SAP Payroll - Gross Part

The Gross Part of the Payroll is used to determine an employee’s gross pay as per the contractual requirements and consists of payments and deductions. The Gross Pay consists of different components, which includes −

- Basic Pay

- Dearest Allowance

- Variation allowance

- Bonuses

- Provident fund

- Gratuity

Then there are different deductions that are made as per the employee enrollment. These deductions include company owned apartment (COA), company sponsored day care, and other deductions.

All these factors are based on a country’s legal labor rules and determines the gross taxable income of the employee.

Wage Types

Wage type is one of the key components in payroll processing. Based on the way they store information; wage type can be divided into the following two categories −

Dialogue wage type or Primary wage type

Primary wage type is defined as the wage type for which data is entered in an Infotype. The Primary wage types are created by copying the model wage types provided by SAP. There are different types of primary wage types −

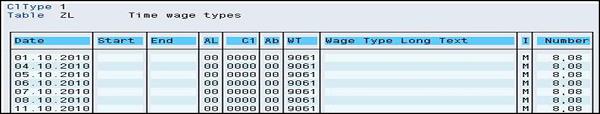

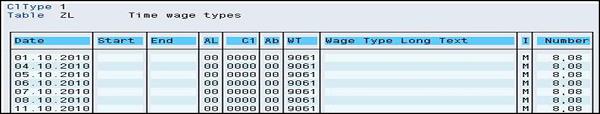

Time wage type

Time wage type is used to store the time related information. This wage type is used to combine payroll and time management. Time wage type is generated at the time of evaluation and is configured through T510S or using a custom PCR.

Dialogue wage type

This wage type includes basic pay IT0008, recurring payments and deductions IT0014, and additional payments IT0015.

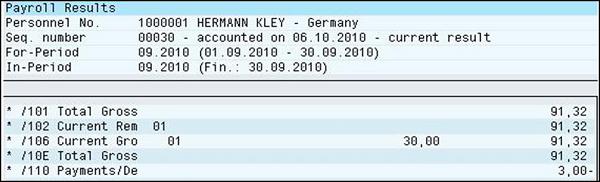

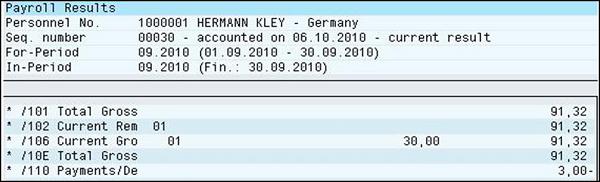

Secondary Wage type or Technical Wage type

The secondary wage types are predefined wage types in the SAP system and starts with a ‘/’. These wage types are created during the payroll run.

These wage types are system generated and can’t be maintained online.

For example − /559 Bank Transfer

Wage Type Elements

The key elements of a wage type include −

- Amount AMT

- Rate RTE

- Number NUM

As per the processing type, each element can have one, two or all element values.

For example − The basic pay can have a Rate and a Number, however a bonus pay can only have an amount.

Payments

The payment includes all the payments given to an employee according to the employment contract and any voluntary payment paid. A payment combines the employee gross remuneration.

This gross remuneration is defined as the calculation of social insurance and tax payments and also for the calculation of net remuneration.

Payment Structure

The payment is defined in terms of the following components in the SAP Payroll system −

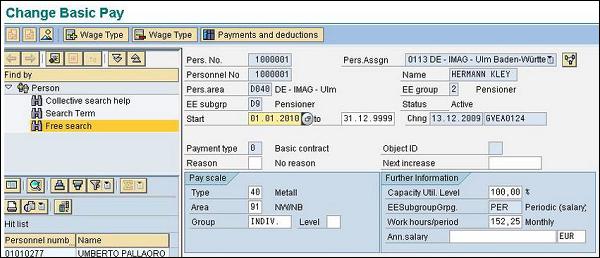

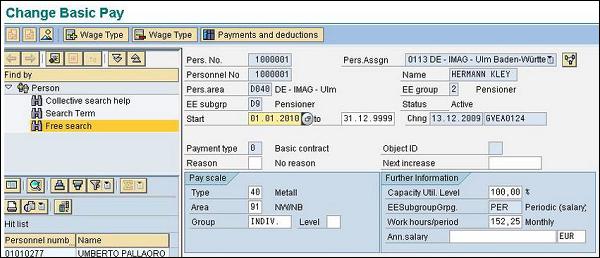

Basic Pay − This component consists of the fixed wage and other salary elements and is paid to the employee for each payroll period. The details are entered in the Basic Pay (0008) Infotype.

Recurring Payments and Deductions − Recurring payments and deductions include components like overtime, leave or other components. This information is maintained in Recurring Payment and deduction Infotype (0014).

Additional Payments − There are many components in the payment section, which are not paid in each payroll period. This information is added to Additional Payments Infotype (0015).

Time Management in Payroll

Time management is one of the key components in Payroll that is used to calculate the gross salary of the employees. Monetary benefits are determined by work schedule and planned working hours.

The time management integration with payroll is used to determine wage types like bonuses for overtime, night/odd hour work allowance, work on holiday, etc.

You can also use Time Data Recording and Administration Component Integration with Time Management component to find out time data information for employees and further to determine the time wage types.

When you use this time evaluation component Integration with Time Management component, this is used to find time wage types determined by Time Evaluation.

Night Shift Compensation/Shift Change Compensation

This component is used to ensure that an employee shouldn’t get financial disadvantage, if he/she is working in odd hours or if a shift time is changed for them.

For example − An employee’s planned working time is changed and he is facing a financial disadvantage, he or she is paid on the basis of the original working time – like an employee gets his shift changed from a night shift with night shift bonuses to an early shift.

If an employee’s shift time is changed and that employee will be benefited financially, he or she is paid on the basis of the changed working time.

Consider an employee whose shift changes from Friday to a Sunday with Sunday bonuses. In this case, a shift change compensation will be listed under the remuneration statement. It is also possible to limit the payment of a shift change compensation for a particular category.

Employee Remuneration Information

This is used to process the manually calculated wages, bonus or non-standard wage types.

| Function |

Required Component |

| Record wage types for work performed and the information on other components in the system |

Cross-application time sheet |

This component provides information on payroll with time and person related time wage types. Time wage type is used to perform the financial evaluation of work performed on a payroll.

Wage Type Valuation

Wage type is one of the key components in payroll processing. Based on the way they store information, they can be defined as Primary and Secondary Wage types.

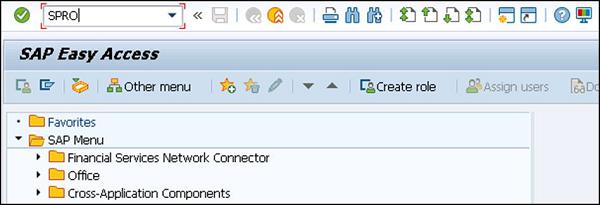

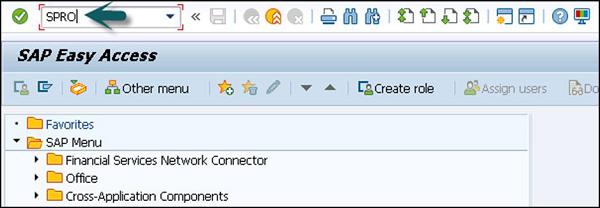

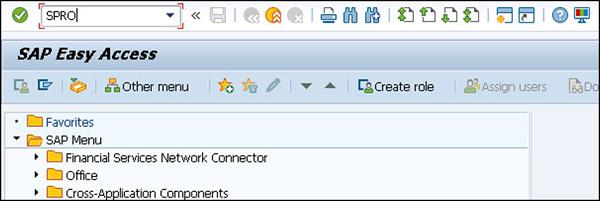

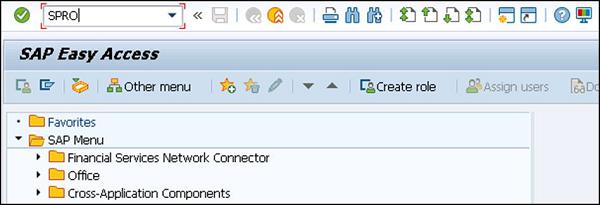

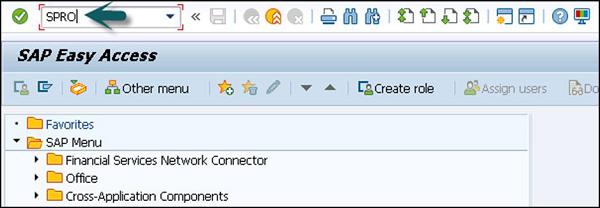

During the payroll run, the primary wage types are provided with the values and secondary wage types are formed at the time of the payroll run. You can check the characteristics of a wage type by going to the following path −

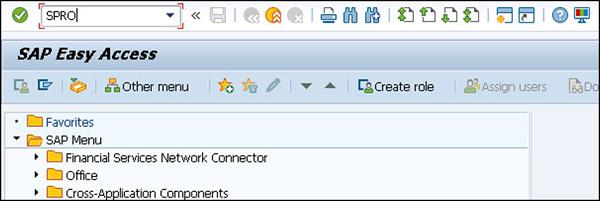

SPRO → IMG → Personnel Management → Personnel Administration → Info Type → Wage types → Wage type catalog → Wage type characteristics

Old and New Processing of Averages

With the release of 4.6B, processing of averages has been changed. Processing of averages depends on the country and release and with countries like Argentina, Brazil and a few other, a new processing is released with version 4.5B.

At one time, you can only use any of these two versions, if you are using an old version, you can continue to use the same version and there is no need to move to the new version, but the older version is not under development.

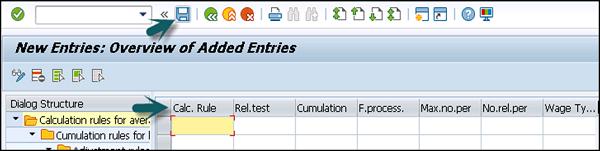

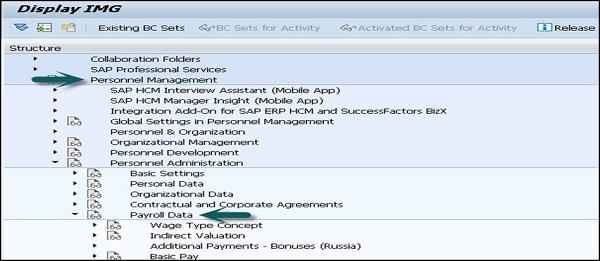

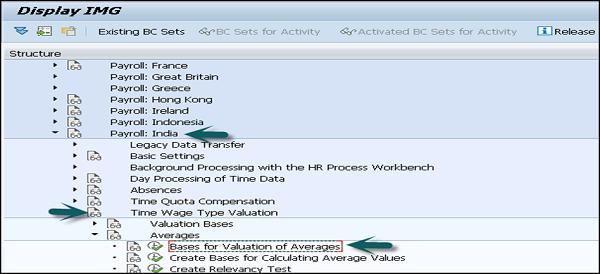

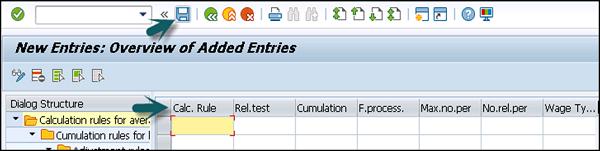

The technical processing of averages can be configured as shown in the following steps −

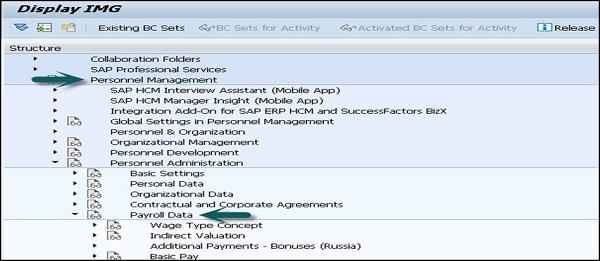

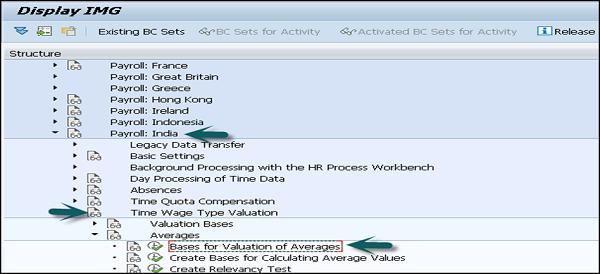

SPRO → IMG → Payroll → Payroll India → Time wage type valuation → Averages → Bases for valuation of Averages

You should check the following perquisites for this −

- Forming the basis for calculating average values

- Definition of calculation rules for averages

- Assignment of calculation rules to wage types

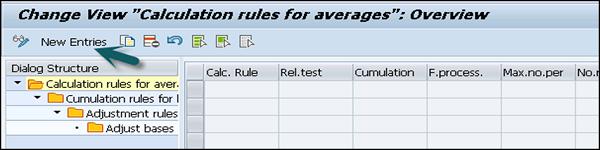

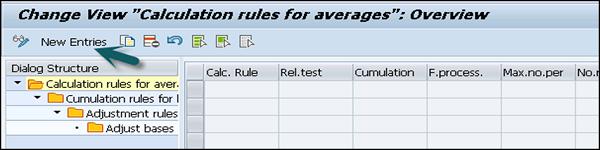

To create a new technical processing of average, click on New Entries

In a new window, define the different rules as mentioned above and click on the save icon at the top.

Incentive Wages: Overview

To maintain incentive wages, different accounting processes are defined in standard SAP system.

Monthly Wage Calculation for Incentive Wages

In this Wage Type, target time for each ticket is calculated using a piecework rate. This is used to calculate the amount for time ticket that the employee is due. This amount consists of −

Basic Monthly Pay − This defines the gross amount that is paid to the employees irrespective of their performance and it can be paid as a monthly sum or in terms of hourly pay as per their contract.

Time Dependent Variable Pay − This is used to define the pay scale rate that is different from a master pay scale rate for an employee. It is possible that an employee is remunerated at a high rate as compared to a master pay rate for specific activities. You have to enter a higher pay scale into the time ticket.

Performance Dependent Variable Pay − This is used to credit when an employee completes the work in less time than the target time. The different between target time and actual time is mentioned on time ticket.

Hourly Wage Calculation for Incentive Wages

This is similar to the monthly wage calculation with the only difference that the monthly wage is specified as an hourly wage from the starting, so you don’t need to convert the monthly basic wage into an hourly wage.

Incentive Wage Accounting: Tools

Personnel calculation schemas −

There are two types of schemas valuation of time tickets for incentive wages −

German Version DIW0 − this contains special features that are specific to German only.

International Version XIW00 − You can use schema XIW00 to set up your own incentive wage accounting rules as per different countries. As valuation of time tickets vary according to different countries and organizations so there are no country specific accounting schemas in it.

Partial Period Remuneration

This component is used to check the remuneration when an employee works for a lesser period of time. You can use factoring in the following cases −

When an employee leaves, joins or remains absent for a specific period of time.

When there is a change in the basic pay, substitution, work reassignment or change in personal work schedule.

To find the correct remuneration for an employee, the remuneration amount is multiplied by a partial period factor which is based on different methods −

- Payment method

- Deduction method

- PWS method

- Hybrid method

Each Payroll system contains few factoring rules that are needed to determine the partial period factor. These rules can be customized to meet specific requirements in the company.

The following Infotypes are calculated for partial period remuneration −

| Actions |

Infotype 0000 |

| Organizational Assignment |

Infotype 0001 |

| Planned working time |

Infotype 0007 |

| Basic Pay |

Infotype 0008 |

| Recurring payments and deductions |

Infotype 0014 |

| Additional Payments |

Infotype 0015 |

| Absences |

Infotype 2001 |

| Substitutions |

Infotype 2003 |

Partial Period Factor

This factor is used to calculate the partial remuneration. This is defined as a variable value which is calculated using different formulas as per the company and the circumstances.

While customizing, partial period factors are defined in a personnel calculation rules for specific situations and assigned to wage types for particular periods.

When you multiply the partial period factor by the fixed remuneration amount, this gives you partial period remuneration amount to be paid for a specific period.

For example − Consider an employee who was on an unpaid leave from 3rd February to 29th March, this means that the employee has worked for 2 days in February and 2 days in March considering 20 workdays in Feb and 23 workdays in Mar.

| Parameter |

February |

March |

| Planned working time (SSOLL) |

148 |

172 |

| Absence(SAU) |

132 |

156 |

| Individual period working time (SDIVI) |

148 |

172 |

| General period working time (SDIVP) |

167,7 |

167,7 |

Now consider reduction using the following different ways −

- Partial Period Factor

- Basic Remuneration

| Method |

Calculation formula |

Remuneration for February |

Remuneration for March |

| PWS |

a = (SSOLL-SAU**)/SDIVI |

0,108 |

0,093 |

|

Reduced remuneration: b×a |

351,22 |

302,44 |

| Payment |

a = (SSOLL-SAU**)/SDIVP |

0,095 |

0,095 |

|

Reduced remuneration: b×a |

308,94 |

308,94 |

| Deduction |

a = (SDIVP-SAU**)/SDIVP |

0,213 |

0,070 |

|

Reduced remuneration: b×a |

692,68 |

227,64 |

Now if you use the payment method, the employee receives the same remuneration for both the months.

If you use the deduction method, the employee is overpaid in Feb and underpaid in March.

If the PWS method is used, the employee receives more salary in Feb as compared to March, however the difference is negligible.

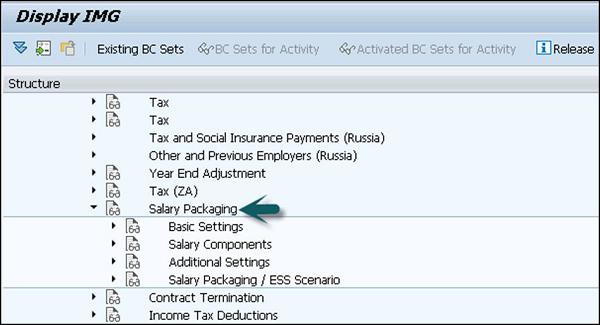

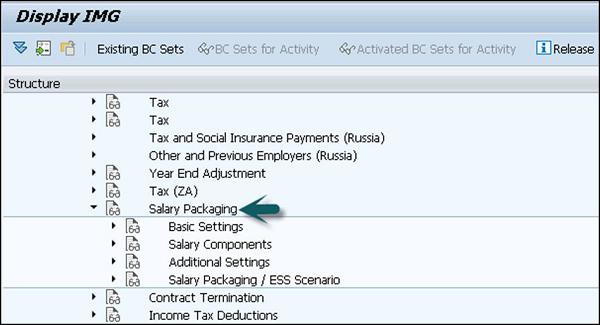

Salary Packaging

This component is used to determine an employee’s gross and net income and various components that effects the net income of an employee.

It consists of the following components −

- Personnel Administration

- Payroll South Africa

- Payroll Australia

The following Infotypes should be configured before setting up the salary package for an employee. The following are Infotypes are country specific and valid only for a few countries only −

- Actions (Infotype 0000)

- Addresses (Infotype 0006)

- Basic Pay (Infotype 0008)

- Organizational Assignment (Infotype 0001)

- Personal Data (Infotype 0002)

- Bank Details (Infotype 0009)

- Planned Working Time (Infotype 0007)

- Social Insurance SA (Infotype 0150) (only for South Africa)

- Superannuation (Infotype 0220) (only for Australia)

- Taxes SA (Infotype 0149) (only for South Africa)

You can find the Salary Packaging SPRO → IMG → Personnel Management → Personnel Administration → Payroll Data → Salary Packaging

You have to define the following components under customizing −

For example − Basic Salary and Company Car.

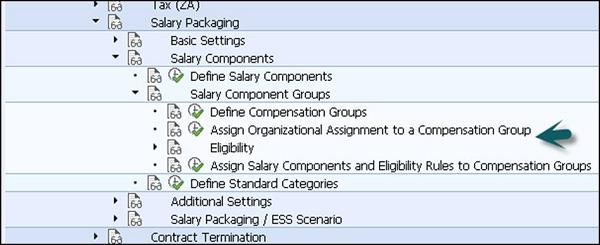

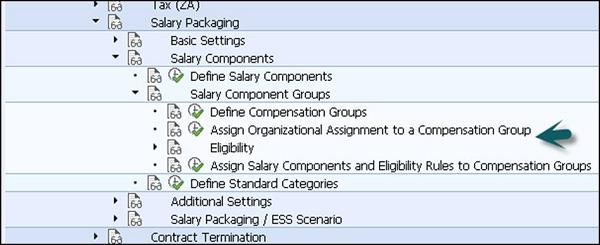

Salary Component Groups

This is used to define the default salary components based on an employee's organizational assignment.

Eligibility Criteria

Using the Eligibility Criteria, you can create checks to determine if an employee will have a specific salary component defaulted into their salary package.

For example − An employee is eligible for a certain salary component, once they reach a specific pay scale level. You can set eligible criteria for this rule.

Additional Settings

This is used to maintain additional features for salary packaging. Various steps can be defined as per different country specifications −

- Maintain Company Car Regulation

- Define Receiver Travel Allowance Rates

- Result

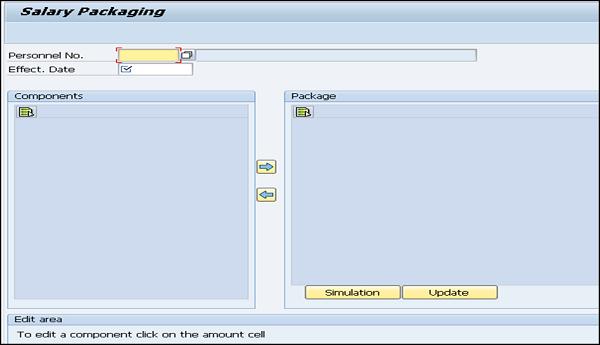

Modeling a Salary Package

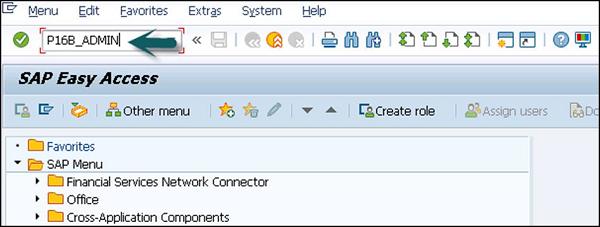

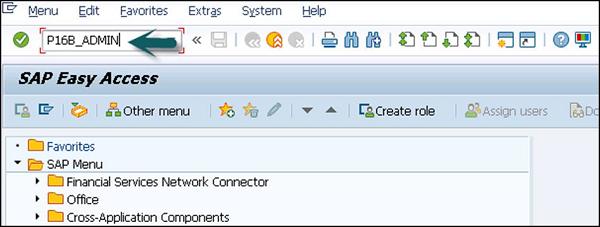

T-code: P16B_ADMIN

The following is some general information about the subsequent screenshot −

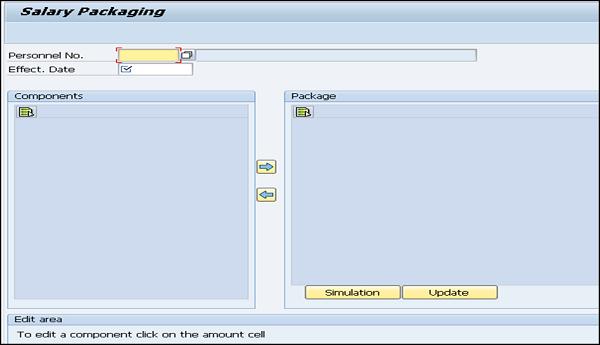

The following tasks should be performed to model a Package −

First is to click on the salary component text and choose the arrow to move the component between two boxes. Using this you can add/remove the components from the package.

If you want to change the component details, click on the amount for the component.

Below this you can see the edit section. This section is specific to each component and contains the relevant amount, percentage, and contribution information valid for the component.

Click Accept to include your new attributes to the package.

You can click on the Reset button to put the last values used.

Once you close the modeling screen, you can select from the following options −

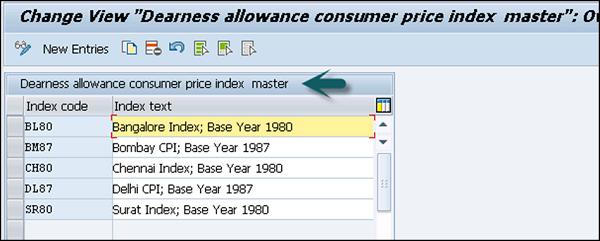

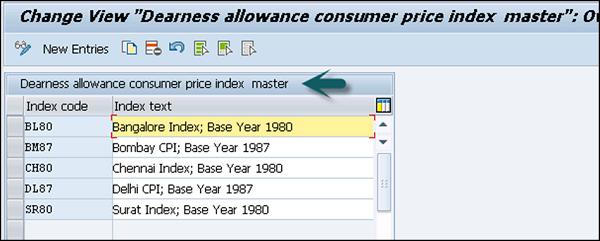

Dearness Allowance

This allowance is a part of the monthly remuneration paid to an employee and varies as per the location and other factors. The value of this component depends on the Consumer Price Index (CPI) for that location and this index varies as per government regulation. When an employee is transferred or moved to a different location, this allowance is also changed as per the location.

Dearness allowance along with other components like Base salary, Income tax, Gratuity, etc., forms the salary package of an employee for computation.

You can calculate Dearness allowance in a standard SAP system by using the following methods −

CPI slab based calculation

You can also define new CPI in SAP system using New Entries.

- Incremental CPI slab based calculation

- Basic slab based calculation

- Basic slab based calculation, subject to minimum value

- Non-slab based calculation

- Incremental basic slab based calculation

Note − For a non-managerial category this allowance is called Dearness allowance however for managerial category employee group it is also called Cost of Living Allowance (COLA).

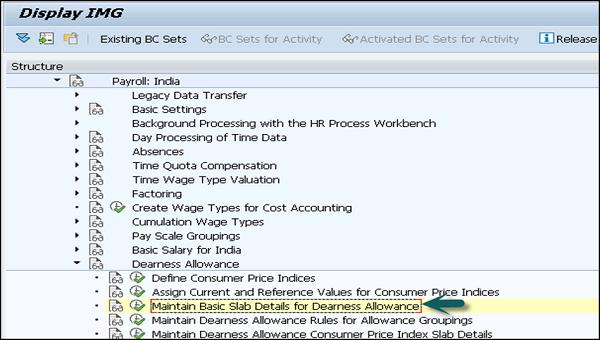

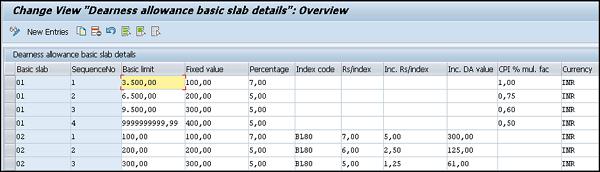

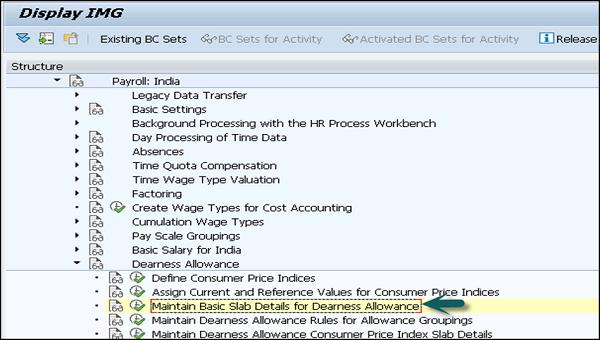

To configure DA in SAP system, go to SPRO → IMG → Payroll → Payroll India → Dearness Allowance → Maintain Basic slab details for Dearness allowance.

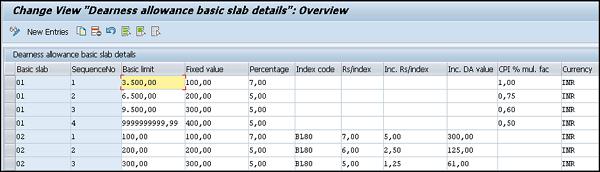

Once you click on this, it shows you the Basic slab details for Dearness allowance, which includes Fixed value, Percentage, CPI % mul. Fac., currency.

Housing Allowance

This component is used to maintain information about an employee accommodation. This is used to calculate tax exemptions and to check perquisite applicable on a housing benefit.

While updating or creating a housing record using the Housing (HRA / CLA / COA) under Infotype (0581), the system dynamically updates the Basic Pay Infotype (0008) with the new or changed wage type for Housing.

Different Types of Accommodation Under Housing

Rented − When an employee uses a Rented Accommodation, he receives a House Rent Allowance (HRA) to meet the expenses incurred by renting a residential accommodation.

In this case, the system calculates the tax exemption on the rented accommodation and rented amount paid by an employee.

Company Leased Accommodation (CLA) − When an employee uses a Company Leased Accommodation, the company leases an accommodation and provides it as a housing benefit to the employee.

The company Leased eligibility depends on the employee Pay Scale Grouping for Allowances. When an employee uses CLA benefit, the system checks the applicable perquisite on the CLA.

Company Owned Accommodation (COA) − When an employee uses COA, in this case company owns the accommodation and provides it as a housing benefit to the employee. Like CLA employee eligibility for COA depends on the employee grouping for pay scale allowance.

When an employee opts for COA benefit, the system will compute the perquisite applicable on the COA.

Hotel Accommodation − A company can also provide a hotel accommodation to the employee. Their stay in the hotel depends on a fixed period as per the Government rule and if the stay exceeds the time limit, a perquisite is applicable on the cost of accommodation.

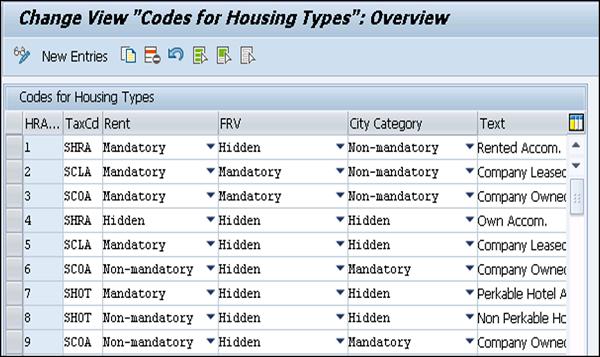

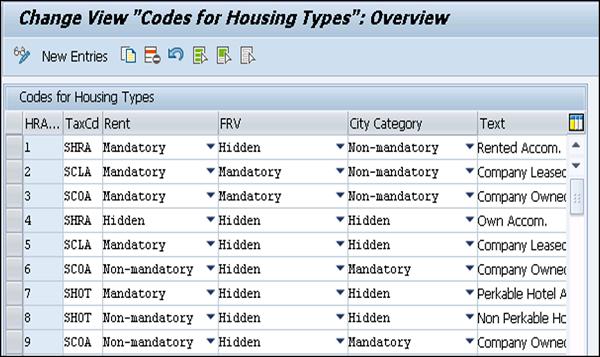

In a SAP standard system, the following accommodation types are configured by default −

- Rented Accommodation

- Company Leased (Old)

- Perkable Hotel Accommodation

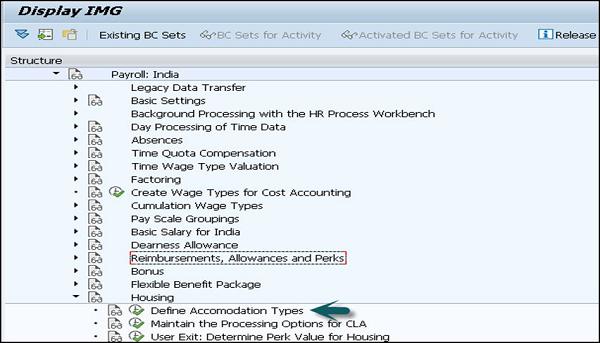

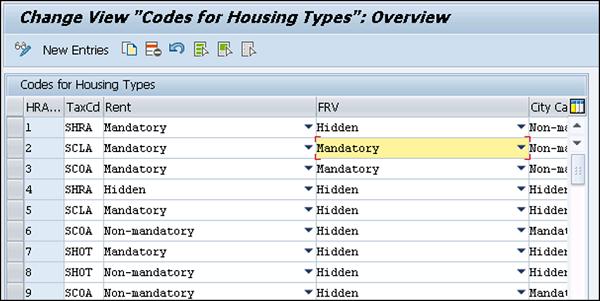

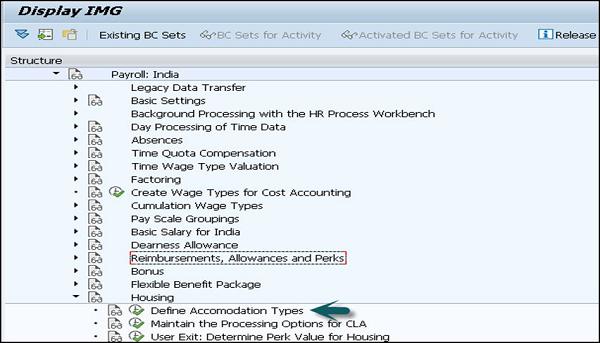

It is also possible to create a new accommodation type in the system. Go to SPRO → IMG → Payroll → Payroll India → Housing → Define Accommodation type

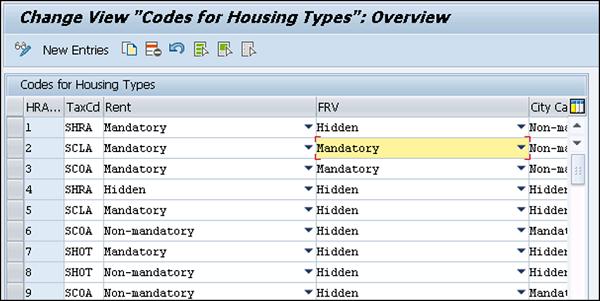

Under the Accommodation type, you can view the already defined Housing types or can create new entries by clicking the New Entries button.

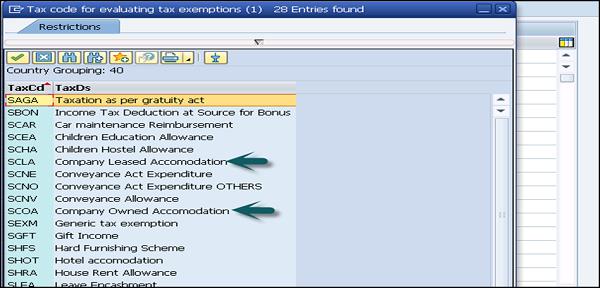

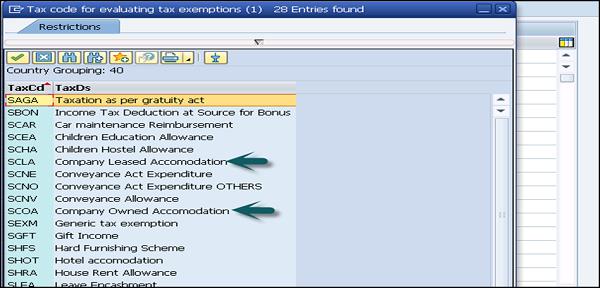

In the Tax Code, select the tax code as per the accommodation type.

Tax code field determines as per different accommodation type −

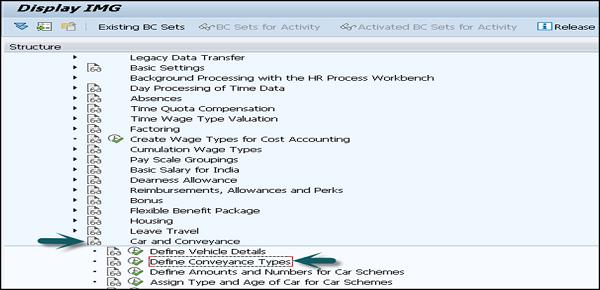

Car and Conveyance Allowance

This component is used to process the exemption on conveyance allowance. The details are maintained in Car and Conveyance Infotype (0583).

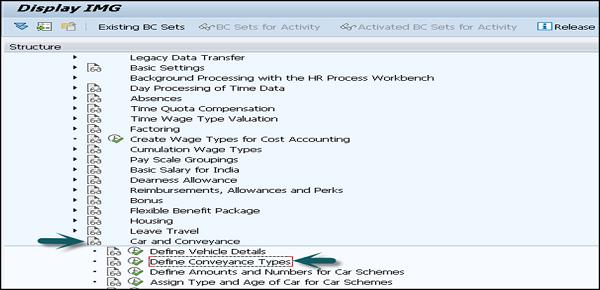

The standard SAP system provides exemption on conveyance allowance given to the employees. The following configuration has to be configured in the system if you want to give conveyance allowance and exemption to the employees.

Go to SPRO → IMG → Payroll → Payroll India → Car and Conveyance → Define Conveyance Type.

Different Car schemas can be used in the SAP system for exemption under different sections.

Long-Term Reimbursements

This defines as the long-term benefits provided to the employees over a fixed period of years. The duration varies from three to five years. In a standard SAP system, long-term benefits can be divided into the following categories −

Hard Furnishing Scheme

This includes benefits provided to employee for purpose of purchasing movable items like Fridge, TV, Washing machine, computer, etc.

Soft Furnishing Scheme or Other Reimbursements

This includes benefits provided to employee for purpose of purchasing consumer good items like Sofa, chair, Carpet, etc.

Car Maintenance Scheme

This benefit includes maintenance of their car over a period of time, etc.

Long Term Reimbursements Infotype (0590)

This Infotype is used to maintain Long Term Reimbursement claimed by the employees and under one of the following subtypes −

Subtype SHFS − For maintaining hard furnishing schemes information

Subtype SSFS − For maintaining soft furnishing schemes information

Subtype SCAR − For maintaining car maintenance schemes information

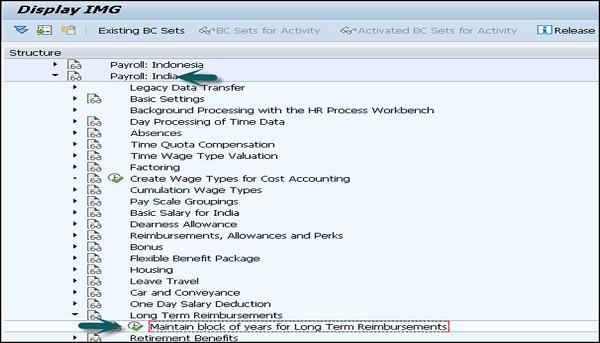

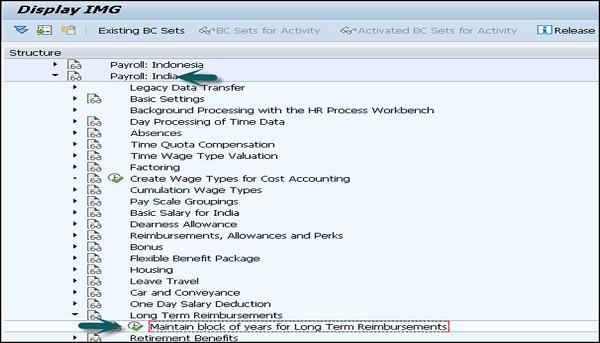

To configure a long term reimbursement, go to SPRO → IMG → Payroll → Payroll India → Long Term Reimbursement → Maintain block of years for long tern reimbursement.

To avail long-term benefits by an employee, there are different perquisites attached with each benefits that should be met −

Hard Furnishing Scheme

In this, there is a fixed percentage as the perquisite value applicable on the assets that an employee can avail during a financial year.

This fixed value is maintained in Calculate Hard Furnishing Perk Value constant (HFPRC) of the table view Payroll Constants (V_T511K).

Soft Furnishing Scheme

In this, the system calculates perquisite value for the assets that an employee avails in the current financial year and it is based on the perquisite percentage that you maintain in the Long Term Reimbursements Infotype (590) and subtype SSFS.

Car Maintenance Scheme

Normally, the system doesn’t contain any perquisite value with the Car Maintenance Scheme or any other similar type of scheme you create in the system.

Claims

In a company, an employee is eligible to claim some monetary and non-monetary benefits and these claims vary as per the pay scale grouping and many other factors. An employee needs to submit the claim based on the eligibility to get these benefits. Claims submitted can be of the following types −

Monetary Claims

This includes the claims that are available as per the eligibility amount.

For example − A conveyance allowance of Rs. 1800 per month or a Medical claim of Rs. 15000 in a given assessment year.

Non-Monetary Claims

These claims are commonly raised by an employee for company work. They are normally placed in units like Stationary request, Calculator, Petrol, etc.

Apart from this, there is one more type of claim known as the slab based claim. A few common types of slab based claims are LTA, car maintenance allowance, etc. These type of claims has an eligibility which is normally more than a year.

For example − Car maintenance allowance – where the validity period starts from the date of purchase of the car and in the first and second year an employee is eligible for a car maintenance allowance of Rs. 3000 and in the third year, claim eligibility is Rs. 5000 and in the fourth year, the eligibility is Rs. 7500.

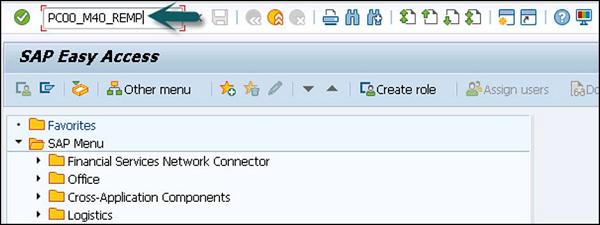

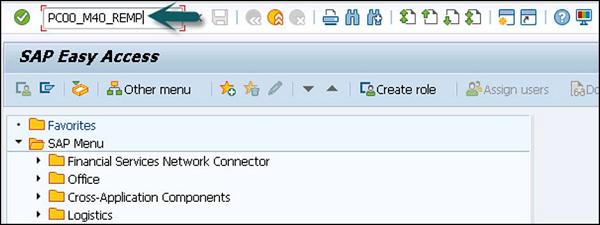

To get into the non-monetary claims section, you should use the following Transaction Code: PC00_M40_REMP as shown in the subsequent screenshot.

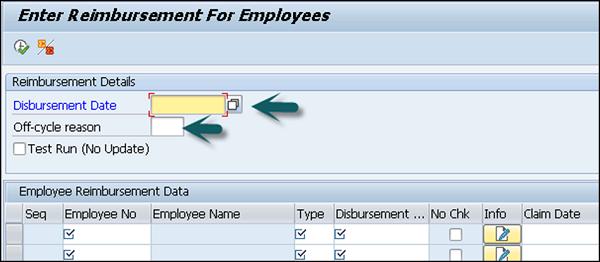

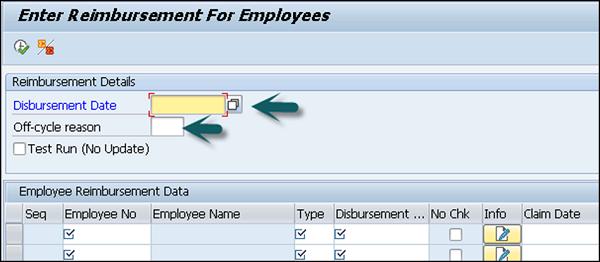

Once you run the above transaction, the reimbursement claim screen will appear.

The claims can be processed via −

Regular payroll run − In this reimbursement type, additional payments Infotype 0015 is updated with the information that you enter in this report and claim disbursement is made along with the regular payroll.

Off-cycle payroll run − In this method, One-Time Payments Off-Cycle Infotype 0267 is updated with the information that you enter in this report and approved claims can be disbursed through an off-cycle payment process.

For example − In this disbursement, claims are disbursed on the same day or claims submitted during the week are disbursed on any day of the week.

Bonus

This component is used to process the employee bonus and can compute both regular and off-cycle bonus.

As with claims, there are two types of bonuses that can be paid −

Type 1 Additional Payments 0015 − In this, the SAP system updates the Infotype when a regular bonus is processed.

Type 2 Additional Off-Cycle Payments for Off-Cycle Bonus 0267 − In this, 0267 Infotype is updated in the system, when an Off-Cycle bonus is computed.

Gratuity

It is defined as a statutory benefit provided to an employee by his employer for his association with the company. The Gratuity can be configured based on the following rules −

Payment of Gratuity Act, 1972 − As per this, a minimum amount that an employer has to contribute for this component is 4.81% of the base salary of the employee. As per the company policy where the benefits are better as compared to the Gratuity Act.

Personal IDs 0185 Gratuity for India subtype 03 − This is used to maintain the employee Personnel id number for Gratuity and the name of the trust to which you are contributing for employee gratuity.

Gratuity Listing Report (HINCGRY0) to Generate Gratuity List − This report is used to generate a list which shows the employee wise contribution to the trust name on behalf of the employee.

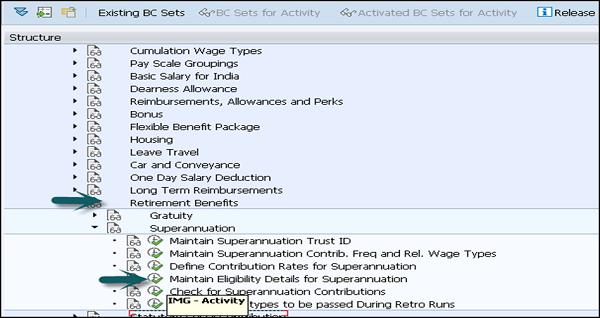

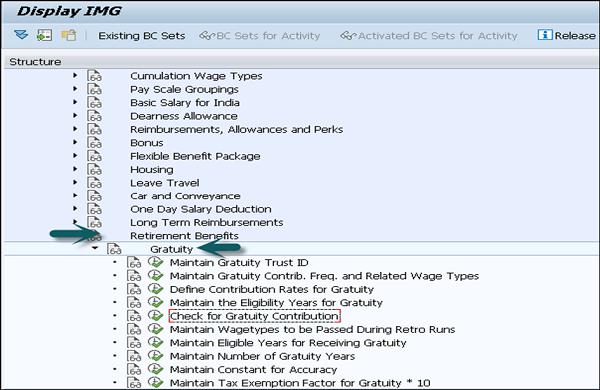

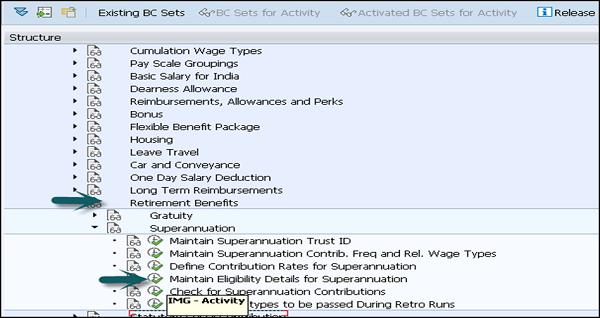

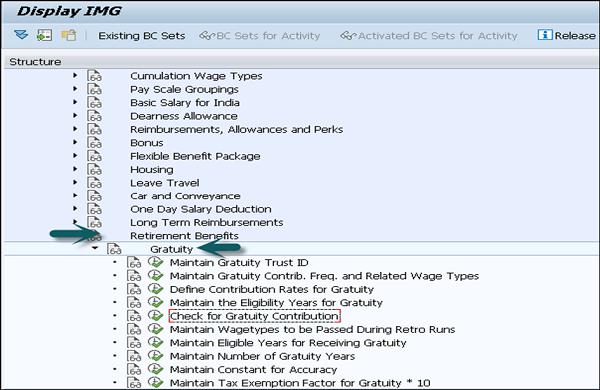

You can configure Gratuity in the SAP system by following this path. Go to SPRO → IMG → Payroll → Payroll India → Retirement benefits → Gratuity.

The employee record for Gratuity (Personnel Id’s) is maintained in Infotype and Gratuity for India Subtype 03.

Superannuation

This is defined as the benefit provided to an employee by the employer for his association with the company. The employer contributes towards Superannuation trust on a monthly or yearly basis to provide this benefit to the employee and it doesn’t include any employee contribution. This component is not presented as part of the monthly pay slip and is not a taxable component.

Superannuation report (HINCSAN0) for list − This report can be used to generate Superannuation List which provides employer contribution for this component for a specific time period.

Superannuation component and configuration − This component consists of the employee record as Personal Id’s Infotype 0185 Superannuation for India Subtype 01. This subtype is used to maintain the trust name and employee identification number for the employee.

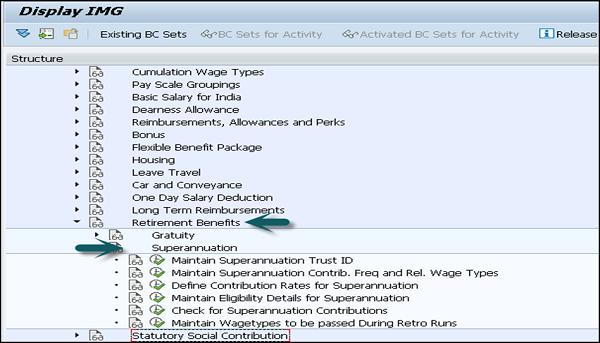

To define the trust name where the employer maintains the Superannuation account, you need to define trust id and name of trust in the system.

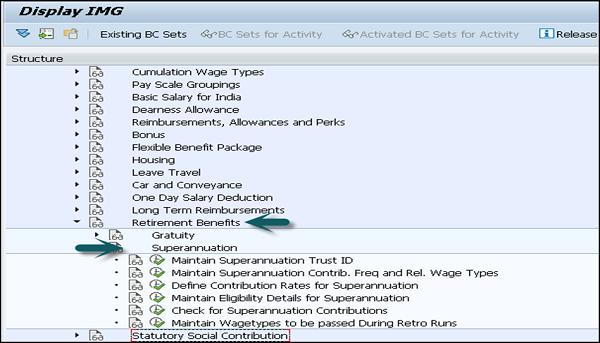

This can be done by going to SPRO → IMG → Payroll → Payroll India → Retirement Benefits → Maintain Superannuation Trust ID

The Superannuation ID field of Personal IDs Infotype (0185) Superannuation for India Subtype (01), displays options as per the Trust IDs that you have configured in this IMG activity.

To configure the criteria under which you want an employee to be eligible for Superannuation, it can be configured in a SAP system with the following method −

SPRO → IMG → Payroll → Payroll India → Retirement Benefits → Maintain Eligibility Details for Superannuation.