Accounting Basics - Quick Guide

Accounting - Overview

Accounting is a business language. We can use this language to communicate financial transactions and their results. Accounting is a comprehensive system to collect, analyze, and communicate financial information.

The origin of accounting is as old as money. In early days, the number of transactions were very small, so every concerned person could keep the record of transactions during a specific period of time. Twenty-three centuries ago, an Indian scholar named Kautilya alias Chanakya introduced the accounting concepts in his book Arthashastra. In his book, he described the art of proper account keeping and methods of checking accounts. Gradually, the field of accounting has undergone remarkable changes in compliance with the changes happening in the business scenario of the world.

A book-keeper may record financial transactions according to certain accounting principles and standards and as prescribed by an accountant depending upon the size, nature, volume, and other constraints of a particular organization.

With the help of accounting process, we can determine the profit or loss of the business on a specific date. It also helps us analyze the past performance and plan the future courses of action.

Definition of Accounting

The American Institute of Certified Public Accountant has defined Financial Accounting as:

“the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which in part at least of a financial character and interpreting the results thereof.”

Objectives and Scope of Accounting

Let us go through the main objectives of Accounting:

To keep systematic records - Accounting is done to keep systematic record of financial transactions. The primary objective of accounting is to help us collect financial data and to record it systematically to derive correct and useful results of financial statements.

To ascertain profitability - With the help of accounting, we can evaluate the profits and losses incurred during a specific accounting period. With the help of a Trading and Profit & Loss Account, we can easily determine the profit or loss of a firm.

To ascertain the financial position of the business - A balance sheet or a statement of affairs indicates the financial position of a company as on a particular date. A properly drawn balance sheet gives us an indication of the class and value of assets, the nature and value of liability, and also the capital position of the firm. With the help of that, we can easily ascertain the soundness of any business entity.

To assist in decision-making - To take decisions for the future, one requires accurate financial statements. One of the main objectives of accounting is to take right decisions at right time. Thus, accounting gives you the platform to plan for the future with the help of past records.

To fulfill compliance of Law - Business entities such as companies, trusts, and societies are being run and governed according to different legislative acts. Similarly, different taxation laws (direct indirect tax) are also applicable to every business house. Everyone has to keep and maintain different types of accounts and records as prescribed by corresponding laws of the land. Accounting helps in running a business in compliance with the law.

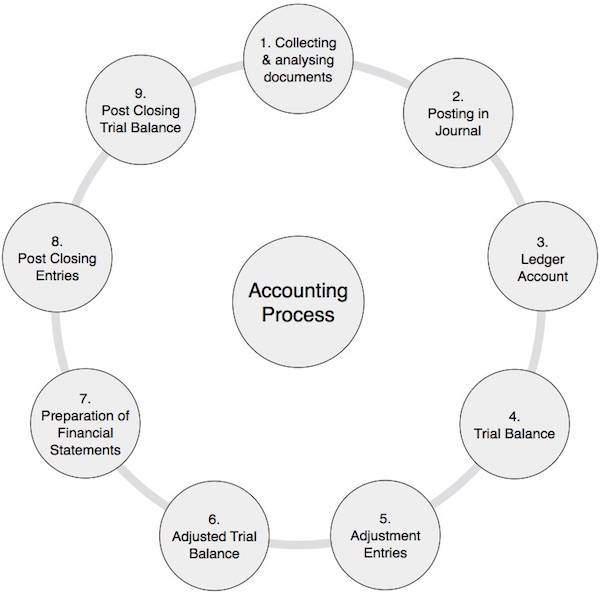

Accounting - Process

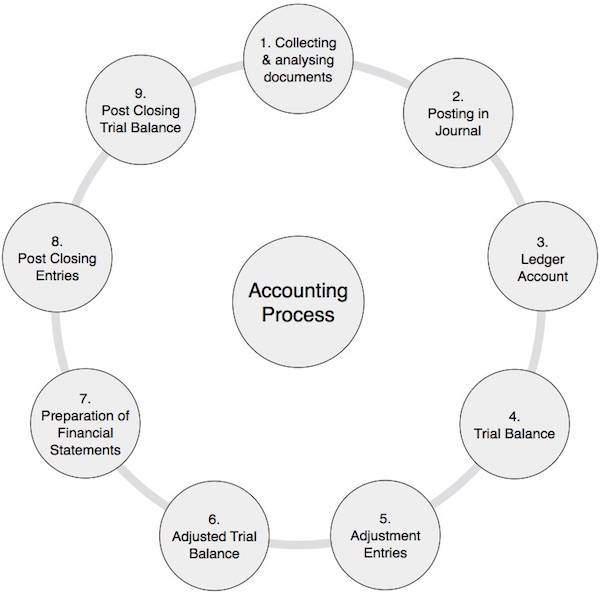

Accounting cycle refers to the specific tasks involved in completing an accounting process. The length of an accounting cycle can be monthly, quarterly, half-yearly, or annually. It may vary from organization to organization but the process remains the same.

Accounting Process

The following table lists down the steps followed in an accounting process -

| 1 |

Collecting and Analyzing Accounting Documents |

It is a very important step in which you examine the source documents and analyze them. For example, cash, bank, sales, and purchase related documents. This is a continuous process throughout the accounting period. |

| 2 |

Posting in Journal |

On the basis of the above documents, you pass journal entries using double entry system in which debit and credit balance remains equal. This process is repeated throughout the accounting period. |

| 3 |

Posting in Ledger Accounts |

Debit and credit balance of all the above accounts affected through journal entries are posted in ledger accounts. A ledger is simply a collection of all accounts. Usually, this is also a continuous process for the whole accounting period. |

| 4 |

Preparation of Trial Balance |

As the name suggests, trial balance is a summary of all the balances of ledger accounts irrespective of whether they carry debit balance or credit balance. Since we follow double entry system of accounts, the total of all the debit and credit balance as appeared in trial balance remains equal. Usually, you need to prepare trial balance at the end of the said accounting period. |

| 5 |

Posting of Adjustment Entries |

In this step, the adjustment entries are first passed through the journal, followed by posting in ledger accounts, and finally in the trial balance. Since in most of the cases, we used accrual basis of accounting to find out the correct value of revenue, expenses, assets and liabilities accounts, we need to do these adjustment entries. This process is performed at the end of each accounting period. |

| 6 |

Adjusted Trial Balance |

Taking into account the above adjustment entries, we create adjusted trial balance. Adjusted trial balance is a platform to prepare the financial statements of a company. |

| 7 |

Preparation of Financial Statements |

Financial statements are the set of statements like Income and Expenditure Account or Trading and Profit & Loss Account, Cash Flow Statement, Fund Flow Statement, Balance Sheet or Statement of Affairs Account. With the help of trial balance, we put all the information into financial statements. Financial statements clearly show the financial health of a firm by depicting its profits or losses. |

| 8 |

Post-Closing Entries |

All the different accounts of revenue and expenditure of the firm are transferred to the Trading and Profit & Loss account. With the result of these entries, the balance of all the accounts of income and expenditure accounts come to NIL. The net balance of these entries represents the profit or loss of the company, which is finally transferred to the owner’s equity or capital. |

| 9 |

Post-Closing Trial Balance |

Post-closing Trial Balance represents the balances of Asset, Liabilities & Capital account. These balances are transferred to next financial year as an opening balance. |

Accounting - Basic Concepts

The first two accounting concepts, namely, Business Entity Concept and Money Measurement Concept are the fundamental concepts of accounting. Let us go through each one of them briefly:

Business Entity Concept

According to this concept, the business and the owner of the business are two different entities. In other words, I and my business are separate.

For example, Mr A starts a new business in the name and style of M/s Independent Trading Company and introduced a capital of Rs 2,000,000 in cash. It means the cash balance of M/s Independent Trading Company will increase by a sum of Rs 2,000,000/-. At the same time, the liability of M/s Independent Trading Company in the form of capital will also increase. It means M/s Independent Trading Company is liable to pay Rs 2,000,000 to Mr A.

Money Measurement Concept

According to this concept, “we can book only those transactions in our accounting record which can be measured in monetary terms.”

Example

Determine and book the value of stock of the following items:

Shirts Rs 5,000/-

Pants Rs 7,500/-

Coats 500 pieces

Jackets 1000 pieces

Value of Stock = ?

Here, if we want to book the value of stock in our accounting record, we need the value of coats and jackets in terms of money. Now if we conclude that the values of coats and jackets are Rs 2,000 and Rs 15,000 respectively, then we can easily book the value of stock as Rs 29,500 (as a result of 5000+7500+2000+15000) in our books. We need to keep quantitative records separately.

Going Concern Concept

Our accounting is based on the assumption that a business unit is a going concern. We record all the financial transaction of a business in keeping this point of view in our mind that a business unit is a going concern; not a gone concern. Otherwise, the banker will not provide loans, the supplier will not supply goods or services, the employees will not work properly, and the method of recording the transaction will change altogether.

For example, a business unit makes investments in the form of fixed assets and we book only depreciation of the assets in our profit & loss account; not the difference of acquisition cost of assets less net realizable value of the assets. The reason is simple; we assume that we will use these assets and earn profit in the future while using them. Similarly, we treat deferred revenue expenditure and prepaid expenditure. The concept of going concern does not work in the following cases:

- If a unit is declared sick (unused or unusable unit).

- When a company is going to liquidate and a liquidator is appointed for the same.

- When a business unit is passing through severe financial crisis and going to wind up.

Cost Concept

It is a very important concept based on the Going Concern Concept. We book the value of assets on the cost basis, not on the net realizable value or market value of the assets based on the assumption that a business unit is a going concern. No doubt, we reduce the value of assets providing depreciation to assets, but we ignore the market value of the assets.

The cost concept stops any kind of manipulation while taking into account the net realizable value or the market value. On the downside, this concept ignores the effect of inflation in the market, which can sometimes be very steep. Still, the cost concept is widely and universally accepted on the basis of which we do the accounting of a business unit.

Dual Aspect Concept

There must be a double entry to complete any financial transaction, means debit should be always equal to credit. Hence, every financial transaction has its dual aspect:

- we get some benefit, and

- we pay some benefit.

For example, if we buy some stock, then it will have two effects:

- the value of stock will increase (get benefit for the same amount), and

- it will increase our liability in the form of creditors.

| Transaction |

Effect |

| Purchase of Stock for Rs 25,000 |

Stock will increase by Rs 25,000 (Increase in debit balance)

Cash will decrease by Rs 25,000 (Decrease in debit balance)

or

Creditor will increase by Rs 25,000 (Increase in credit balance)

|

Accounting Period Concept

The life of a business unit is indefinite as per the going concern concept. To determine the profit or loss of a firm, and to ascertain its financial position, profit & loss accounts and balance sheets are prepared at regular intervals of time, usually at the end of each year. This one-year cycle is known as the accounting period. The purpose of having an accounting period is to take corrective measures keeping in view the past performances, to nullify the effect of seasonal changes, to pay taxes, etc.

Based on this concept, revenue expenditure and capital expenditure are segregated. Revenues expenditure are debited to the profit & loss account to ascertain correct profit or loss during a particular accounting period. Capital expenditure comes in the category of those expenses, the benefit of which will be utilized in the next coming accounting periods as well.

Accounting period helps us ascertain correct position of the firm at regular intervals of time, i.e., at the end of each accounting period.

Matching Concept

Matching concept is based on the accounting period concept. The expenditures of a firm for a particular accounting period are to be matched with the revenue of the same accounting period to ascertain accurate profit or loss of the firm for the same period. This practice of matching is widely accepted all over the world. Let us take an example to understand the Matching Concept clearly.

The following data is received from M/s Globe Enterprises during the period 01-04-2012 to 31-03-2013:

| S.No. |

Particulars |

Amount |

| 1 |

Sale of 1,000 Electric Bulbs @ Rs 10 per bulb on cash basis. |

10,000.00 |

| 2 |

Sale of 200 Electric Bulb @ Rs. 10 per bulb on credit to M/s Atul Traders. |

2,000.00 |

| 3 |

Sale of 450 Tube light @ Rs.100 per piece on Cash basis. |

45,000.00 |

| 4 |

Purchases made from XZY Ltd. |

40,000.00 |

| 5 |

Cash paid to M/s XYZ Ltd. |

38,000.00 |

| 6 |

Freight Charges paid on purchases |

1,500.00 |

| 7 |

Electricity Expenses of shop paid |

5,000.00 |

| 8 |

Bill for March-13 for Electricity still outstanding to be paid next year. |

1,000.00 |

Based on the above data, the profit or loss of the firm is calculated as follows:

| Particulars |

Amount |

Total |

| Sale |

|

|

| Bulb |

12,000.00 |

|

| Tube |

45,000.00 |

57,000.00 |

| Less - |

|

|

| Purchases |

40,000.00 |

|

| Freight Charges |

5,000.00 |

|

| Electricity Expenses |

1,500.00 |

|

| Outstanding Expenses |

1,000.00 |

47,500.00 |

| Net Profit |

|

9,500.00 |

In the above example, to match expenditures and revenues during the same accounting period, we added the credit purchase as well as the outstanding expenses of this accounting year to ascertain the correct profit for the accounting period 01-04-2012 to 31-03-2013.

It means the collection of cash and payment in cash is ignored while calculating the profit or loss of the year.

Accrual Concept

As stated above in the matching concept, the revenue generated in the accounting period is considered and the expenditure related to the accounting period is also considered. Based on the accrual concept of accounting, if we sell some items or we rendered some service, then that becomes our point of revenue generation irrespective of whether we received cash or not. The same concept is applicable in case of expenses. All the expenses paid in cash or payable are considered and the advance payment of expenses, if any, is deducted.

Most of the professionals use cash basis of accounting. It means, the cash received in a particular accounting period and the expenses paid cash in the same accounting period is the basis of their accounting. For them, the income of their firm depends upon the collection of revenue in cash. Similar practice is followed for expenditures. It is convenient for them and on the same basis, they pay their Taxes.

Objective Evidence Concept

According to the Objective Evidence concept, every financial entry should be supported by some objective evidence. Purchase should be supported by purchase bills, sale with sale bills, cash payment of expenditure with cash memos, and payment to creditors with cash receipts and bank statements. Similarly, stock should be checked by physical verification and the value of it should be verified with purchase bills. In the absence of these, the accounting result will not be trustworthy, chances of manipulation in accounting records will be high, and no one will be able to rely on such financial statements.

Accounting - Conventions

We will discuss the accounting conventions in this section.

Convention of Consistency

To compare the results of different years, it is necessary that accounting rules, principles, conventions and accounting concepts for similar transactions are followed consistently and continuously. Reliability of financial statements may be lost, if frequent changes are observed in accounting treatment. For example, if a firm chooses cost or market price whichever is lower method for stock valuation and written down value method for depreciation to fixed assets, it should be followed consistently and continuously.

Consistency also states that if a change becomes necessary, the change and its effects on profit or loss and on the financial position of the company should be clearly mentioned.

Convention of Disclosure

The Companies Act, 1956, prescribed a format in which financial statements must be prepared. Every company that fall under this category has to follow this practice. Various provisions are made by the Companies Act to prepare these financial statements. The purpose of these provisions is to disclose all essential information so that the view of financial statements should be true and fair. However, the term ‘disclosure’ does not mean all information. It means disclosure of information that is significance to the users of these financial statements, such as investors, owner, and creditors.

Convention of Materiality

If the disclosure or non-disclosure of an information might influence the decision of the users of financial statements, then that information should be disclosed.

For better understanding, please refer to General Instruction for preparation of Statement of Profit and Loss in revised scheduled VI to the Companies Act, 1956:

A company shall disclose by way of notes additional information regarding any item of income or expenditure which exceeds 1% of the revenue from operations or Rs 1,00,000 whichever is higher.

A Company shall disclose in Notes to Accounts, share in the company held by each shareholder holding more than 5% share specifying the number of share held.

Conservation or Prudence

It is a policy of playing safe. For future events, profits are not anticipated, but provisions for losses are provided as a policy of conservatism. Under this policy, provisions are made for doubtful debts as well as contingent liability; but we do not consider any anticipatory gain.

For example, If A purchases 1000 items @ Rs 80 per item and sells 900 items out of them @ Rs 100 per item when the market value of stock is (i) Rs 90 and in condition (ii) Rs 70 per item, then the profit from the above transactions can be calculated as follows:

| Particulars |

Condition(i) |

Condition(ii) |

|

|

|

| Sale Value (A) (900x100) |

90,000.00 |

90,000.00 |

| Less - Cost of Goods Sold |

|

|

| Purchases |

80,000.00 |

80,000.00 |

| Less - Closing Stock |

8,000.00 |

7,000.00 |

| Cost of Goods Sold (B) |

72,000.00 |

73,000.00 |

| Profit(A-B) |

18,000.00 |

17,000.00 |

In the above example, the method for valuation of stock is ‘Cost or market price whichever is lower’.

The prudence however does not permit creation of hidden reserve by understating

the profits or by overstating the losses.

Accounting - Classification of Accounts

It is necessary to know the classification of accounts and their treatment in double entry system of accounts. Broadly, the accounts are classified into three

categories:

- Personal accounts

- Real accounts

- Tangible accounts

- Intangible accounts

Let us go through them each of them one by one.

Personal Accounts

Personal accounts may be further classified into three categories:

Natural Personal Account

An account related to any individual like David, George, Ram, or Shyam is

called as a Natural Personal Account.

Artificial Personal Account

An account related to any artificial person like M/s ABC Ltd, M/s General

Trading, M/s Reliance Industries, etc., is called as an Artificial Personal

Account.

Representative Personal Account

Representative personal account represents a group of account. If there are a

number of accounts of similar nature, it is better to group them like salary payable account, rent payable account, insurance prepaid account, interest receivable account, capital account and drawing account, etc.

Real Accounts

Every Business has some assets and every asset has an account. Thus, asset account is called a real account. There are two type of assets:

Tangible assets are touchable assets such as plant, machinery, furniture, stock, cash, etc.

Intangible assets are non-touchable assets such as goodwill, patent, copyrights, etc.

Accounting treatment for both type of assets is same.

Nominal Accounts

Since this account does not represent any tangible asset, it is called nominal or fictitious account. All kinds of expense account, loss account, gain account or income accounts come under the category of nominal account. For example, rent account, salary account, electricity expenses account, interest income account, etc.

Accounting - Systems

There are two systems of accounting followed -

- Single Entry System

- Double Entry System

Single Entry System

Single entry system is an incomplete system of accounting, followed by small businessmen, where the number of transactions is very less. In this system of accounting, only personal accounts are opened and maintained by a business owner. Sometimes subsidiary books are maintained and sometimes not. Since real and nominal accounts are not opened by the business owner, preparation of profit & loss account and balance sheet is not possible to ascertain the correct position of profit or loss or financial position of business entity.

Double Entry System

Double entry system of accounts is a scientific system of accounts followed all over the world without any dispute. It is an old system of accounting. It was developed by ‘Luco Pacioli’ of Italy in 1494. Under the double entry system of account, every entry has its dual aspects of debit and credit. It means, assets of the business always equal to liabilities of the business.

Assets = Liabilities

If we give something, we also get something in return and vice versa.

Rules of Debit and Credit under Double Entry System of Accounts

The following rules of debit and credit are called the golden rules of accounts:

| Classification of accounts |

Rules |

Effect |

| Personal Accounts |

Receiver is Debit

Giver is Credit

|

Debit=Credit |

| Real Accounts |

What Comes In Debit

What Goes Out Credit

|

Debit=Credit |

| Nominal Accounts |

Expenses are Debit

Incomes are Credit

|

Debit=Credit |

Example

Mr A starts a business regarding which we have the following data:

| Introduces Capital in cash |

Rs |

50,000 |

| Purchases (Cash) |

Rs |

20,000 |

| Purchases (Credit) from Mr B |

Rs |

25,000 |

| Freight charges paid in cash |

Rs |

1,000 |

| Goods sold to Mr C on credit |

Rs |

15,000 |

| Cash Sale |

Rs |

30,000 |

| Purchased computer |

Rs |

10,000 |

| Commission Income |

Rs |

8,000 |

Journal entries for above items would be done as -

| S.No. |

Journal Entries |

Classification |

Rule |

| 1 |

Cash A/c Dr. 50,000

To Capital A/c 50,000

|

Real A/c

Personal A/c

|

Debit what comes in;

Credit the giver(Owner)

|

| 2 |

Goods Purchase A/c Dr. 20,000

To cash A/c 20,000

|

Real A/c

Real A/c

|

Debit what comes in;

Credit what goes out

|

| 3 |

Goods Purchase A/c Dr. 25,000

To B A/c 25,000

|

Real A/c

Personal A/c

|

Debit what comes in;

Credit the giver

|

| 4 |

Freight A/c Dr. 1,000

To cash A/c 1,000

|

Nominal A/c

Real A/c

|

Debit all expenses

Credit what goes out

|

| 5 |

C A/c Dr. 15,000

To Sale A/c 15,000

|

Personal A/c

Real Account

|

Debit the receiver

Credit what goes out

|

| 6 |

Cash A/c Dr. 30,000

To Sale A/c 30,000

|

Real A/c

Real A/c

|

Debit what comes in;

Credit what goes out

|

| 7 |

Computer A/c Dr. 10,000

To cash A/c 10,000

|

Real A/c

Real A/c

|

Debit what comes in;

Credit what goes out

|

| 8 |

Cash A/c Dr. 8,000

To commission A/c 8,000

|

Real A/c

Nominal A/c

|

Debit what comes in;

Credit all incomes

|

It is very clear from the above example how the rules of debit and credit work. It is also clear that every entry has its dual aspect. In any case, debit will always be equal to credit in double entry accounting system.

Financial Accounting - Journal

“The process of recording a transaction in a journal is called journalizing the transactions.”

---Meigs and Meigs and Johnson

Journal is a book that is maintained on a daily basis for recording all the financial entries of the day. Passing the entries is called journal entry. Journal entries are passed according to rules of debit and credit of double entry system.

| 1 |

2 |

3 |

4 |

5 |

| Date |

Particulars |

L.F. |

Amount |

| Debit |

Credit |

| xx-xx-xx |

... ... ... ... A/c Dr.

To ... ... ... ... A/c

(... ... Narration... ...)

|

xx

xx

|

xxxx |

xxxx |

Column 1: It represents the date of transaction.

Column 2: Line 1 (... ... ... ...) represents the name of account to be debited.

Line 2 (... ... ... ...) represents the name of account to be credited.

Line 3 for narration of transaction.

Column 3: Ledger Folio (L.F.) represents the page number of ledger account on

which we post these entries.

Column 4 : Amount(s) to be debited.

Column 5 : Amount(s) to be credited.

Notes

If there are multiple transactions in a day, the total amount of all the transaction through a single journal entry may pass with total amount.

If debit or credit entry is same and the corresponding entry is different, we may post a combined entry for the same. It is called ‘compound entry’ regardless of how many debit or credit entries are contained in compound journal entry. For example,

| 1 |

2 |

3 |

4 |

5 |

| Date |

Particulars |

L.F. |

Amount |

| Debit |

Credit |

| Xxxx |

... ... ... ... A/c Dr.

... ... ... ... A/c Dr.

To ... ... ... ... A/c

(Narration... ... ... ...)

|

xx

xx

xx

|

xx

xx

|

xxxx |

Analysis and Treatment of Transactions

Let us go through the nature of transactions and their treatment in our books of accounts. The following accounting entries are commonly used in every business and they come under the category of routine journal entries.

| S.No. |

Transaction Nature |

Analysis and Treatment |

| 1 |

Capital |

Capital account is personal account. Whenever the owner introduces capital in the form of cash, goods or assets, the entry will be as here under:

| Cash/Goods/Asset A/c |

Dr. |

xx |

|

| To Capital A/c |

|

|

xx |

(Being cash/goods/assets introduced as capital)

|

| 2 |

Drawing Account |

Drawing account is also a capital account. Whenever the owner of the business withdraws money for his personal use, it is called drawing. The balance of Drawing account is transferred to the capital account at the end of the accounting year.

| Drawing A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being withdrawal of cash for personal use)

|

|

Notes:

1. Introduction of capital as well as withdrawal of capital may occur any time during the accounting year.

2. In addition to cash, there may be other expenses of the owner/proprietor which may pay directly on his behalf debating his account. For example, payment of his insurance, taxes, rent, electricity or personal phone bills.

3. Business account and personal account of proprietor are different as owner of the business and business, both are separate entities.

|

| 3 |

Trade Discount |

Trade discount is allowed by seller to buyer directly on their sales invoice. Buyer in this case are usually whole-sellers, traders or manufacturers, who further sell this material to their customers or use the material in their manufacturing process. Rate of discount may vary from customer to customer.

Treatment - No need to pass any journal entry in this case. The sale is booked on the net of trade discount. Similarly, if we get trade discount from our supplier, we book our purchase at the net of trade discount.

|

| 4 |

Cash Discount |

Cash discount is also allowed by seller to his buyer; still it does not come in the category of trade discount. Cash discount is a sort of scheme to inspire their debtors to release their due payment in time. For example, a seller may allow 5% cash discount, if he gets payment within a week against the time limit of 45 days.

Treatment - If A allowed a discount of 5% to B, then

| In the books of A: |

|

|

|

| Cash A/c |

Dr. |

xx |

|

| Discount A/c |

Dr. |

xx |

|

| To B A/c |

|

|

xxxx |

(Being 5% discount allowed to B on payment of Rs........)

| In the books of B: |

|

|

|

| A A/c |

Dr. |

xxxx |

|

| To Discount A/c |

|

|

xx |

| To B A/c |

|

|

xx |

(Being payment of Rs xx made to A and getting a discount of 5%)

Note - In the above case, discount is a loss to A and income to B.

|

| 5 |

Bad Debts |

Part of credit sale which is unrecovered from debtors due to some reason like insolvency, dishonesty, etc. are called bad debts of the company. Bad debts are loss to the company.

Treatment:

(1) To book bad debts

| Bad Debts A/c |

Dr. |

xx |

|

| To Debtor A/c |

|

|

xx |

(Being loss on account of bad debts)

(2) To recover bad debts

| Cash A/c |

Dr. |

xx |

|

| To bad debts recovery A/c |

|

|

xx |

(Being recovery of bad debts)

|

| 6 |

Expenses on purchase of Goods |

There are a few types of expenses incurred on the purchases of goods like inward freight, octroi, cartage, unloading charges, etc.

Treatment:

| Inward freight/Cartage/Octroi A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being freight charges paid on purchase of goods)

|

| 7 |

Expenses on Sale of Goods |

Expenses are also incurred while selling products to customers such as freight outward, insurance charges, etc.

Treatment:

| Freight outward/Insurance Expenses A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being freight charges paid on sale of goods)

|

| 8 |

Expenses on Purchase of Assets |

Sometimes we need to pay expenses on the purchase of fixed assets like transportation charges, installation charges, etc.

Treatment:

Expenses incurred on purchases of fixed asset are added in the value of fixed assets and could not be treated like expenses on purchases of goods:

| Fixed Asset A/c |

Dr. |

xx |

|

| To Cash A/c |

Dr. |

|

xx |

(Expenses incurred on purchase of asset)

|

| 9 |

Payment of Expenses |

Treatment:

| Expenses A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being expenses incurred)

|

| 10 |

Outstanding Expenses |

Sometimes expenses remain outstanding at the end of the financial year, but due to the accrual basis of accounting, we need to book those expenses which are due for payment and to be paid in the next accounting year. For example, the salary due on the last day of the accounting year to be paid in the next year.

Treatment:

| Salary A/c |

Dr. |

xx |

|

| To salary outstanding A/c |

|

|

xx |

(Being salary for the month of .........due)

|

| 11 |

Prepaid Expenses

|

Sometimes we pay expenses in advance such as insurance paid three months before the closing of the accounting year. Since insurance is usually paid for the whole year, in this case, the insurance for nine months is treated as prepaid insurance. Similarly, rent for the first month of next accounting year may be paid in advance.

Treatment:

| Prepaid Expenses A/c |

Dr. |

xx |

|

| To Expenses/Cash A/c |

|

|

xx |

(Being prepaid expenses for month paid)

Note: Expenses account is replaced with the respective head of expense account.

|

| 12 |

Income Received |

Treatment:

| Cash/Debtor A/c |

Dr. |

xx |

|

| To Income A/c |

|

|

xx |

(Being Income received in cash)

Note: Income account will be replaced with the respective head of Income account.

|

| 13 |

Banking Transactions |

(1) Cheque deposited in bank

Cheque received from party is deposited in bank, Cheque direct deposit by party in our bank account, payment made by party through NEFT or RTGS, or cash directly deposited by party in our bank account. The entry remains same in all the above cases.

| Bank A/c |

Dr. |

xx |

|

| To Debtor A/c |

|

|

xx |

(2) Payment made to party through cheque

Cheque issued to party or directly deposited in his bank account, or payment made through either by NEFT, RTGS, or cash directly deposited in his bank account. Entry remains same in all the above cases except in the case of cash deposited in his bank account.

| Debtor A/c |

Dr. |

xx |

|

| To Bank A/c |

|

|

xx |

(Being payment made through ..... )

If we deposit cash in his bank account, entry will be as follows:

| Debtor A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being payment made through ..... )

(3) Cash withdrawn for office Expenses

| Cash A/c |

Dr. |

xx |

|

| To Bank A/c |

|

|

xx |

(Being cash withdrawn from bank for office use)

(4) Cash deposited with Bank

| Cash A/c |

Dr. |

xx |

|

| To Cash A/c |

|

|

xx |

(Being cash withdrawn from bank for office use)

Note: The above entries No. 3 & 4 are called ‘contra’ entries.

(5) Bank charge debited by bank

Sometimes banks debit from our account against some charges for service provided by them. For example, cheque book issuing charges, demand draft issuing charges, Bank interest, etc.

| Bank Commission/Charges A/c |

Dr. |

xx |

|

| To bank A/c |

|

|

xx |

(Bank charges/commission/interest debited by bank)

|

| 14 |

Interest on Capital |

Interest on capital, introduced by sole proprietor or partners of the firm: This entry is passed on the last date of the accounting year as follows:

| Interest on capital A/c |

Dr. |

xx |

|

| To Capital A/c |

|

|

xx |

(Being interest @..... on capital provide)

|

| 15 |

Payment on behalf of others |

Some expenses may be on behalf of our debtors or creditors.

| Debtors/Creditors A/c |

Dr. |

xx |

|

| To Cash/Expenses A/c |

|

|

xx |

(Being expenses debited to party, paid on his behalf)

|

| 16 |

Advance received against supply of goods/services |

Sometimes the customers pay an advance amount for the supply of goods/services, which need to be adjusted later:

| Bank/Cash A/c |

Dr. |

xx |

|

| To Advance from Customers A/c |

|

|

xx |

(Being advance received from xxxxxxxx)

|

| 17 |

Advance paid against supply of goods/services |

As above, we may also pay an advance amount to our supplier against supply of goods/services:

| Advance against supply of goods A/c |

Dr. |

xx |

|

| To Cash/Bank A/c |

|

|

xx |

(Being advance paid against supply of goods/services)

|

Financial Accounting - Ledger

Now let us try to understand how a journal works. With the help of journal entries, we book each and every financial transaction of the organization chronically without considering how many times the same type of entry has been repeated in that particular accounting year or period.

Journal entries in any organization may vary from hundreds to millions depending upon the size and structure of the organization. With the help of a journal, each of the transactions might be recorded; however, we can conclude nothing from a journal. Let us consider the following cases. Suppose we want to know:

- the total sale value or purchase value

- the total of any particular income or expenses

- the total of amount payable to any particular creditor or receivable from a debtor

In such cases, it might be a tedious job for any bookkeeper or accountant. Hence, the next step is ledger accounts.

The ledger helps us in summarizing journal entries of same nature at single place. For example, if we pass 100 times a journal entry for sale, we can create a sales account only once and post all the sales transaction in that ledger account date-wise. Hence, an unlimited number of journal entries can be summarized in a few ledger accounts. Transferring journal entries into a ledger account is called ‘posting’.

Ruling of Account in Ledger Account

Let us see various formats of ledger accounts:

Format-1

| In the books of M/s. ABC Company |

| Ledger account of M/s XYZ LTD. |

| Dr. |

Cr. |

| Date |

Particulars |

F |

Amount |

Date |

Particulars |

F |

Amount |

| xxxx |

To Balance b/d |

|

xxx |

Xxxx |

By Balance b/d |

|

xxx |

|

|

|

|

|

|

|

|

| xxxx |

To Name of the debit account |

|

xxx |

Xxxx |

By Name of Credit account |

|

xxx |

|

|

|

|

|

|

|

|

| xxxx |

To Balance c/d |

|

xx |

xxxx |

By Balance c/d |

|

xx |

|

Total Rs. |

|

xxxx |

|

Total Rs. |

|

xxxx |

Format-2

Nowadays, the handwritten books are being replaced by computerized accounts. The companies majorly use a six-column format to maintain ledger accounts of their customers. It looks as follows:

| In the books of M/s. ABC Bank Ltd. |

| Ledger account of M/s XYZ Ltd. |

| Date |

Particulars |

LF |

Amount |

Balance |

| Debit |

Credit |

Dr. / Cr. |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Format-1 is used for academic purpose. Hence, this format is useful to learn the basics and principles of accounting.

Format-2 is used by banking and financial organization as well as well as by most of the business organizations.

Important Points Regarding Ledger

Each side of a journal entry is posted in the same side of the ledger. It means the debit entry of a journal is posted in the debit side and vice-a-versa.

Balance c/d refers to the balance carried down and balance b/d refers to the balance brought down.

After posting in ledger, balancing of ledger is done. In the column named Total, the figure comes on the basis of ‘whichever is higher’. Means, if the total of debit side is Rs 10,000 and the total of credit is Rs 5,000, we write Rs 10,000 in the column named Total of both, the debit and the credit side.

The difference of both sides (in this case, it is Rs 5,000) is written in the last row of the credit side as ‘balance c/d’. This balance is called the debit balance of account or vice-a-versa.

All expenses and assets represent debit balance.

All the income and liabilities represent credit balance including capital account.

Debit balance of personal account represents ‘Amount Receivable’. This comes under the category of assets. For example debtors.

Credit balance of personal accounts signifies ‘Amount Payable’. This comes under liabilities side and represents that we need to pay this amount which is credited due to goods, service, loan, or advance received.

Debit side of real account means stock in hand or any kind of assets. Credit balance of Real account is not possible.

Debit balance of nominal account means expenses of organization.

Credit balance of nominal accounts means income earned.

Debit balance of cash book means cash in hand.

Debit side of Bank book means balance at bank.

Credit balance of Bank book indicates ‘Bank Overdraft’.

Debit and credit balances of nominal account (Expenses and income will be nil, because these balances get transferred to trading, and profit & loss account to arrive at profit and loss of the company.

Balances of real and personal account appear in balance sheet of the company and to be carried forward to next accounting years.

Illustration

Journalize the following transactions and post them in to ledger account:

| S.No. |

Transactions |

Amount |

| 1 |

Commenced business and introduced cash |

400,000.00 |

| 2 |

Goods purchased for cash |

50,000.00 |

| 3 |

Goods purchased from Mr.Abdul |

135,000.00 |

| 4 |

Freight charges paid on purchases |

1,500.00 |

| 5 |

Computer purchased-cash |

35,000.00 |

| 6 |

Freight charges paid on purchases of computer |

500.00 |

| 7 |

Sale made to Mr.Ram |

200,000.00 |

| 8 |

Rent paid |

12,000.00 |

| 9 |

Salary paid |

15,000.00 |

| 10 |

Cash received from Mr.Ram |

150,000.00 |

| 11 |

Cash deposited in bank |

75,000.00 |

| 12 |

Office Expenses paid |

25,000.00 |

Journal Entries

| S.No. |

Particulars |

L.F. |

Amount |

| Debit |

Credit |

| 1 |

Cash A/c Dr.

To Capital A/c

(Being capital introduced)

|

** |

4,00,000 |

4,00,000 |

| 2 |

Purchase A/c Dr.

To Cash A/c

(Being cash purchase made)

|

** |

5,00,000 |

5,00,000 |

| 3 |

Purchase A/c Dr.

To Abdhul A/c

(Being goods purchase from Abdhul)

|

** |

135,000 |

1,35,000 |

| 4 |

Inward Freight Charges A/c Dr.

To Cash A/c

(Being freight charges Paid)

|

** |

1,500 |

1,500 |

| 5 |

Computer A/c Dr.

To Cash A/c

(Being computer purchased on cash)

|

** |

35,000 |

35,000 |

| 6 |

Computer A/c Dr.

To Cash A/c

(Being freight charges on computer paid)

|

** |

500 |

500 |

| 7 |

Ram A/c Dr.

To Sale A/c

(Being sold to Mr. Ram)

|

** |

2,00,000 |

2,00,000 |

| 8 |

Rent A/c Dr.

To Cash A/c

(Being rent paid )

|

** |

12,000 |

12,000 |

| 9 |

Salary A/c Dr.

To Cash A/c

(Being salary paid)

|

** |

15,000 |

15,000 |

| 10 |

Cash A/c Dr.

To Ram A/c

(Being cash Received from Mr. Ram)

|

** |

1,50,000 |

1,50,000 |

| 11 |

Bank A/c Dr.

To Cash A/c

(Being cash deposited in Bank)

|

** |

75,000 |

75,000 |

| 12 |

Office Expenses A/c Dr.

To Cash A/c

(Being office expenses paid)

|

** |

25,000 |

25,000 |

Financial Accounting - Subsidiary Books

Cash Book

Cash book is a record of all the transactions related to cash. Examples include: expenses paid in cash, revenue collected in cash, payments made to creditors, payments received from debtors, cash deposited in bank, withdrawn of cash for office use, etc.

In double column cash book, a discount column is included on both debit and credit sides to record the discount allowed to customers and the discount received from creditors respectively.

In triple column cash book, one more column of bank is included to record all the transactions relating to bank.

Note: In modern accounting, simple cash book is the most popular way to record cash transactions. The double column cash book or three column cash book is practically for academic purpose. A separate bank book is used to record all the banking transactions as they are more than cash transactions. These days, cash

is used just to meet petty and routine expenditures of an organization. In most of the organizations, the salaries of employees are paid by bank transfer.

Note: Cash book always shows debit balance, cash in hand, and a part of current assets.

Single Column Cash Book

Cash book is just like a ledger account. There is no need to open a separate cash account in the ledger. The balance of cash book is directly posted to the trial balance. Since cash account is a real account, ruling is followed, i.e. what comes in – debit, and what goes out – credit. All the received cash is posted in the debit side and all payments and expenses are posted in the credit side of the cash book.

Format

| CASH BOOK (Single Column) |

| Dr. |

Cr. |

| Date |

Particulars |

L.F. |

Amount |

Date |

Particulars |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Double Column Cash Book

Here, we have an additional Discount column on each side of the cash book. The debit side column of discount represents the discount to debtors of the company and the credit side of discount column means the discount received from our suppliers or creditors while making payments.

The total of discount column of debit side of cash book is posted in the ledger account of ‘Discount Allowed to Customers’ account as ‘To Total As Per Cash Book’. Similarly, credit column of cash book is posted in ledger account of ‘Discount Received’ as ‘By total of cash book’.

Format

| CASH BOOK (Single Column) |

| Dr. |

Cr. |

| Date |

Particulars |

L.F. |

Discount |

Amount |

Date |

Particulars |

L.F. |

Discount |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Triple Column Cash Book

When one more column of Bank is added in both sides of the double column cash book to post all banking transactions, it is called triple column cash book. All banking transactions are routed through this cash book and there is no need to open a separate bank account in ledger.

Petty Cash Book

In any organization, there may be many petty transactions incurring for which payments have to be done. Therefore, cash is kept with an employee, who deals with it and makes regular payments out of it. To make it simple and secure, mostly a constant balance is kept with that employee.

Suppose cashier pays Rs 5,000 to Mr A, who will pay day-to-day organization expenses out of it. Suppose Mr A spend Rs 4,200 out of it in a day, the main cashier pays Rs 4,200, so his balance of petty cash book will be again Rs 5,000. It is very useful system of accounting, as it saves the time of the main cashier and provides better control.

We will soon discuss about ‘Analytical or Columnar Petty Cash Book’ which is most commonly used in most of the organizations.

Format

| PETTY CASH BOOK |

| Amount Recieved |

C.B.F |

Date |

Particulars |

Amount Paid |

Stationery & Printing |

Cartage |

Loading |

Postage |

L.F. |

Purchase Book

Purchase book is prepared to record all the credit purchases of an organization. Purchase book is not a purchase ledger.

Format

| PURCHASE BOOK |

| Date |

Particulars |

Inward Invoice No. |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

Sale Book

The features of a sale book are same as a purchase book, except for the fact that it records all the credit sales.

Format

| SALE BOOK |

| Date |

Particulars |

Outward Invoice No. |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

Purchase Return Book

Sometimes goods are to be retuned back to the supplier, for various reasons. The most common reason being defective goods or poor quality goods. In this case, a debit note is issued.

Format

| PURCHASE RETURN BOOK |

| Date |

Particulars |

Credit Note No. |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

Sale Return Book

The reason of Sale return is same as for purchase return. Sometimes customers return the goods if they don’t meet the quality standards promised. In such cases, a credit note is issued to the customer.

Format

| SALE RETURN BOOK |

| Date |

Particulars |

Debit Note No. |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

Bills Receivables Book

Bills are raised by creditors to debtors. The debtors accept them and subsequently return them to the creditors. Bills accepted by debtors are called as ‘Bills Receivables’ in the books of creditors, and ‘Bills Payable’ in the books of debtors. We keep them in our record called ‘Bills Receivable Books’ and ‘Bills Payable Book’.

Format

| BILLS RECEIVABLE BOOK |

| Date |

Received From |

Term |

Due Date |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

Bills Payable Book

Bills payable issues to the supplier of goods or services for payment, and the record is maintained in this book.

Format

| BILLS PAYABLE BOOK |

| Date |

To Whom Given |

Term |

Due Date |

L.F. |

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

Key Features of Subsidiary Books

There is a difference between a purchase book and a purchase ledger. A purchase book records only credit purchases and a purchase ledger records all the cash purchases in chronical order. The daily balance of purchase book is transferred to purchase ledger. Therefore, purchase ledger is a comprehensive account of all purchases.

The same rule applies to sale book and sale ledgers.

It is quite clear that maintaining a subsidiary book is facilitation to journal entries, practically it is not possible to post each and every transaction through journal entries, especially in big organizations because it makes the records bulky and unpractical.

Maintenance of subsidiary books gives us more scientific, practical, specialized, controlled, and easy approach to work.

It provides us facility to divide the work among different departments like sale department, purchase department, cash department, bank department, etc. It makes each department more accountable and provides an easy way to audit and detect errors.

In modern days, the latest computer technology has set its base all over the world. More and more competent accounts professionals are offering their services. Accuracy, quick results, and compliance of law are the key factors of any organization. No one can ignore these factors in a competitive market.

Bank Reconciliation

On a particular date, reconciliation of our bank balance with the balance of bank passbook is called bank reconciliation. The bank reconciliation is a statement that consists of:

- Balance as per our cash book/bank book

- Balance as per pass book

- Reason for difference in both of above

This statement may be prepared at any time as per suitability and requirement of the firm, which depends upon the volume and number of transaction of the bank.

In these days, where most of the banking transactions are done electronically, the customer gets alerts for every transaction. Time to reconcile the bank is reduced more.

Format

| BANK RECONCILIATION STATEMENT |

| Particulars |

Debit Bank Balance as per Bank Book |

Credit Bank Balance as per Bank Book (overdraft) |

| Balance as per Bank Book |

50,000 |

-50,000 |

| 1. Add: Cheque issued to parties but not presented in bank |

3,25,000 |

3,25,000 |

| 2. Less: Cheque deposited in bank but not cleared yet |

-50,000 |

-50,000 |

| 3. Less: Bank Charges debited by bank but not entered in our books of accounts |

-1,200 |

-1,200 |

| 4. Less: Bank interest charged by bank but not entered in our books of accounts |

-10,000 |

-10,000 |

| 5. Add: Payment direct deposited by party without intimation to us |

1,75,000 |

1,75,000 |

| Balance as per Bank Pass Book/ Statement |

4,88,000 |

3,88,000 |

Trial Balance

Trial balance is a summary of all the debit and credit balances of ledger accounts. The total of debit side and credit side of trial balance should be matched. Trial balance is prepared on the last day of the accounting cycle.

Trial balance provides us a comprehensive list of balances. With the help of that, we can draw financial reports of an organization. For example, the trading account can be analyzed to ascertain the gross profit, the profit and loss account is analyzed to ascertain the profit or Loss of that particular accounting year, and finally, the balance sheet of the concern is prepared to conclude the financial position of the firm.

Format

| TRIAL BALANCE |

| S.No. |

Ledger Accounts |

L.F. |

Debit(Rs.) |

Credit(Rs.) |

| 1 |

ADVANCE FROM CUSTOMERS |

|

|

XX |

| 2 |

ADVANCE TO STIFF |

|

XX |

|

| 3 |

AUDIT FEES |

|

XX |

|

| 4 |

BALANCE AT BANK |

|

XX |

|

| 5 |

BANK BORROWINGS |

|

|

XX |

| 6 |

BANK INTEREST PAID |

|

|

XX |

| 7 |

CAPITAL |

|

|

XX |

| 8 |

CASH IN HAND |

|

XX |

|

| 9 |

COMMISSION ON SALE |

|

XX |

|

| 10 |

ELECTRICITY EXPENSES |

|

XX |

|

| 11 |

FIXED ASSETS |

|

XX |

|

| 12 |

FREIGHT OUTWARD |

|

XX |

|

| 13 |

INTEREST RECEIVED |

|

|

XX |

| 14 |

INWARD FREIGHT CHARGES |

|

XX |

|

| 15 |

OFFICE EXPENSES |

|

XX |

|

| 16 |

OUTSTANDING RENT |

|

|

XX |

| 17 |

PREPAID INSURANCE |

|

XX |

|

| 18 |

PURCHASES |

|

XX |

|

| 19 |

RENT |

|

XX |

|

| 20 |

REPAIR AND RENUWALS |

|

XX |

|

| 21 |

SALARY |

|

XX |

|

| 22 |

SALARY PAYABLE |

|

|

XX |

| 23 |

SALE |

|

|

XX |

| 24 |

STAFF WELFARE EXPENSES |

|

XX |

|

| 25 |

STOCK |

|

XX |

|

| 26 |

SUNDRY CREDTIORS |

|

|

XX |

| 27 |

SUNDRY DEBITORS |

|

XX |

|

|

TOTAL |

|

XXXXX |

XXXXX |

Financial Statements

Financial statements are prepared to ascertain the profit or loss of the business, and to know the financial position of the company.

Trading, profit & Loss accounts ascertain the net profit for an accounting period and balance sheet reflects the position of the business.

All the above has almost a fixed format, just put all the balances of ledger accounts into the format given below with the help of the trial balance. With that, we may derive desired results in the shape of financial equations.

|

Trading & Profit & Loss Account of M/s ABC Limited

For the period ending 31-03-2014

|

| Particulars |

Amount |

Particulars |

Amount |

| To Opening Stock |

XX |

By Sales |

XX |

| To Purchases |

XX |

By Closing Stock |

XX |

| To Freight charges |

XX |

By Gross Loss c/d |

XXX |

| To Direct Expenses |

XX |

|

|

| To Gross Profit c/d |

XXX |

|

|

| Total |

XXXX |

Total |

XXXX |

|

|

|

|

| To Salaries |

XX |

By Gross Profit b/d |

XXX |

| To Rent |

XX |

|

|

| To Office Expenses |

XX |

By Bank Interest received |

XX |

| To Bank charges |

XX |

By Discount |

XX |

| To Bank Interest |

XX |

By Commission Income |

XX |

| To Electricity Expenses |

XX |

By Net Loss transfer to Balance sheet |

XX |

| To Staff Welfare Expenses |

XX |

|

|

| To Audit Fees |

XX |

|

|

| To Repair & Renewal |

XX |

|

|

| To Commission |

XX |

|

|

| To Sundry Expenses |

XX |

|

|

| To Depreciation |

XX |

|

|

| To Net Profit transfer to Balance sheet |

XX |

|

|

| Total |

XXXX |

Total |

XXXX |

|

Balance sheet of M/s ABC Limited

as on 31-03-2014

|

| Liabilities |

Amount |

Assets |

Amount |

|

Capital XX

Add:Net Profit XX

|

XX |

Fixed Assets XXXX

Less:Description XX

|

XX |

| Bank Borrowings |

XX |

Current Assets - |

|

| Long Term Borrowing |

XX |

Stock |

XX |

| Current Liabilities - |

|

Debtors |

XX |

| Advance Form Customers |

XX |

Cash In hand |

XX |

| Sundry creditors |

XXX |

Cash at Bank |

XX |

| Bills Payable |

|

Bills receivables |

XX |

| Expenses Payable |

|

|

|

| Total |

XXXX |

Total |

XXXX |

Owner’s Equity

The equation of equity is as follows:

Owner Equity = Assets – liability

The owner or the sole proprietor of a business makes investments, earns some profit on it, and withdraws some money out of it for his personal use called drawings. We may write this transaction as follows:

Investment (capital) ± Profit or Loss – drawings = Owner’s Equity

Current Assets

Assets that are convertible into cash within the next accounting year are called current assets.

Cash in hand, cash in bank, fixed deposit receipts (FDRs), inventory, debtors, receivable bills, short-term investments, staff loan and advances; all these come

under current assets. In addition, prepaid expenses are also a part of current assets.

Note: Prepaid expenses are not convertible into cash, but they save cash for the next financial or accounting year.

Current Liabilities

Like current assets, current liabilities are immediate liabilities of the firm that are to be paid within one year from the date of balance sheet.

Current liabilities primarily include sundry creditors, expenses payable, bills payable, short-term loans, advance from customers, etc.

Financial Accounting - Depreciation

Depreciation reduces the value of assets on a residual basis. It also reduces the profits of the current year.

Depreciation indicates reduction in value of any fixed assets. Reduction in value of assets depends on the life of assets. Life of assets depends upon the usage of assets.

There are many deciding factors that ascertain the life of assets. For example, in case of a building, the deciding factor is time. In case of leased assets, the deciding factor is the lease period. For plant and machinery, the deciding factor should be production as well as time. There can be many factors, but the life of assets should be ascertained on some reasonable basis.

Why Do We Need to Account for Depreciation?

Here is why we need to provide depreciation:

To ascertain the true profit during a year, it is desirable to charge depreciation.

To ascertain the true value of assets, depreciation should be charged. Without calculating the correct value of assets, we cannot ascertain the true financial position of a company.

Instead of withdrawal of overstated profit, it is desirable to make provisions to buy new assets to replace old asset. The accumulated value of depreciation provides additional working capital.

Depreciation helps in ascertaining uniform profit in each accounting year.

Depreciation allows to take the advantage of tax benefit.

Accounting Entries Related to Assets and Depreciation

Let us see the accounting entries related to assets and depreciation:

| S.No. |

Particulars |

Journal Entries |

| 1 |

Purchase of Fixed Assets |

| Asset A/c |

Dr. |

| To Bank A/c |

|

|

| 2 |

Expenses on purchase of Fixed Assets |

| Related Asset A/c |

Dr. |

| To Cash/Bank A/c |

|

|

| 3 |

For Providing depreciation |

| Depreciation A/c |

Dr. |

| To Assets A/c |

|

|

| 4 |

Transfer of depreciation to Profit & Loss a/c |

| Profit & Loss A/c |

Dr. |

| To Depreciation A/c |

|

|

| 5 |

Sale of Assets |

| Bank A/c |

Dr. |

| To Assets A/c |

|

|

Depreciation =

Cost of Assets−Scrap Value of Assets

/

Estimated Life of Assets

Method of Depreciation

Depreciation can be calculated using any of the following methods, however the most popular methods remain (a) Straight Line Method and (b) Written Down Value Method.

- Straight Line Method

- Written Down Value Method

- Annuity Method

- Insurance Policy Method

- Machine Hour Rate Method

- Depletion Method

- Revaluation Method

- Depreciation Fund Method

Format

| DEPRECIATION CHART |

| Desc. |

Opening Value |

Addition during the year |

Sale |

Balance |

Rate of Depreciation |

Value of Depreciation |

Closing Value |

| 1 |

2 |

3 |

4 |

5

(2+3-4)

|

6 |

7 |

8

(5-7)

|

Format of ledger accounts

| ASSET ACCOUNT |

| Date |

Particulars |

L.F. |

Amt |

Date |

Particulars |

L.F. |

Amt |

| 25-06-13 |

To Bank |

|

xxx |

31-03-2014 |

By Depreciation |

|

xx |

|

|

|

|

|

By Balance c/d |

|

xx |

|

Total |

|

xxx |

|

Total |

|

xxx |

| 01-04-2014 |

To Balance |

|

xx |

|

By Depreciation |

|

xx |

Cost Accounting - Introduction

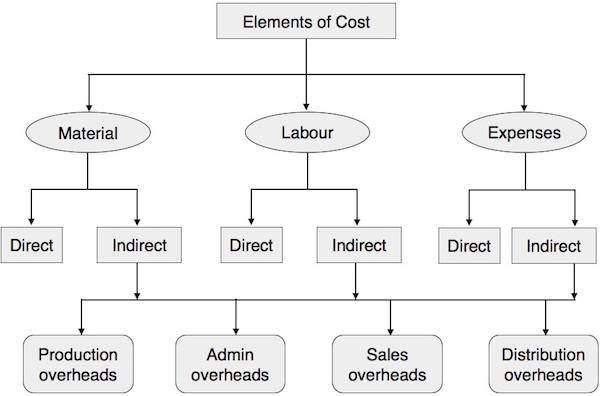

Cost accounting is the application of accounting and costing principles, methods, and techniques in the ascertainment of costs and the analysis of saving or excess cost incurred as compared with previous experience or with standards.

…Wheldon.

Concepts of Cost Accounting

Following are the main concepts of cost accounting:

Cost

There is a cost involved to purchase or produce anything. Costs may be different for the same product, depending upon the stages of completion. The cost changes according to the stage a product is in, for example, raw material, work in progress, finished goods, etc. The cost of a product cannot be perfect and it may vary for the same product depending upon different constraints and situations of production and market.

Expenses

Some costs are actual, such as raw material cost, freight cost, labor cost, etc. Some expenses are attributable to cost. To earn revenue, some expenses are incurred like rent, salary, insurance, selling & distribution cost, etc. Some expenses are variable, some are semi-variable, and some of fixed nature.

Loss

Expenses are incurred to obtain something and losses are incurred without any compensation. They add to the cost of product or services without any value addition to it.

Cost Center

Cost center refers to a particular area of activity and there may be multiple cost centers in an organization. Every cost center adds some cost to the product and every cost center is responsible for all its activity and cost. A cost center may also be called a department or a sub-department. There are three types of cost centers:

Personal and Impersonal Cost Centers - A group of persons in an organization responsible as a whole for a group activity is called a personal cost center. In case of impersonal call center, the activities are done with the help of plant and machinery.

Operation and Process Cost Centers - The same kind of activity is done in an operation department. In a process cost center, as the name suggests, different kinds of processes are involved.

Product and Service Cost Centers - A department where all activities refer to product is called a product department. When the centers render their services to a product department for its smooth functioning, they are called service cost centers.

Profit Center

Profit centers are inclusive of cost centers as well as revenue activities. Profit centers set targets for cost centers and delegates responsibilities to cost centers. Profit centers adopt policies to achieve such targets. Profit centers play a vital role in an organization.

Cost Drivers

Cost of any product depends upon cost drivers. There may be different types of cost drivers such as number of units or types of products required to produce. If there is any change in cost driver, the cost of product changes automatically.

Conversion Cost

The cost required to convert raw material into product is called as conversion cost. It includes labor, direct expenses, and overhead.

Carrying Costs

Carrying cost represents the cost to maintain inventory, lock up cost of inventory, store rent, and store operation expenses.

Out of Stock Cost

Sometimes loss is incurred due to shortage of stock such as loss in sale, loss of goodwill of a business or idle machine. It is called out of stock cost.

Contribution Margin

Contribution margin is the difference between sale price and variable cost.

Ordering Costs

Ordering costs represent the cost to place an order, up to to stage until the material is included as inventory.

Development Cost

To develop new product, improve existing product, and improved method in producing a product called development cost.

Policy Cost

The cost incurred to implement a new policy in addition to regular policy is called policy cost.

Idle Facilities Cost and Idle Capacity Cost

If available facilities remain idle and some loss incurred due to it, it is called idle facilities cost. If capacity is unused due to repair, shut down or any other reason, it is called capacity cost.

Expired Cost

When the cost is fully consumed and no future monetary value could be measured, it is called expired cost. Expired cost relates to current cost. Suppose the expenses incurred in an accounting period do not have any future value, then it is called an expired cost.

Incremental Revenue

Incremental revenue implies the difference in revenues between two alternatives. While assessing the profitability of a proposed alternative, incremental revenues are compared with incremental costs.

Added Value

Added value means value addition to any product. Value addition of the product may be due to some process on product or to make the product available or there may be other reasons; but it also includes the profit share on it.

Urgent Cost

There are some expenses that are to be incurred on an immediate basis. Delaying such expenses may result in loss to business. These expenses are called urgent cost. Urgent costs are not be postponed.

Postponable Cost

Without avoiding any expenses, if we are able to defer some expenses to future, then it is called a postponable cost.

Pre-production Cost

The cost incurred before commencing formal production or at the time of formation of new establishment or project is called pre-production cost. Some of these costs are of capital nature and some of these are called deferred revenue expenditure.

Research Cost

Research costs are incurred to discover a new product or to improve an existing product, method, or process.

Training Cost

The costs incurred on teaching, training, apprentice of staff or worker inside or outside the business premise to improve their skills is called training cost.

Cost Accounting - Advantages

The advantages of cost accounting are:

Disclosure of profitable and unprofitable activities

Since cost accounting minutely calculates the cost, selling price and profitability of product, segregation of profitable or unprofitable items or activities becomes easy.

Guidance for future production policies

On the basis of data provided by costing department about the cost of various processes and activities as well as profit on it, it helps to plan the future.

Periodical determination of profit and losses

Cost accounting helps us to determine the periodical profit and loss of a product.

To find out exact cause of decrease or increase in profit

With the help of cost accounting, any organization can determine the exact cause of decrease or increase in profit that may be due to higher cost of product, lower selling price or may be due to unproductive activity or unused capacity.

Control over material and supplies

Cost accounting teaches us to account for the cost of material and supplies according to department, process, units of production, or services that provide us a control over material and supplies.

Relative efficiency of different workers

With the help of cost accounting, we may introduce suitable plan for wages, incentives, and rewards for workers and employees of an organization.

Reliable comparison

Cost accounting provides us reliable comparison of products and services within and outside an organization with the products and services available in the market. It also helps to achieve the lowest cost level of product with highest efficiency level of operations.

Helpful to government

It helps the government in planning and policy making about import, export, industry and taxation. It is helpful in assessment of excise, service tax and income tax, etc. It provides readymade data to government in price fixing, price control, tariff protection, etc.

Helpful to consumers

Reduction of price due to reduction in cost passes to customer ultimately. Cost accounting builds confidence in customers about fairness of price.

Classification and subdivision of cost

Cost accounting helps to classify the cost according to department, process, product, activity, and service against financial accounting which give just consolidate net profit or loss figure of any organization without any classification or sub-division of cost.

To find out adequate selling price

In tough marketing conditions or in slump period, the costing helps to determine selling price of the product at the optimum level, neither too high nor too low.

Proper investment in inventory

Shifting of dead stock items or slow moving items into fast moving items may help company to invest in more proper and profitable inventory. It also helps us to maintain inventory at the most optimum level in terms of investments as well as variety of the stock.

Correct valuation of inventory

Cost accounting is an accurate and adequate valuation technique that helps an organization in valuation of inventory in more reliable and exact way. On the other hand, valuation of inventory merely depends on physical stock taking and valuation thereof, which is not a proper and scientific method to follow.

Decision on manufacturing or purchasing from outside

Costing data helps management to decide whether in-house production of any product will be profitable, or it is feasible to purchase the product from outside. In turn, it is helpful for management to avoid any heavy loss due to wrong decision.

Reliable check on accounting

Cost accounting is more reliable and accurate system of accounting. It is helpful to check results of financial accounting with the help of periodic reconciliation of cost accounts with financial accounts.

Budgeting

In cost accounting, various budgets are prepared and these budgets are very important tools of costing. Budgets show the cost, revenue, profit, production capacity, and efficiency of plant and machinery, as well as the efficiency of workers. Since the budget is planned in scientific and systemic way, it helps to keep a positive check over misdirecting the activities of an organization.

Cost Accounting vs Financial Accounting

Both cost accounting and financial accounting help the management formulate and control organization policies. Financial management gives an overall picture of profit or loss and costing provides detailed product-wise analysis.

No doubt, the purpose of both is same; but still there is a lot of difference in financial accounting and cost accounting. For example, if a company is dealing in 10 types of products, financial accounting provides information of all the products in totality under different categories of expense heads such as cost of material, cost of labor, freight charges, direct expenses, and indirect expenses. In contrast, cost accounting gives details of each overhead product-wise, such as much material, labor, direct and indirect expenses are consumed in each unit. With the help of costing, we get product-wise cost, selling price, and profitability.

The following table broadly covers the most important differences between financial accounting and cost accounting.

| Point of Differences |

Financial Accounting |

Cost Accounting |

| Meaning |

Recoding of transactions is part of financial accounting. We make financial statements through these transactions. With the help of financial statements, we analyze the profitability and financial position of a company. |

Cost accounting is used to calculate cost of the product and also helpful in controlling cost. In cost accounting, we study about variable costs, fixed costs, semi-fixed costs, overheads and capital cost. |

| Purpose |

Purpose of the financial statement is to show correct financial position of the organization. |

To calculate cost of each unit of product on the basis of which we can take accurate decisions. |

| Recording |

Estimation in recording of financial transactions is not used. It is based on actual transactions only. |

In cost accounting, we book actual transactions and compare it with the estimation. Hence costing is based on the estimation of cost as well as on the recording of actual transactions. |

| Controlling |

Correctness of transaction is important without taking care of cost control. |

Cost accounting done with the purpose of control over cost with the help of costing tools like standard costing and budgetary control. |

| Period |

Period of reporting of financial accounting is at the end of financial year. |

Reporting under cost accounting is done as per the requirement of management or as-and-when-required basis. |

| Reporting |

In financial accounting, costs are recorded broadly. |

In cost accounting, minute reporting of cost is done per-unit wise. |

| Fixation of Selling Price |

Fixation of selling price is not an objective of financial accounting. |