her pay. |

|

| Special repayment (external) |

The employee makes an unscheduled repayment by check or bank transfer. |

|

| Loan balance transfer |

You want to transfer company loans from a legacy system. |

You can also use the payment type Loan payment (external) for transfering loans from legacy systems. |

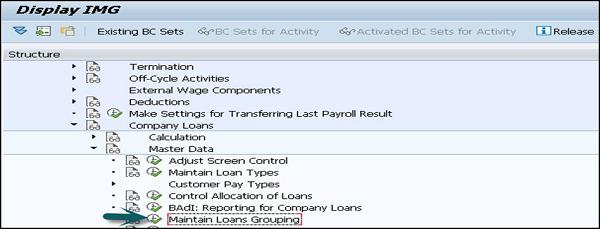

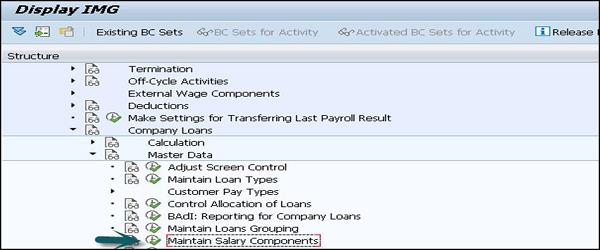

Loans Enhancement - India

This section describes the Loan enhancement customization available in the SAP system for payroll India. You can make the following configuration for the company loans in India −

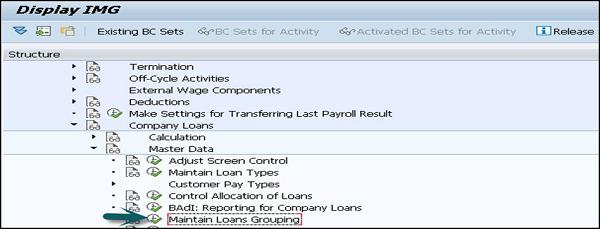

To maintain Loan grouping, go to SPRO → IMG → Payroll → Payroll India → Company Loans → Master data → Maintain Loan Grouping.

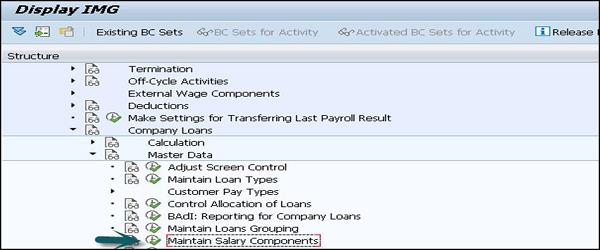

To define different salary components that define the salary for a loan grouping, go to SPRO → IMG → Payroll → Payroll India → Company Loans → Master Data → Maintain Salary Components.

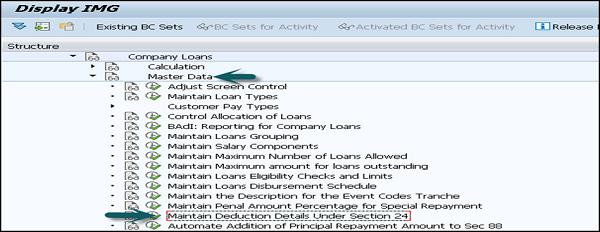

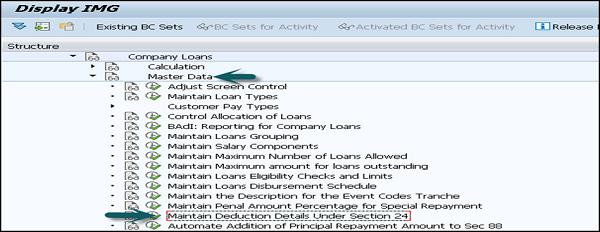

To specify if a Loan Type is eligible for Section 24 Deduction, go to SPRO → IMG → Payroll → Payroll India → Company Loans → Master Data → Maintain Deduction Details Under Section 24.

Similarly, you can create various customizations under Payroll India for processing Loan enhancement.

One Day Salary Deduction

This component is used to process the voluntary salary deduction for employees and is applicable for one or multiple days. This component calculates the employee contribution for the same amount at it was paid by the employer. This voluntary deduction normally involves payment to charitable trust, prime minister Relief fund, etc.

In the SAP system, this component is maintained in the table V_T7INO1.

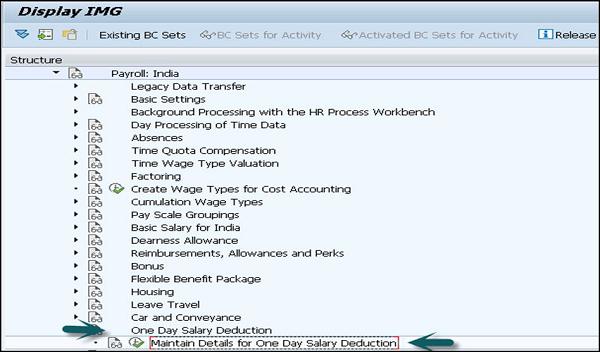

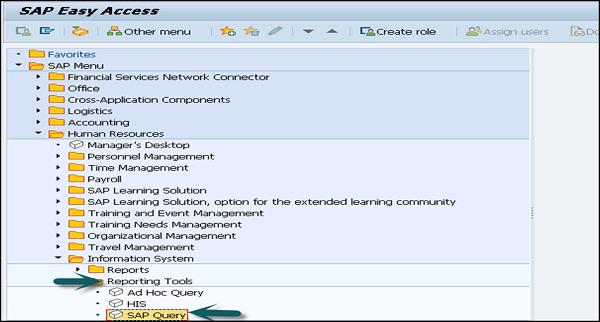

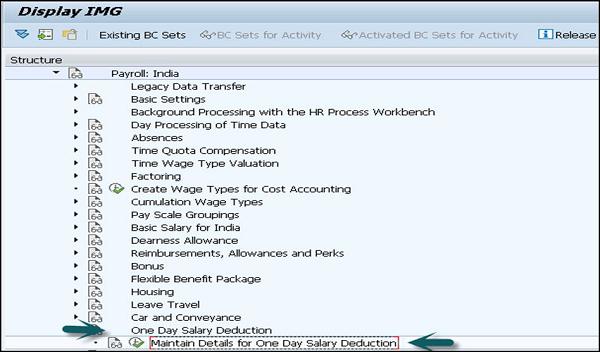

Go to SPRO → IMG → Payroll → Payroll India → One day Salary deduction → Maintain Details for one day Salary deduction.

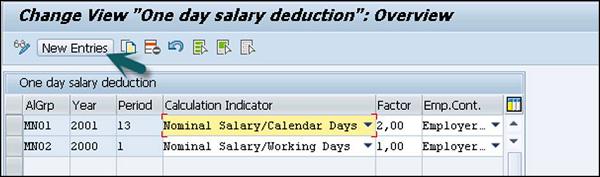

For example − Consider an employee’s details in a table view One-day salary deduction (V_T7INO1) for Pay Scale Grouping for Allowances MN01.

- Year - 2010

- Period - 01

- Calculation Indicator - Actual Salary/Calendar Days

Employer Contribution – As the employer also contributes.

You run the payroll for an employee, who belongs to a Pay Scale Grouping for Allowances MN01, in June 2010. Let the Actual Salary of the employee for June 2010 be Rs. 6000 and the calendar days KSOLL for the month June = 30.

One-day salary deduction payroll function (INDSD) reads the table view one-day salary deduction (V_T7INO1) for the Pay Scale Grouping for Allowances MN01, and generates the following wage types −

For employee, one-day salary deduction wage type (/3OE) = Rs (6000/30) * 2 → 400.

For employer, one-day salary contribution wage type (/3OF), which is also equal to 400.

SAP Payroll - Subsequent Activities

This includes the activities that should be carried out after processing of gross and net payroll for employees.

Posting of Payment Transactions

This is used to post the personnel expenses within a company to financial accounting and Cost Accounting.

This includes payables to the employees who are posted against the Wages and Salaries Payable account. It also includes payables to the recipients as the deductions received from the employee are posted in the additional payables account and this varies as per the country.

Subsequent activities are performed for this, which includes −

Payables against employees are settled by payment.

Receivables against third party like tax, insurance are settled by payments.

For each transaction, the following steps are performed −

Step 1 − Amounts payable are calculated

Step 2 − Amounts calculated are paid

Step 3 − A payable account to bank clearing account is created.

You can perform Step 2 and Step 3 either automatically or manually and it varies according to the country and the transaction type.

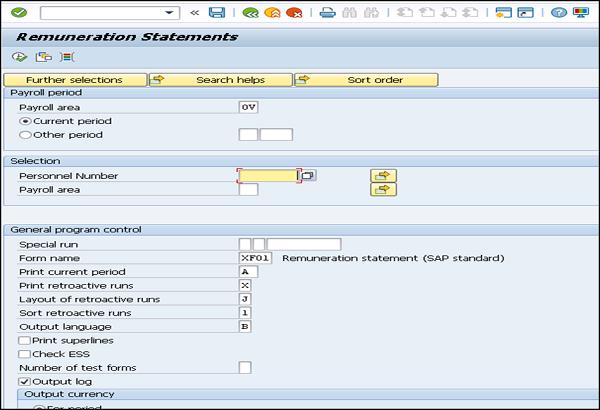

Salary/Remuneration Statement Tool

To create or edit the salary/remuneration statement, you can use HR Forms Workplace. This allows you to create a new salary statement with the Forms Workplace and also provides you multi-functional graphical options for structuring the layout of the form and then print program.

A form can be printed from the HR Forms Workplace or by using a SAP Easy access menu.

SAP Payroll - Reports

This is used for the evaluation of payroll results and you can generate reports and statistics using this component. You have the following options available in the SAP system to perform the evaluation −

Payroll Infotypes

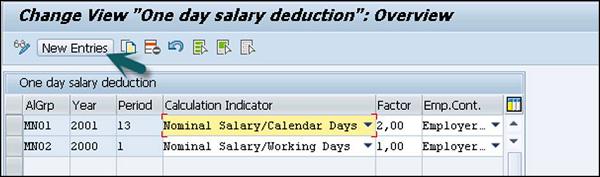

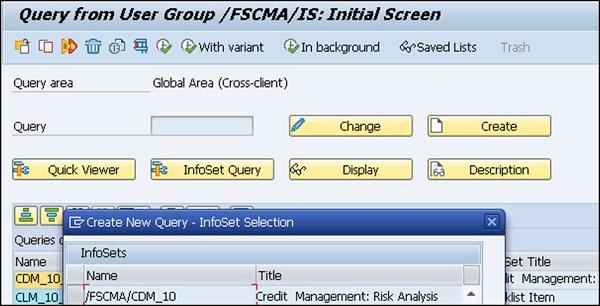

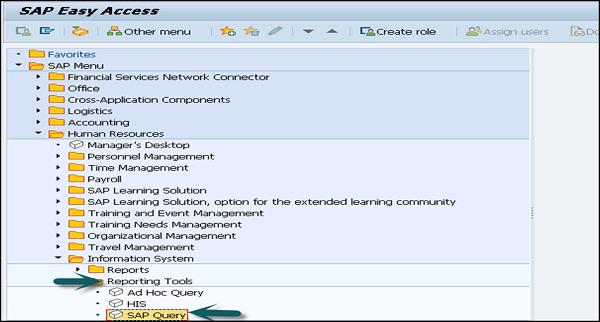

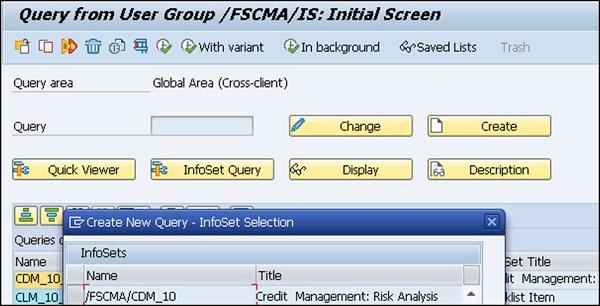

InfoSet Query − To check the InfoSet query, follow the below path. Go to Human Resources → Information System → Reporting Tool → SAP Query.

To create a new infoset query, click on Infoset query.

Standard Reports

You can also evaluate payroll results using the following standard reports.

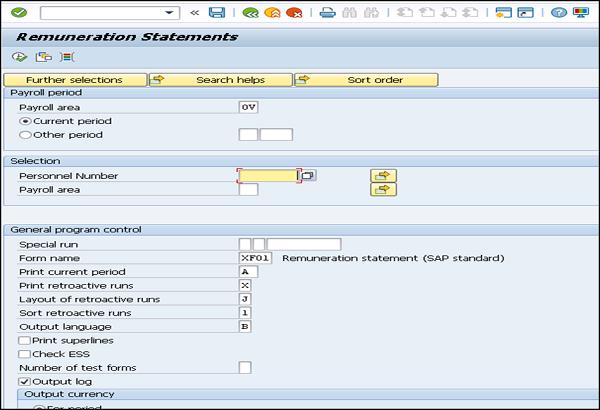

- Remuneration statement

- Payroll journal

- Payroll account

- Wage type reporter

SAP Payroll - Reporting

In this chapter, we will discuss about the reporting pattern in SAP Payroll.

Basic – General Increments Report

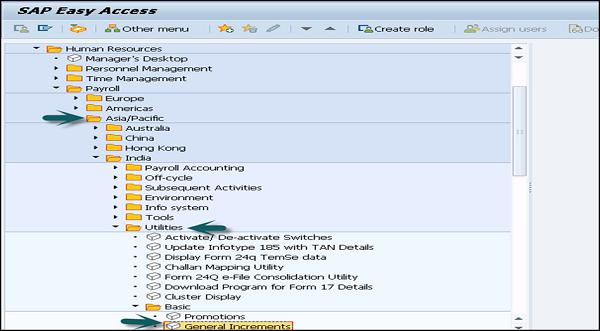

This is used to perform the increment update on the base pay wage type in Infotype 0008. This can be maintained under the Human Resource in SAP Easy access.

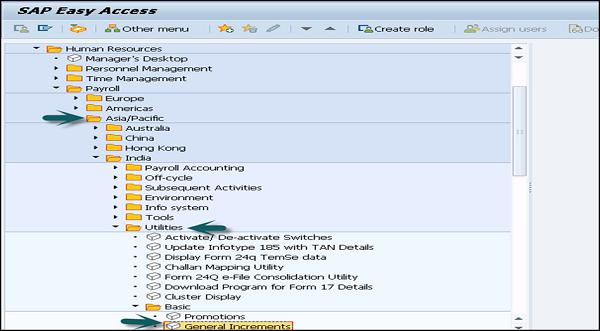

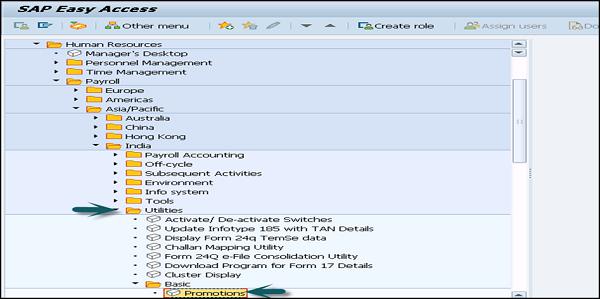

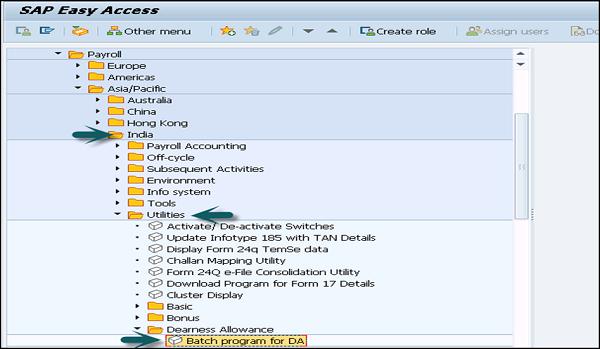

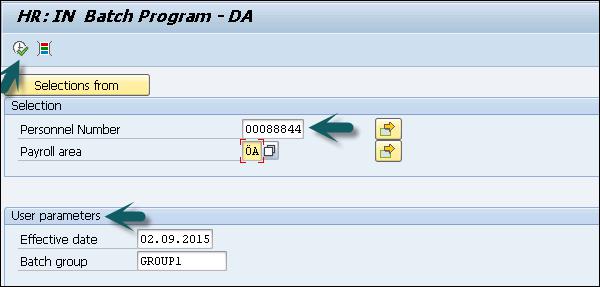

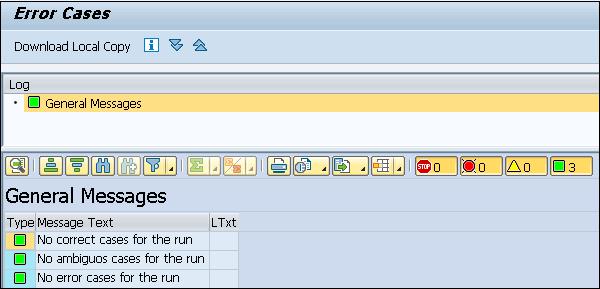

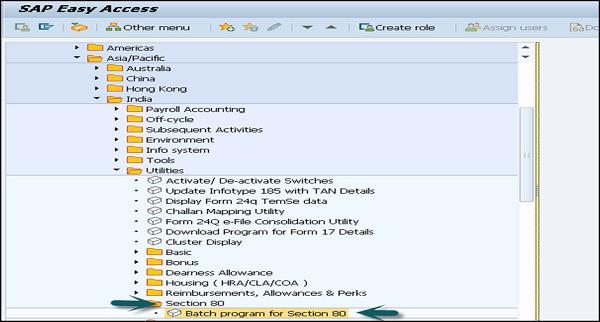

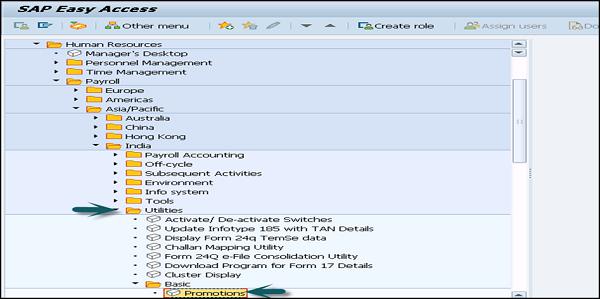

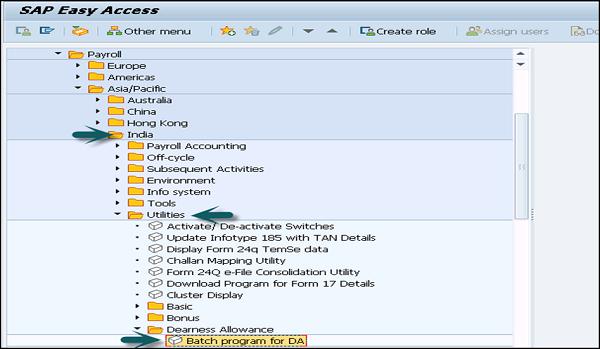

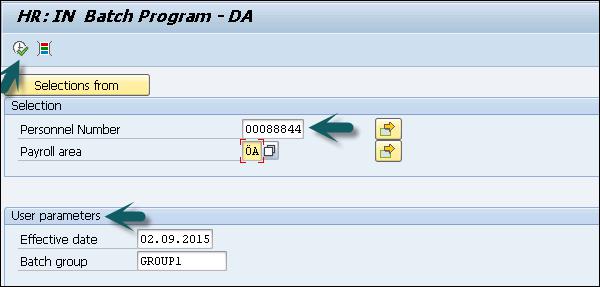

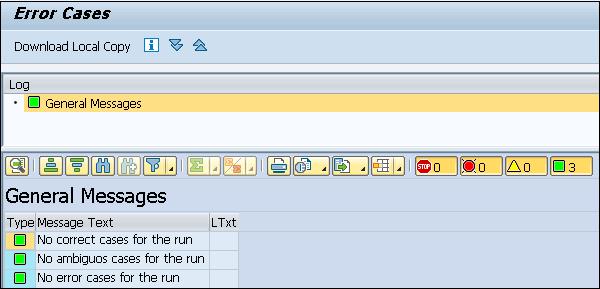

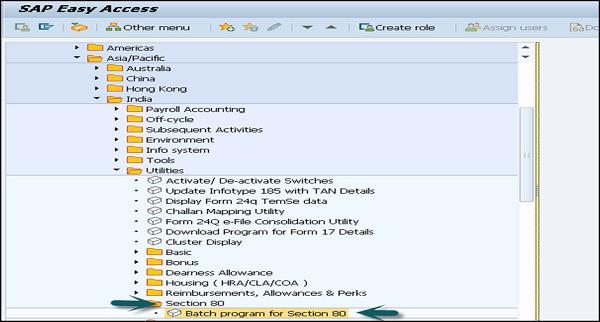

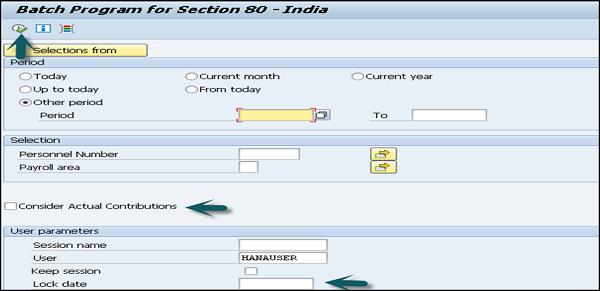

In SAP Easy access → Human Resource → Payroll → Asia/Pacific → India → Utilities → Basic → General increments.

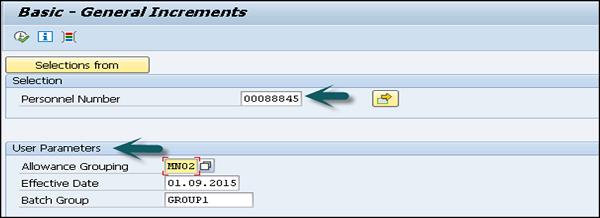

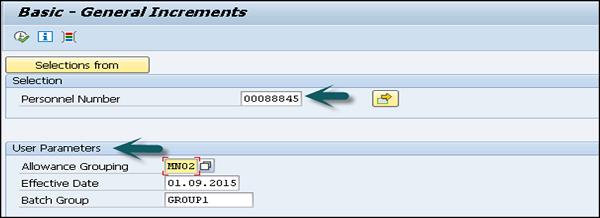

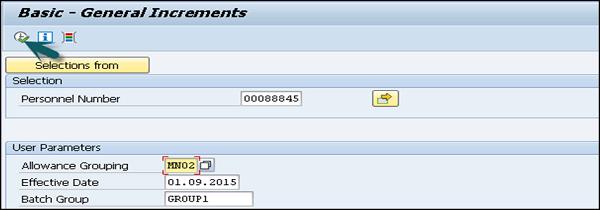

Enter the Personnel number and Pay Scale Grouping for Allowances of the employees to whom you want to give increments in the Basic Salary.

Enter the Personnel number and pay scale grouping.

Enter the date from which the increment has to be effective and the name of that batch session. Click Execute.

The list of employees eligible for the increment appears. You have the following options on the output screen −

Increment

You can select this option to process the increment for all the eligible employees. The system creates a batch session. You can execute this batch session to update the Basic Pay Infotype 0008.

Ambiguous Cases

You can select this option to display the ambiguous cases.